Let’s face it – tax is super boring!

And when you move to the US as an international student or scholar, the local tax system will likely be the furthest thing from your mind.

However, boring or not, compliance with the American tax authorities – the IRS – is crucial for any international student. In fact it’s one of the conditions of your visa! And how you handle your US tax affairs can play a big part in the outcome of your future visa or Green Card applications.

But, by doing some research into US tax when you first arrive, you can save you a lot of hassle down the line.

As a nonresident, there are a number of key tax forms and documents that you’ll need to become very familiar with during your time in the US.

In this blog, you’ll find a guide to five of the most important tax documents including what each form is used for, why you need to file them, and the easiest way to complete each form.

The documents we will be looking at are:

Key Terms

But before we get started, there are a couple of key terms that you will see popping up in many of the tax forms you will encounter during your time in the US. These terms can often cause considerable confusion for many international students and, with this in mind, we have briefly explained some of the most common terms below.

Tax year

An American tax year is counted from January 1 – December 31. One of the most important tax dates in 2024 is April 15, 2024 – this is the tax filing deadline.

The tax return you file must relate to the previous tax year. In other words, the tax return you file on April 15 will account for the income you earned during the 2023 tax year.

Residency status

Most international students will be treated differently to US citizens when it comes to tax in America.

International students and scholars are usually referred to as ‘nonresident aliens’ for tax purposes in the US. You can learn more about how to determine your residency status here.

Withholding Agent

Usually, an organization that pays your income will also withhold tax from that income.

This organization is known as a ‘withholding agent’. In other words, if you are receiving income from your university, that university will likely be your withholding agent.

Tax Treaty

A tax treaty is an agreement between two countries about how they tax each other’s residents.

Many students can avail of tax treaty benefits and are entitled to reductions in the amount of tax that is deducted from their wages.

Taxpayer Identification Number (TIN)

A Taxpayer Identification Number (TIN) is a unique number that is used to identify you for tax purposes in the United States.

Two of the most common types of TIN include the Social Security Number (SSN) and the Individual Taxpayer Identification Number (ITIN).

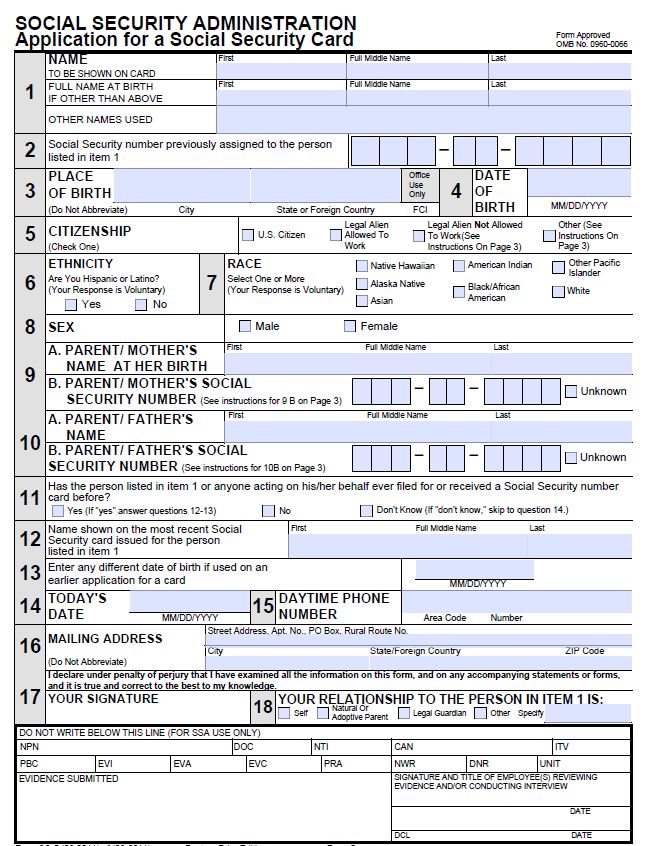

1. Form SS-5 & W-7

One of the first things that you should do when you arrive in the US is apply for a Social Security Number (SSN) and you expect to work in the US.

As mentioned above, you cannot work and earn income in the US without a TIN which the IRS can use to identify you.

The SSN is the most common type of identifier if you are allowed to work on or off campus in the US.

Simply put, you will not be able to work in the US as a nonresident student without a number the IRS can use to identify you for tax purposes.

You can apply for a Social Security Card directly with your local SSA office by completing a Form SS-5.

When you are submitting your SS-5 you will also need to bring along some original documentation showing your age, identity, immigration status, and entitlement to work in the US.

Meanwhile, if you expect to receive taxable Scholarship, Fellowship or Grant Income or any other income that is not employment income, you most probably do not qualify for a Social Security Number (SSN), you must instead apply for an Individual Taxpayer Identification Number (ITIN). ITIN is only used for tax purposes and it is recognized only by the IRS and some state tax offices, but not by SSA.

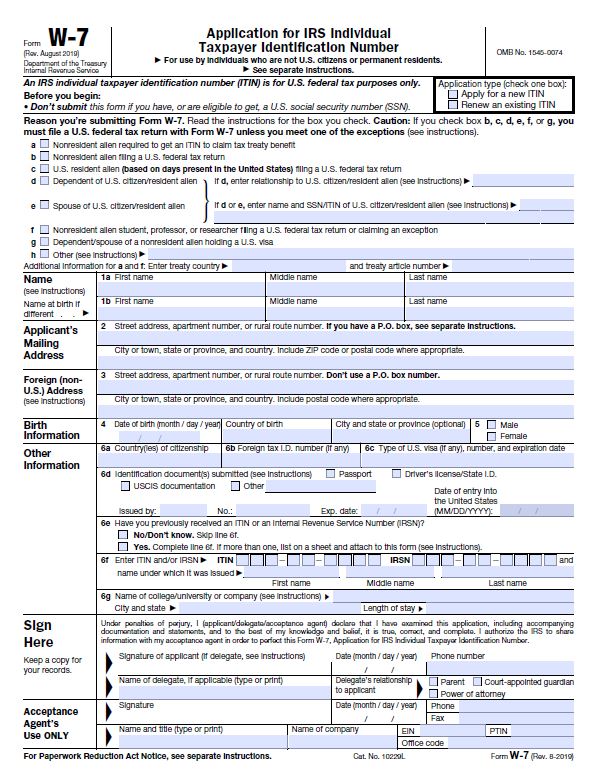

You can apply for your ITIN with the IRS directly by completing a W-7 form.

Fill in your ITIN application with Sprintax

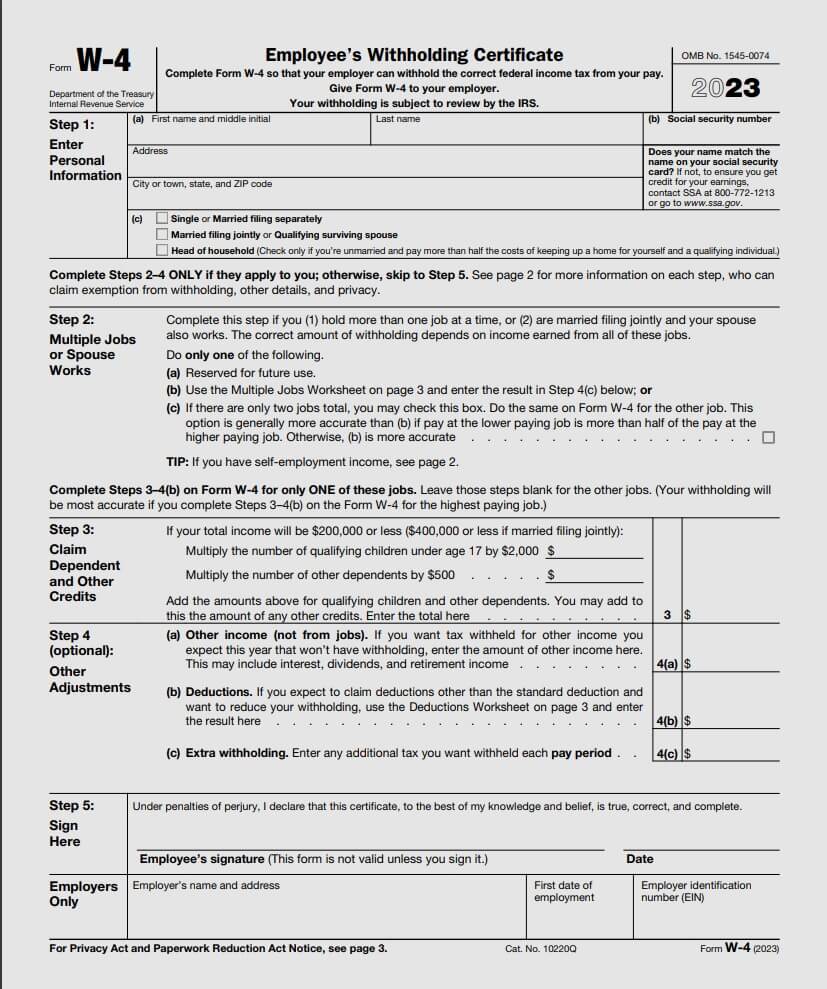

2. Form W-4

When you start working and earning income in the US, your employer will give you a W-4 form on your first day in a new job.

The purpose of this form is to determine how much tax should be withheld from your wages, scholarship, or grant.

It’s crucial that you complete your Form W-4 correctly. If your W-4 is not right, you may pay too little tax during the year and face a large balancing payment at the end of the tax year.

Completing a W-4 form

In order to fill out your W-4 form you will need to provide some personal details including your name, US address, TIN and marital status (tip: enter ‘single’ unless you’re married to a US citizen and filing jointly).

It’s also important to keep in mind that, as a nonresident, you can only claim one allowance on your W-4 Form – unless you are a resident of Canada, Mexico, India or the Republic of Korea, in which you may case you may be able to claim additional allowances.

Finally, before submitting your form, it’s always a good idea to double check the form to ensure each detail is correct. Once you are satisfied that your W-4 is accurate, you should print the form, sign and date it and give it to your employer.

You can prepare your W-4 form with Sprintax Forms.

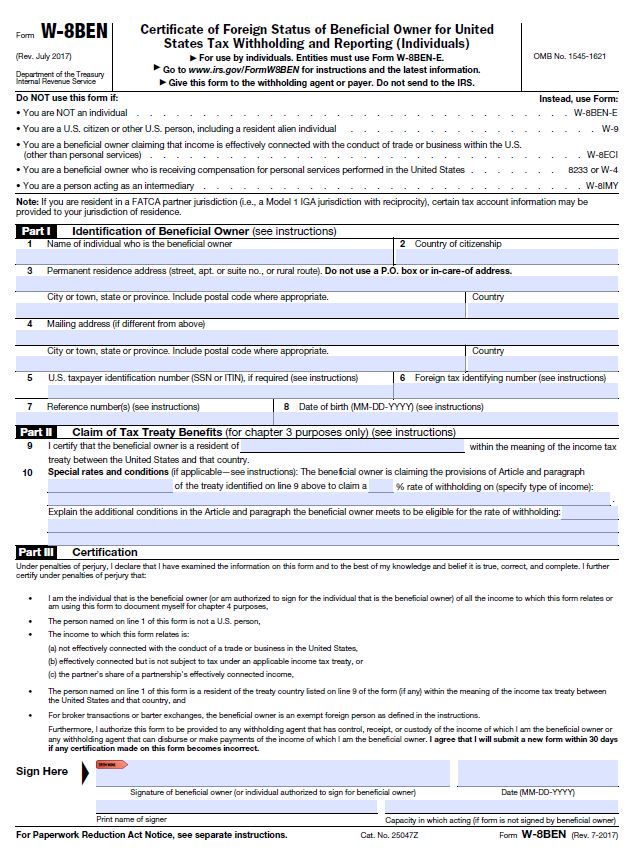

3. Form W-8BEN

In order to claim a tax treaty benefit you must fill out a W-8 Form or 8233 form.

The US has lots of different tax treaties with many countries around the world.

And the good news is that, as a nonresident international student in the US, you may be able to avail of a tax treaty in order to pay a reduced amount of US tax on income you earn from working at a university, your OPT, teaching or research and other types of payments.

In fact, you may not have to pay any US tax at all, depending on the type of tax treaty!

There are a variety of W-8 forms and each is fairly complex. The W-8BEN form is the most common type used by nonresident employees.

Completing a W-8BEN

In truth, a W-8 form is fairly complex and it can be tricky to complete.

Though it requires the basics like name, country of origin and TIN, it also asks for the contacts from which it is receiving the income it reports. Often, a professional is consulted to assist in completing Part II the form, concerning tax treaty eligibility and details.

Determining your tax treaty eligibility is really easy with Sprintax Forms.

All you have to do is enter your information into our short questionnaire.

Our tax determination software will then instantly determine whether or not you’re permitted to claim a tax treaty.

4. Form 8233

If you receive non-compensatory scholarship or fellowship income and personal services income (including compensatory scholarship or fellowship income) from your university and you want to claim a tax treaty benefit for both and pay a reduced amount of US tax you will need to complete a Form 8233 and submit it to your university.

You must complete a separate Form 8233:

- For each tax year (be sure to specify the tax year in the space provided above Part I of the form)

- For each withholding agent (University), and

- For each type of income

In order to complete Form 8233 you will need:

- Personal information such as your name, TIN and address in your country of residence

- Details of your US visa type including:

– The date of your entry to the US (relating to your current non-immigrant status) and the date that your current non-immigrant status expires

– You may also need to include a copy of your visa - A description of the services provided, and the total amount of income earned

- The exact treaty (and article of the treaty) on which you are basing your claim for tax exemption

- And more

5. Form 1040NR

Every nonresident alien studying in the US is legally required to file a tax return and you do so by filing a 1040NR.

As of 2020, the IRS no longer uses or accepts 1040NR-EZ.

So, which tax return should I file?

Most nonresident international students will be required to file a 1040NR tax return.

In order to complete your 1040NR, you will need…

- Personal information

Including your name, address and TIN - Details of your wages, salaries, tips, etc.

Your employer will provide you with a Form W-2 (Wage and Tax Statement) by early February and you will find this document very useful when you are filing your end of year tax return. The form includes important details regarding your total gross earnings including wages, tips and taxable fringe benefits, and the Federal and State tax that is withheld. - Details of your scholarship and fellowship grants, if applicable

- Details of treaty-exempt income

If you are entitled to avail of tax treaty benefits, you should report all your income that is exempt - Your signature!

Don’t forget to sign your return. Form 1040NR is not considered a valid return unless you sign and date it.

Remember, from the 2020 tax year onwards, Form 1040NR-EZ is no longer accepted by the IRS by the IRS and is not an option to file. This form may only be filed by nonresidents for years prior to 2020 (instructions here)

The deadline for filing a 1040NR for 2023 tax year is April 15, 2024.

Who can help?

If you, like many other international students find US tax to be daunting, you may be wondering if anyone can help you complete your tax documents correctly and ensure your compliance with the IRS.

The answer?

Sprintax is the only online tax software for nonresident federal tax e-filing and state tax return preparation in the US. When you choose Sprintax, you can enjoy a stress-free service from start to finish. Plus, if you have any questions, our live chat team are on hand 24/7 to support you.

When you create your account, the Sprintax software will assist you in preparing fully compliant Federal and State tax returns. Sprintax will also enable you to receive your maximum legal tax refund.

Prepare your international student tax return

Sprintax Calculus

Our tax determination software Sprintax Calculus (formerly Sprintax TDS) is designed specifically for educational institutions to ensure that nonresident students, scholars, and employees are taxed correctly and that the right amount of tax is withheld from earnings and reported to the IRS.

You can easily apply for your SSN, establish your tax residency status and determine your tax treaty entitlement.

Sprintax Calculus can also be used to easily prepare tax forms such as the SS-5, W-8BEN, 8233 and W-4 and help students to secure their SSN or ITIN.

If you want to learn more about your US tax obligations, why not check this guide: US tax season survival guide for international students on F-1 visas