How can nonresident aliens get an ITIN before tax season?

It is important that nonresident aliens file their US tax documents to remain compliant with the IRS.

And when you sit down to file your end of year tax return you will need to have your taxpayer identification number (TIN) details close by.

In short, there are two types of Taxpayer Identification Numbers – the Social Security Number (SSN) and the Individual Taxpayer Identification Number (ITIN).

If you are not eligible for a SSN and have triggered a tax filing obligation, then you will need to apply for an ITIN. And exactly how to get your hands on an ITIN during tax season will be the focus of this piece.

Why am I not eligible for a Social Security Number?

In general if you are not authorized to work in the US by the Department of Homeland Security (DHS) you will not be eligible for a SSN.

Nonresident aliens eligible for a SSN include:

- F-1 students that have employment on-campus or are authorized to work off-campus

- F-1 PhD students

- J-1 students with permission to work from a sponsor

- J-2 spouses with permission to work from USCIS

What is an Individual Taxpayer Identification Number (ITIN)?

An ITIN is a tax processing number issued by the IRS to nonresidents that are not eligible for a Social Security Number (SSN). It is a nine-digit number, beginning with the number nine, that is used to confirm your identity with the IRS.

Why do I need an ITIN?

You need an ITIN if you have federal tax reporting or tax filing requirements with the IRS, but you do not qualify for a SSN.

If you earn money in the US you will need an ITIN.

You will also require an ITIN to file your US tax return with the IRS to ensure you are remaining tax complaint.

Can a nonresident get an ITIN?

ITINs are available regardless of immigration status, as both resident and nonresident aliens may have a U.S. filing or reporting requirement under the Internal Revenue Code.

ITINs are issued for federal tax reporting. However, ITINs are also useful as a form of ID in cases such as setting up a bank account, or obtaining a mortgage.

When should I apply for an ITIN?

When you have a filing or reporting requirement, you should apply for your ITIN as soon as possible. ITIN applications are accepted at all stages throughout the year.

It is important to renew your ITIN in sufficient time to avoid any tax complications when filing taxes or carrying out other tax-related transactions.

How do I qualify for an ITIN?

ITINs are issued to resident and nonresident aliens who are required to have a US taxpayer identification number, but are not eligible for a SSN.

Essentially, you qualify for an ITIN if you are a foreign national in the US with tax requirements.

How do I get an ITIN as a nonresident alien?

In order to get an ITIN number you must complete and sign a Form W-7 and you must provide proof of identity and foreign nationality status.

You can prepare your W-7 form online with Sprintax Forms

ITIN application process

There are two main ways to obtain an ITIN number.

Option 1 – File for an ITIN application in advance of filing your tax return

If you are filing your ITIN application in advance of filing your tax return, you will need to complete and sign a Form W-7.

At this stage, students can get a responsible officer at an SEVP approved institution (any US learning institution that has applied for and received approval to enroll nonimmigrant students) to certify copies of their passport, visa and DS-2019 or I-20.

You must then include the certification letter, identifying documents, and your signed W-7 form when mailing to the IRS.

Below is the address to mail your ITIN application to:

Internal Revenue Service

Austin Service Center

ITIN Operation

P.O. Box 149342

Austin, TX 78714-9342

Option 2 – File your ITIN application alongside your tax return

It is also possible to apply for your ITIN alongside filing for a tax return.

When mailing your ITIN application you must include:

- 1040 NR (This is your Federal tax return)

- ITIN application – ensure this is signed

- A certified copy of your passport

The copy of your passport must be certified by one of the following:

- Certified Acceptance Agent or IRS official

- The United States Embassy or Consulate (be sure to book prior to your visit)

- The governmental department that issues the identification document

Note: If you are a student filing your ITIN application alongside your tax return it is no longer possible to get your documents certified by an officer at an SEVP certified school.

What information is required when completing an ITIN application?

Information required and supporting documents for the W-7 Form include:

- Your name, mailing address and foreign address if applicable

- Your date and location of birth

- Your country of citizenship

- Your foreign tax ID number, if applicable

- Your US visa number, if applicable

- Other details verifying your identity

See more information on how to apply for your ITIN from outside the US here.

What documents are required when applying for an ITIN?

Along with your W-7 Form and attached tax return, you must include documentation proving your identity and foreign status.

If you are applying for your ITIN in advance of your tax return you will require the following:

- Passport

- Visa

- DS-2019 or I-20

If you are applying for your ITIN alongside your tax return you will require:

- Passport

These documents must be the original document or certified copies.

However, we do not recommend sending original documents with your ITIN application and strongly recommend that you use copies of these documents.

As mentioned above, documents must be certified by one of the following:

- Certified Acceptance Agent or IRS official

- The United States Embassy or Consulate (be sure to book prior to your visit)

- The governmental department that issues the identification document

It is important to note that a passport is the only documentation that can be used to prove both identity and foreign status.

Below is a list of acceptable documents:

- Passport

- National Identification card (must show photo, name, current address, date of birth, and expiration date)

- US driver’s license

- Civil birth certificate

- Foreign driver’s license

- US state Identification card

- US military identification card

- Foreign military identification card

- US state identification card

- Visa

- Medical records (dependents only – under 6 years old)

- School records (dependents only – under 14/ under 18 if a student)

- US Citizenship and Immigration Services (USCIS) photo identification

Does an ITIN have an expiry date?

ITINs are valid for five years, however if the ITIN is not used at least once in the previous three-year period it will expire. Therefore, ITINs not used in the tax years 2019, 2020, or 2021 will have expired on 31 December 2022.

The IRS will send out a Notice CP48, letting you know if your ITIN number is set to expire.

It is important to ensure that your ITIN is active to avoid delays in processing your tax return.

When you are renewing your ITIN you will receive Notice CP565 to let you know it is renewed and your previously assigned ITIN will remain the same.

How long does it take to get an ITIN number?

During peak tax season (15 January – 30 April) ITIN processing times can take many months.

Therefore, it is highly recommended that you get your ITIN application in as early as possible to ensure you have your ITIN to file your tax return on the 18 April deadline.

In off-peak times the processing time for an ITIN is generally within seven weeks, provided you qualify for an ITIN and your application is complete.

Why you should get an ITIN before tax season

It is highly recommended that you apply for your ITIN before tax season to ensure that you can file your tax return before the tax deadline on 18 April.

That’s the advice from Emiko Christopherson, International Student Advisor at Oregon State University.

“ITIN applications are a very important part of tax season.”

“It’s important to remember that ITIN applications submitted to IRS outside of the tax season take approximately three months for adjudication. Meanwhile, applications submitted during the height of tax season take up to five months or more to be adjudicated.”

“So we are talking about significant periods of time that can be spent waiting for ITIN applications to be completed. And with this in mind, it’s important that ITINs are applied for as early as possible.”

Also, by having everything in order with your ITIN this will ensure that you are ahead of the queue to receive your tax refund if you are due one.

“At OSU, we have worked with Sprintax to significantly improve our ITIN application process for both students and staff. As a result, we are delighted to report that we have increased ITIN application success rates while decreasing the processing timelines involved.”

Prepare your ITIN application form here

How can Sprintax help me?

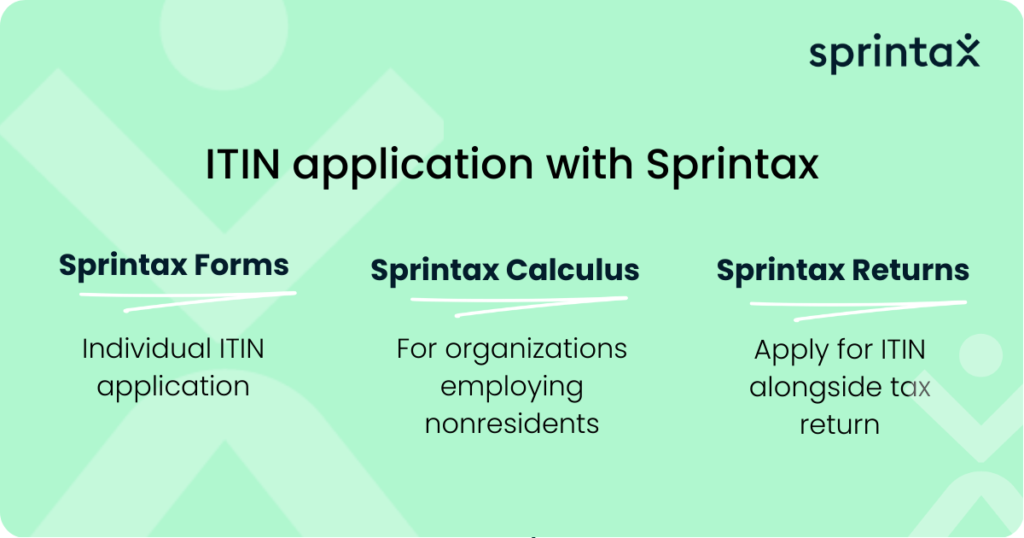

Individual ITIN applications

At Sprintax Forms we can help with individual ITIN applications ensuring correct supporting documents are sent to the IRS to avoid any delays in getting your ITIN.

ITIN applications for organizations employing nonresidents

If you are an organization or educational institution looking for a streamlined approach to applying for ITINs for your nonresident population, then Sprintax Calculus can help to achieve this.

ITIN application alongside tax return preparation

And that’s not all! Sprintax Returns can also help to file nonresident tax returns, ensuring nonresidents get their maximum refund and remain compliant with the IRS. Sprintax Returns can also produce the W-7 form if you are filing an ITIN application alongside your tax returns.