There are several key tax forms that you need to be aware of as a nonresident in the US.

After all, knowing what to expect can make the difference when tax season rolls around.

Form 8233 is one of the most important forms to know, as it can stop you paying too much tax on your income.

In this blog post, we’ll look at Form 8233 and how Sprintax Forms can help you to complete it!

What is Form 8233 and what is its purpose?

Every year, countless nonresidents ask us what Form 8233 is used for.

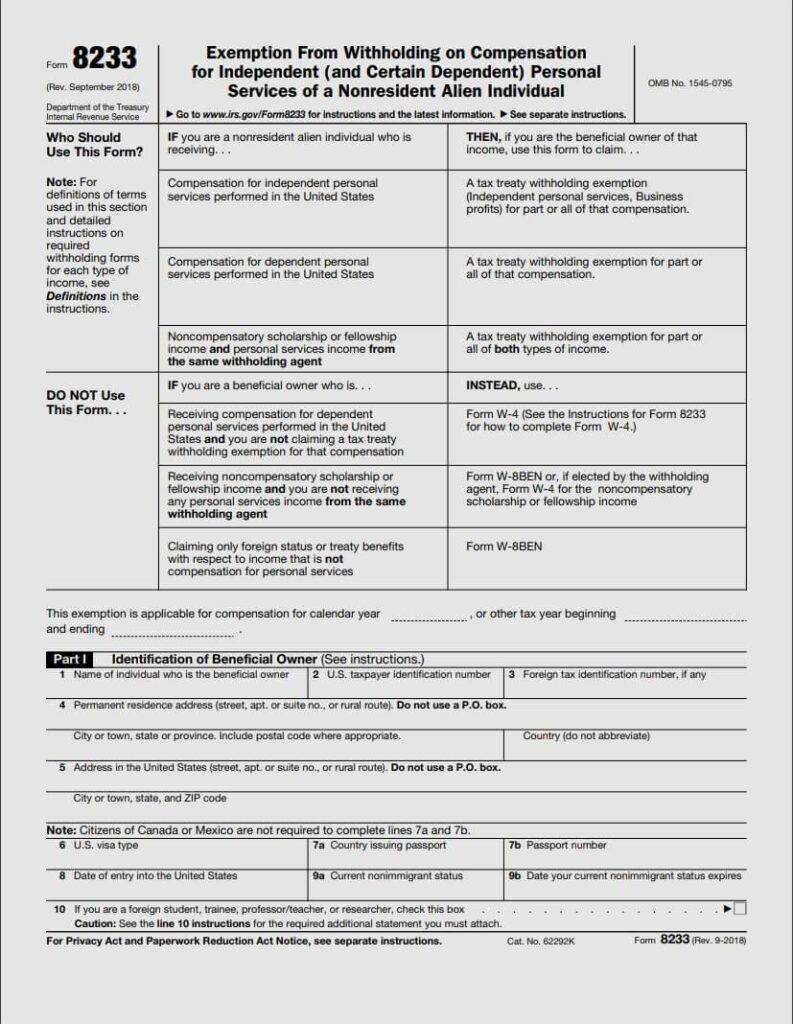

Form 8233 (Exemption From Withholding on Compensation for Independent and Certain Dependent Personal Services of a Nonresident Alien Individual) is one of many tax forms used by nonresident aliens who are working in the United States.

Put simply, its primary function is to claim an exemption from any tax on income from within the United States.

Essentially, the purpose of Form 8233 is for nonresidents to avoid double taxation on their earnings.

While a nonresident alien will complete the form themselves, it must be approved by the employer and also the IRS before the nonresidents can receive a reduced rate of withholding tax or exemption from withholding tax.

Who needs to fill out Form 8233?

Most nonresident aliens, whether you are an F1 student or camp counselor on a J1 visa, who live and work within the United States will be subject to federal income tax on their income from US sources.

However, under certain circumstances, they may be eligible to be exempt from paying full taxes on their earnings.

This is where Form 8233 comes in.

Completing Form 8233 will allow you to avail of any income tax treaties that your home country has agreed with the US on your income from personal services (wages and other compensations for services performed).

To claim the benefits of any of tax treaty for personal service income (dependent or independent), you’ll need to complete Form 8233 and send it to your employer.

The employer should then determine whether you are eligible for either a partial or total exemption from withholding tax under this treaty.

If your employer determines that the treaty is applicable to you, they will not withhold tax from your earnings covered by the treaty.

What is a tax treaty and how does a tax treaty work?

US tax treaties are also known as Double Taxation Agreements (DTA), and are agreements between a foreign country and the US that aim to avoid double taxation of one and the same income in both countries.

Generally, if your home country has an income tax treaty with the US, you may be taxed at a reduced tax rate or will be able to benefit from exemptions on specific types of income under the conditions set in the tax treaty documents.

Ensuring you apply for a tax treaty is very important, as it can save you paying far too much income tax on your earnings!

The U.S. has a tax treaty network of approximately 65 countries all over the world, including:

| Armenia | Australia | Austria | Azerbaijan | Bangladesh | Barbados |

| Belarus | Bulgaria | Canada | China | Cyprus | Czech Republic |

| Denmark | Egypt | Estonia | Finland | France | Georgia |

| Germany | Greece | Hungary | Iceland | India | Indonesia |

| Ireland | Israel | Italy | Jamaica | Japan | Kazakhstan |

| Korea | Kyrgyzstan | Latvia | Lithuania | Luxembourg | Malta |

| Mexico | Moldova | Morocco | Netherlands | New Zealand | Norway |

| Pakistan | Philippines | Poland | Portugal | Romania | Russia |

| Slovak Republic | Slovenia | South Africa | Spain | Sri lanka | Sweden |

| Switzerland | Tajikistan | Thailand | Trinidad | Tunisia | Turkey |

| Turkmenistan | Ukraine | Venezuela | United Kingdom | Uzbekistan | Belgium |

Read more here.

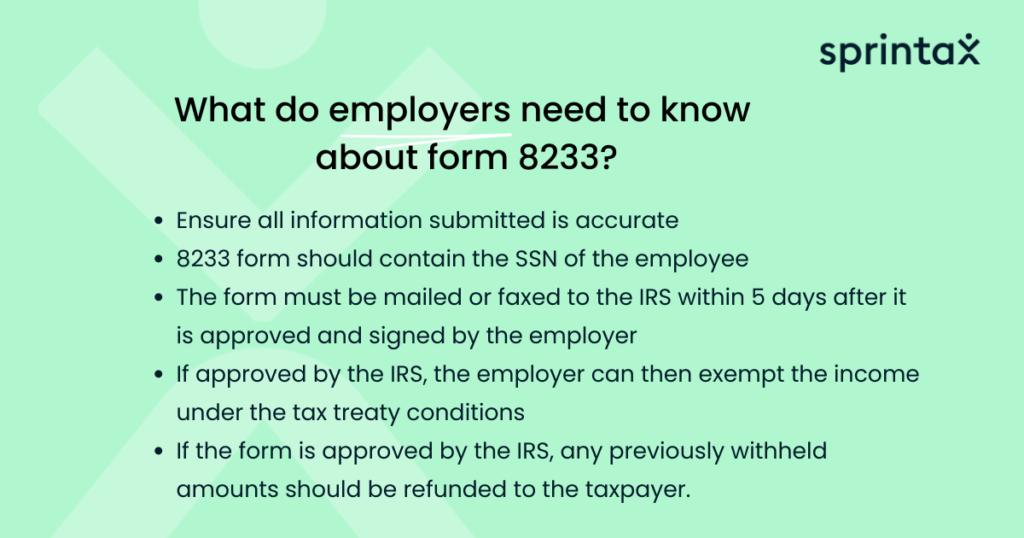

What do employers need to know about form 8233?

Employers have a key role to play in the Form 8233 process.

That’s because employers are held responsible for withholding the correct amount of federal income tax from their employees’ wages, and determining whether an employee is eligible for an exemption will play a key role in this.

To be able to determine this, employers need to review the form once it is submitted by the employee and ensure all information submitted is accurate.

Please note that the 8233 form should contain the SSN of the employee. If the employee still does not have SSN, the tax treaty may not be granted on employment income.

The form must be mailed or faxed to the IRS within five days after it is approved and signed by the employer and if the form is approved by the IRS, the employer can then exempt the income under the tax treaty conditions.

If the form is approved by the IRS, any previously withheld amounts should be refunded to the taxpayer. If the form is rejected, the employer should continue to collect tax.

Difference between Form 8233 to Form W-8BEN

A lot of nonresidents are unsure whether they need to file a Form 8233 or W-8BEN.

Essentially, it depends on your income type.

Form W-8BEN should only be completed when there is any income that is not deemed ‘personal services income’ while an 8233 is completed to outline personal services income.

The other main difference between the W-8BEN form and Form 8233 is that the withholding agent, such as an employer, should submit form 8233 to the IRS for approval before they can exempt any income form tax..

How to submit form 8233 to the IRS

Firstly, the employee will need to successfully complete all aspects of the form.

It will be then sent to the employer, who will review Form 8233 and add their information and signature in Part IV, also known as Withholding Agent Acceptance and Certification.

Once the form is approved and signed, it will need to be mailed to the IRS within 5 days. It is important that you keep a copy of the form for yourself and one for your employer. You can do this by scanning the document.

Generally, the IRS will accept the Form 8233 if there is room for an exemption, but if they reject it, the employer will need to continue withholding the right amount from the employee’s paychecks immediately.

What are the key terms to know for Form 8233?

There are several key terms that both nonresident aliens and their employers need to be familiar with when it comes to Form 8233, here are just a few:

Tax treaty:

This is an agreement between the US and another country that sets out the rules for how taxes will be withheld.

Nonresident alien:

An individual who is in the US but is not a US national, and not a resident of the United States for tax purposes under any of the residency tests.

US-sourced income:

Income that is earned from within the United States. This includes income such as wages, salaries, and tips.

Withholding tax:

Tax that is withheld from the employee’s wages by their employer

Exemption:

A reduction or elimination of the amount of tax that is withheld from an employee’s wages.

What documents to attach to form 8233

In addition to the completed and signed Form 8233, you may need to attach any necessary supporting documents to the form.

The specific documents that will need to be submitted alongside it will depend on the type of income being received and the tax treaty being claimed.

For example if you are a nonresident alien claiming an exemption from withholding as a student on your compensation during study or training, you should provide your employer a copy of your I-20, student visa, and passport.

If you are a camp counselor that exempts personal service income, passport and a proof of nonresident status are sufficient.

How often should you complete Form 8233?

Form 8233 will need to be completed every year that you want to avail of a tax treaty.

This will require the same process each year.

However, once you know what you are doing, it gets easier to do!

Who can sign form 8233

Form 8233 must be signed by the nonresident alien.

However, if the nonresident alien is unable to sign the form for whatever reason, it is possible to get a qualified representative to sign it on their behalf.

This is someone who is authorized to act on the nonresident alien’s behalf, such as a tax professional or attorney.

Who can help me with my taxes?

You can always complete Form 8233 by yourself.

However, many nonresidents are understandably not 100% comfortable managing their tax requirements alone.

That’s why the best way to prepare your Form 8233 is by using Sprintax Forms!

Our system ensures that you will prepare a fully compliant Form 8233 before you send it to your employer!

We’ll analyze your personal situation to ensure you are applicable for a tax treaty.