As a nonresident in the US, IRS Form 1040-NR is one of the most important tax forms you will need to familiarize yourself with when tax season comes around.

After all, the 1040-NR is the form you will use when filing a tax return with the IRS.

In this blog, we’ll analyze whether or not you need to file 1040-NR, and share our top tips on how to file your tax return correctly.

What is Form 1040-NR?

Form 1040-NR (some may refer to it as 1040NR), is the nonresident version of Form 1040, formally known as the US Individual Income Tax Return.

Essentially, it is the primary tax return form for nonresidents who earned US-sourced income to file during tax season.

Previously, nonresidents may have had to file Form 1040-NR-EZ, which has been made obsolete as of 2020 in order to streamline the tax-filing process.

Who needs to file Form 1040-NR?

If you’re classed as a nonresident alien, you’ll have to file form 1040-NR if you worked in the US, or had US-sourced income.

Examples of taxable income in the US include: employment/ self-employment income, investment income, taxable scholarship, fellowship grant and rental income.

It’s vitally important for nonresidents to comply with their tax obligations.

By not filing correctly, or filing after the tax deadline of 18 April, you risk receiving fines and penalties from US Revenue.

How to file Form 1040-NR – instructions for nonresident aliens

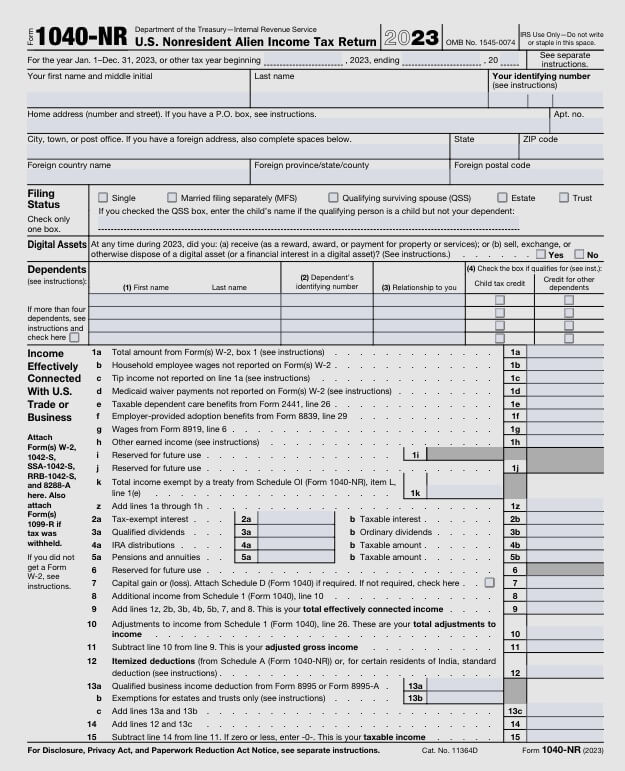

What should be included on Form 1040-NR?

When observing Form 1040NR instructions, you will notice that you need to include personal information, such as your name and address.

You will need to also enter your Social Security number (SSN). However, if you don’t have an SSN, you can include your Individual Taxpayer Identification Number (ITIN).

Along with the US-sourced income that you will include on a Form 1040-NR, you’ll also use it to report the following types of income:

- Ordinary and qualified dividends

- Scholarship as well as fellowship grants

- Capital gains

- Real estate or farm income

Nonresidents with capital gains are expected to report their gains on Schedule NEC along with their Form 1040NR.

Filing 1040NR online

While it is possible to file Form 1040-NR by yourself, Sprintax offers the best solution for doing this!

The advantage of filing alone is that it’s free, but by filing on your own, you may need to download, print and mail a physical copy of your tax return to the correct tax office.

The disadvantages of filing alone is that you have to manage the tax paperwork yourself and ensure you are filing correctly – not an easy task if you’re a nonresident and this is your first time filing

That’s why, our e-filing tax solution ensures you can prepare and file a nonresident tax return online.

Prepare and file form 1040NR easily online with Sprintax Returns

Where do I send Form 1040-NR?

If you e-file your return, there is no need to mail it.

If mail it, send it to the relevant 1040NR mailing address, see the IRS website for details.

1040-NR and tax refunds

Filing the tax form is the only way to receive a US tax refund that you may be due.

You can easily determine whether or not you’re due a tax refund with Sprintax.

Simply create your account easily today.

Will tax treaties affect my tax return?

When tax-filing, you may be able to claim a tax relief if your home country has a tax treaty in place with the US.

This treaty could allow you to exempt some of all of your US-sourced income from a federal and/or state level.

The US has treaties with over 65 countries, and most target specific areas around double taxation to ensure you will not overpay tax.

When is 1040-NR due?

If you did earn income subject to tax withholding, you’ll generally need to file by 15 April of the following year. So, if you earned income in 2023, you’ll need to file by 15 April 2024.

If you did not earn income from US-sources, you’ll still need to file a tax form 8843.

This will generally be due on 15 June.

What happens if I file 1040-NR late?

It’s vitally important that you file 1040-NR before the US tax deadline.

If you don’t file on time, and haven’t applied for an extension (more below), you will be leaving yourself open to fines and penalties from the IRS.

Incorrect filing without amending your return will also affect future Green Card and visa applications.

I cannot file before 15 April. Can I get an extension?

If you are not able to complete your form by the due date, you will need to file Form 4868 to request an extension of time to file.

However, you will still need to file Form 4868 by the 1040-NR due date (15 April).

Ensuring that you have all of your documents ready in the weeks and months before tax-filing season will give you the best chance of ensuring smooth sailing before the deadline begins to loom.

I made a mistake on my taxes. How can I amend my US tax return?

Incorrectly filed a US tax return?

Firstly – don’t worry! It’s not the end of the world. Plenty of nonresidents make errors when tax season rolls around.

The key to ensuring the matter is resolved is acting quickly and decisively.

In order to amend your federal tax return, you will need to file a Form 1040-X, also known as “Amended US Individual Income Tax Return”.

The good news? If this affects you, it’s easy to amend your tax return in just a few steps with Sprintax!

Can I file my US taxes online from home?

Understandably, a lot of nonresidents in the US aren’t fully at ease when it comes to completing their tax requirements by themselves.

That’s where Sprintax Returns can help you out!

Sprintax is live for E-filing, meaning you can file from the comfort of your own home!

Remember, you’ll not be able to file online if:

- Any of your payment documents do not have an EIN

- If one of your 1042-S forms do not have a unique code identifier

- You have capital gains income

- You have form 1099-NEC

- You have form 1099-INT

- You have form 1099-MISC with box 4 higher than box 0

- You have included your final payslip

- You earned self-employment income

Create your Sprintax Returns account here.