(Updated for 2025)

Coming to the US from a foreign country presents both thrills and challenges to every nonresident. One of the more common difficulties nonresidents face is filing their tax return.

In this blog post, we’ll be discussing Forms 1040, 1040NR, 1040NR-EZ, and how they apply to each person’s situation (Important: Since 2020, form 1040-NR-EZ is no longer used.)

Form 1040 (NR) figures out the total taxable income of the taxpayer and determines how much of a refund the person may be due.

So, without further ado, let’s examine how to find out which form applies to you!

Table of Contents

- Determine your residency status for tax purposes

- Filing a 2024 Nonresident tax return

- Should I file Form 1040 or 1040NR?

- Dual-status aliens – which tax form to file?

- Filed 1040 instead of 1040NR

- I had no US income. Which form to file?

- Get help with form 1040NR

Determining your residency status for tax purposes

This is always a key part of figuring out which forms you need to file for your US tax return, and how much tax you will pay.

One of the more common mistakes nonresidents make is filing their taxes as a resident (i.e. filing form 1040). If a nonresident files as a resident they can claim benefits and receive refunds that they’re not entitled to.

There are three types of residency for tax purposes: resident for tax purposes, nonresident for tax purposes, and dual resident. Check this resource for more information.

You can also determine your tax residency status for free using Sprintax – simply create an account to get started.

Should I file a Form 1040 or 1040NR?

Essentially, each resident should file a Form 1040 and a nonresident should file with a Form 1040NR.

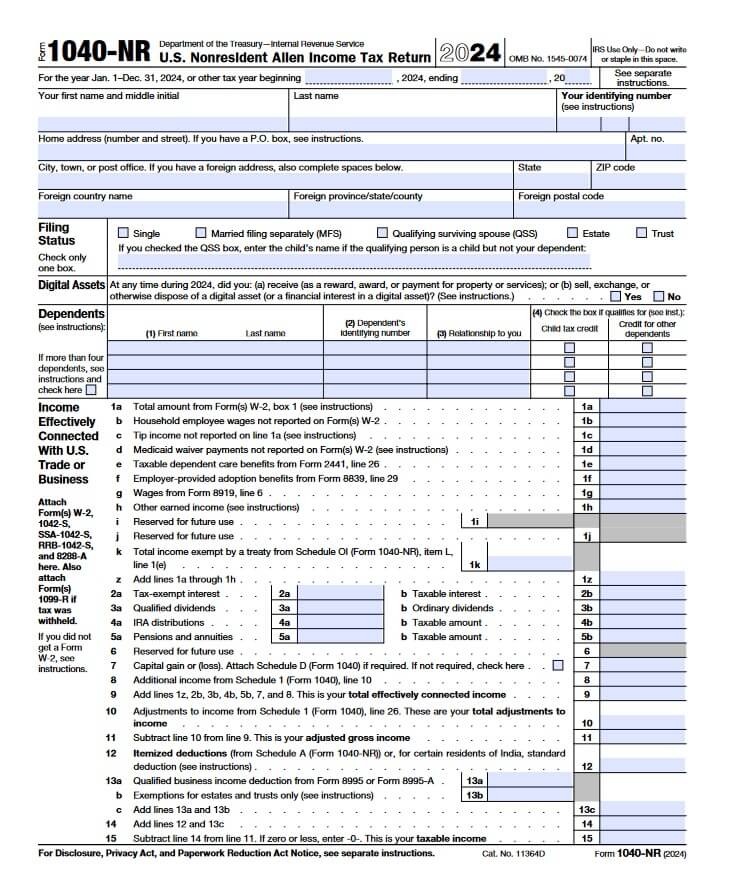

What is form 1040NR?

Form 1040NR (U.S. Nonresident Alien Income Tax Return) is the income tax return form that nonresident aliens in the U.S. have to file if they had any income from U.S. sources throughout the year.

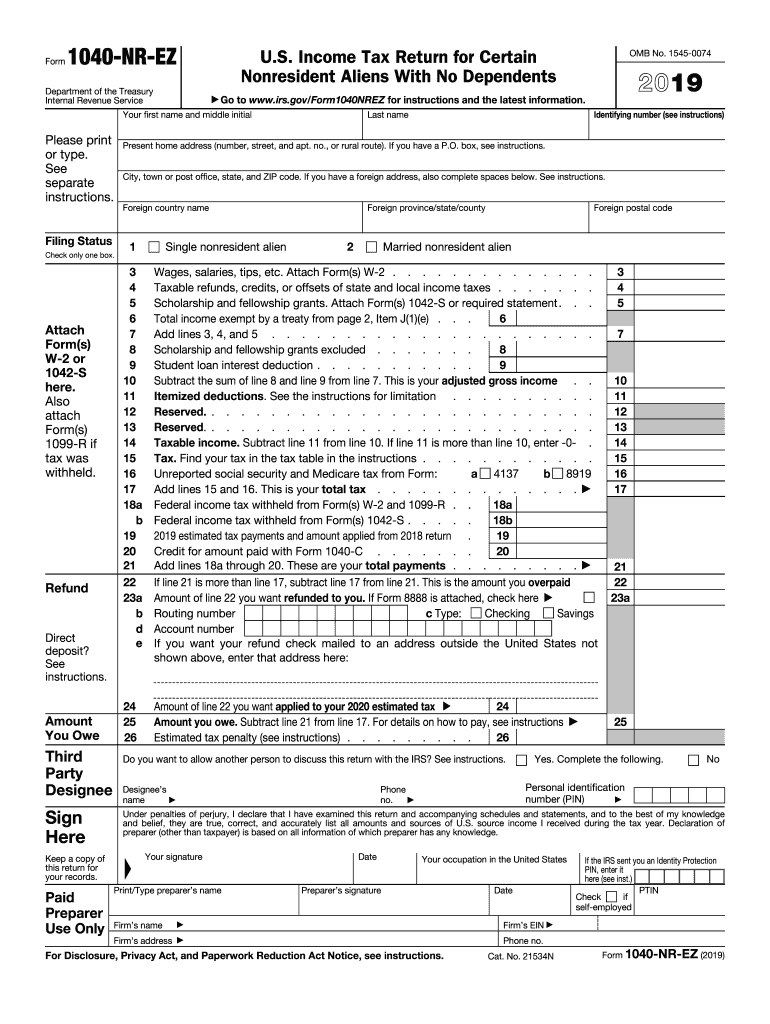

Form 1040NR-EZ

If you are filing your Nonresident tax return you should use the Form 1040NR.

From the 2020 tax year onwards, the Form 1040NR-EZ has been made obsolete by the IRS and is no longer available as an option to file. This form may only be filed by nonresidents for years prior to 2020 (instructions here)

Filing your US Nonresident alien tax return

As a nonresident if you are filing a tax return for the 2024 tax year you should use form 1040-NR to file your tax return.

Sprintax can help guide you through the tricky tax filing process.

When do I need to file my 1040-NR?

The deadline for filing a 1040-NR is 15 April.

So, if you are filing taxes for 2024, you’ll need to file by 15 April 2025.

Remember, by not filing your US tax return as a nonresident, you leave yourself open to fines and penalties from the IRS, as well as future visa issues.

Can 1040NR be filed electronically?

The IRS allows e-filing of 1040NR forms.

Alternatively, you can mail the 1040NR to the address listed on the form.

Filing 1040-NR with Sprintax

If you need some help with your taxes, you can easily prepare and e-file your nonresident tax return online with Sprintax’ 1040NR software.

Firstly, we’ll determine your tax residency status and then identify which forms you need to complete based on your own personal circumstances.

Plus, if you have any questions, our Vita Qualified Live Chat team is on hand to help 24/7!

Find out if you are eligible to e-file your taxes here.

Sprintax is the only tax preparation software for nonresident aliens in the US and the nonresident tax partner of Turbotax!

We are currently the only nonresident tax prep solution offering e-filing services.

In case you’re not eligible for e-filing, you can still prepare your form, download and sign it, and mail it to the nearest IRS processing center in the state you were in during your stay.

File your US tax documents the easy way today! Create an account to get started with your online tax return preparation.

I am a dual-status alien! Which tax form should I file?

Nonresident aliens at the beginning of the tax year and resident aliens at the end of the tax year should file Form 1040 labeled “Dual-Status Return” with Form 1040NR attached as a schedule and labeled “Dual-Status Statement.”

Taxpayers who were resident aliens at the beginning of the tax year and nonresident aliens at the end of the tax year should instead file Form 1040NR labeled “Dual-Status Return” with Form 1040 attached as a schedule and labeled “Dual-Status Statement.”

What if I filed 1040 instead of 1040NR?

Filing the wrong form can lead to complications when applying for a future US visa or for a Green Card.

There may also be a fine or penalty for filing a 1040 instead of a 1040NR.

If you file the wrong form, you should amend your tax return so it does not lead to problems with the IRS later in the year.

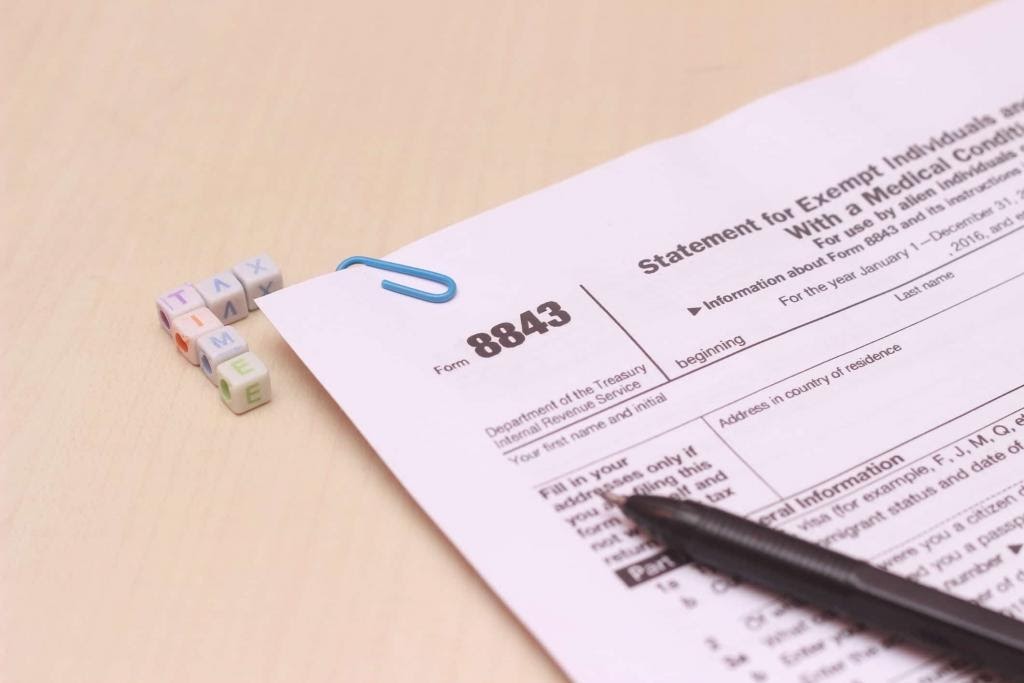

I didn’t receive any income. Which form applies to me?

If you did not receive any US sourced income during your stay in the States, you should file a Form 8843. This only applies to you if your are:

- On a F, J, M or Q visas

- Other non-residents that exclude days of presence for Substantial Presence Test

This should not be completed by any individuals that are on a working or immigrant visas like for example, H1B, H2B, L, DACA.

Form 8843 is not an income tax return. Instead, it is a statement you file for the US Government if you are a certain type of nonresident alien for tax purposes.

However, if you earned income in the US you must file a tax return – either Form 1040NR/Form 1040 NR-EZ (only for years prior to 2020) – as well as Form 8843.

You can find out more about Form 8843 here.

Filing your Nonresident tax return for years prior to 2020

You should file a Form 1040NR or a 1040NR-EZ for years prior to 2020.

The difference between 1040NR and 1040NR-EZ

Form 1040NR-EZ is used if your only income from US sources is salaries, tips, wages, refunds of state and local income taxes, or fellowship grants and scholarship.

Most international students filing for years prior to 2020 will file Form 1040NR-EZ. This is because it meets the criteria of most nonresident individual’s circumstances.

As mentioned, it depends on the individual’s circumstances. You should file 1040NR-EZ instead of Form 1040NR only if you are filing for years prior to 2020 and then if any of the below sounds like you:

- Your taxable income is less than $100,000

- Your only US source income was from wages, salaries, tips, refunds of state and local income taxes, scholarship or fellowship grants, and non-taxable interest or dividends. Note: If you had taxable interest or dividend income, you must use Form 1040NR.

- The only taxes you owe are: The tax from the Tax Table, or Unreported social security and Medicare tax from Form 4137 or 8919

- You do not claim any tax credits

- The only itemized deduction you can claim is for state and local income taxes. Note: Residents of India who were students or business apprentices may be able to take the standard deduction instead of the itemized deduction for state and local income taxes

- The only exclusion you can claim is the exclusion for scholarship and fellowship grants, and the only adjustment to income you can take is the student loan interest deduction

- You do not claim a child or child care expenses tax credits

- You cannot claim any deduction other than the student loan interest deduction and the itemized deduction for state and local income taxes (or, if a resident of India who was a student or business apprentice, the standard deduction)

- You do not claim any dependents

- You cannot be claimed as a dependent on another person’s US tax return (such as your parent’s return)

- If you expatriated or terminated your US residency, or you are subject to the expatriation tax, you must use Form 1040NR if you are required to file that form

Below you can see the 1040NR-EZ form, with instructions outlining what you will need in order to complete the document.

As you can see, the form will ask you for some personal information, such as:

- Your name, address, and TIN

- Details of your wages, salaries, tips, etc. Your employer will provide you with a Form W-2 (Wage and Tax Statement) by early February, and you will find this document very useful when you are filing your end of year tax return. The form includes important details regarding your total gross earnings including wages, tips, taxable fringe benefits, and the Federal and State tax that is withheld

- Details of your scholarship and fellowship grants, if applicable

- Details of treaty-exempt income – If you are entitled to avail of tax treaty benefits, you should report all your income that is exempt on your Form 1040NR-EZ

Filing 1040NR for years prior to 2020

Prior to 2020, this form was typically used for reporting income such as self-employment compensation, investments, as well as the types of income.

It is typically for nonresidents who earned investment income, sold or bought a house, or had self-employment income, or other income.

It can also be used by nonresidents who qualify for a tax treaty and wish to claim a tax refund for employment taxes that were withheld before the tax treaty was granted.