You might be surprised to learn that, at present, there are around one million international students studying in the United States. What won’t surprise you however, is that each of these one million students have tax obligations in the United States.

What are these obligations? This is where things get a bit tricky!

If you’re an international student in the US you might not be too familiar with the local tax system. And it’s highly likely that you’ll have some questions about your tax obligations and what you’re entitled to. That’s why we’ve created this handy guide to US tax for international students and other nonresident aliens.

So let’s get into it.

What is the IRS?

The Internal Revenue Service (IRS) is the US government agency responsible for the collection of taxes and the enforcement of tax laws. The agency dates all the way back to 1862 when it was introduced by the then President Abraham Lincoln. Its primary purpose includes the collection of individual income taxes and employment taxes. The IRS also handles corporate, gift, excise and estate taxes.

How does the American tax system work?

Both Americans and foreign nationals residing in the US must pay taxes to both the State and Federal government. Usually, when an individual earns an income, a portion of it is automatically deducted and transferred directly to the government. Every January employers send summaries to their employees of how much income they were paid as well as how much of their income was sent to the IRS.

What income will I need to pay tax on in the US?

As an international student in the US you will have to pay tax on the following types of income:

- Wages

- Salaries

- Tips

- Interest

- Dividends

- Some scholarships/fellowship grants

How do I know if I made ‘US source income’?

US source income is defined as wages from a job in the United States, received scholarship money from an American organization, or made interest on money in an American bank account etc.

What is an Income Tax Return?

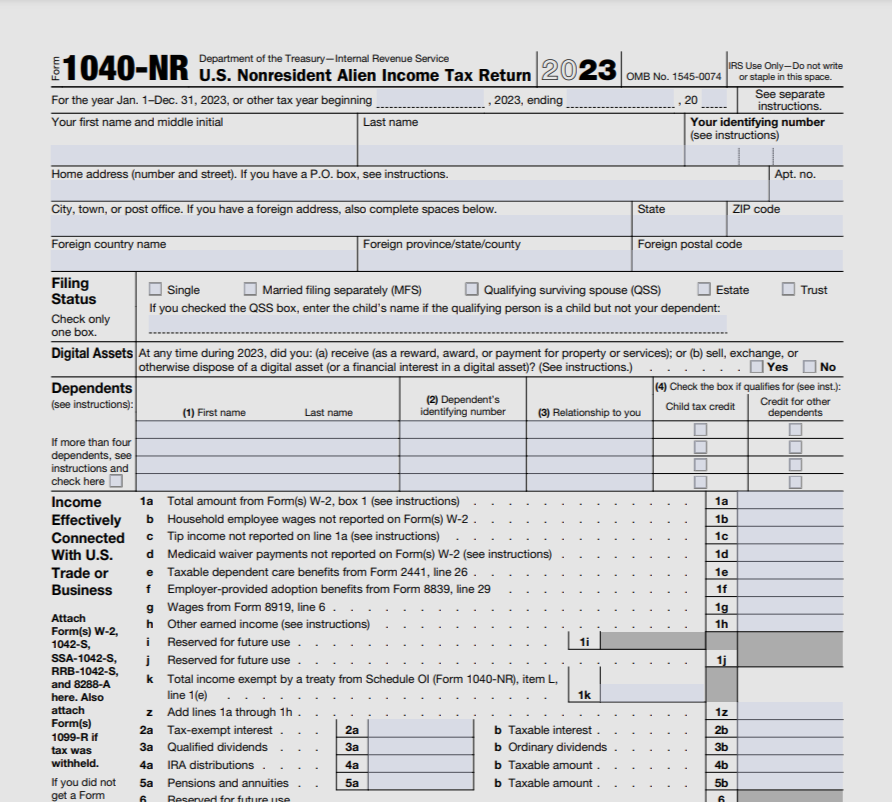

An income tax return is the form that individuals and businesses submit to the IRS in order to file their taxes. ‘Form 1040 NR’ is an example of an income tax form.

The purpose of filing your tax return is so that you can report all sources of your income to the government – including the tax you have already paid and what you still owe. It’s also an opportunity to claim any deductions or exemptions that you may qualify for.

At the end of the process, you calculate the total tax you should have paid. If you paid more than what you owe during the year, you will be reimbursed. On the other hand, if you didn’t pay enough, you have to pay the difference.

Am I required to file a tax return?

If you received any US income during the tax year, you’re required to file a tax return.

Even if you didn’t receive income, you’re still required to file form 8843.

What is tax residency status?

US residents have differing tax obligations depending on their relationship with the country. Each taxpayer must determine their own residency status before they file their tax return. The most common tax residency statuses are ‘resident’ and ‘nonresident aliens’.

How can I work out my residency status?

Most international students who are studying in the US on F, J, M or Q visas are considered nonresident aliens for tax purposes.

International students on F1 visas are automatically considered nonresident aliens for their first 5 calendar years in the US, and scholars (and their dependents) on J visas are automatically considered nonresidents for their first 2 calendar years in the US.

If you’ve been in the US for longer than the 5 or 2 calendar years, you will be considered a ‘resident alien’ for tax purposes if you pass either the ‘green card test’ or the ‘substantial presence test’ for the calendar year (January 1-December 31).

Learn more about your residency status here.

What is a Substantial Presence Test?

You will be considered a US resident for tax purposes if you pass the substantial presence test for the calendar year. To meet this test, you must be physically present in the US on at least:

- 31 days during the current year and

- 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

– Every day you were present in the current year

and

– 1/3 of the days you were present in the first year before the current year

and

– 1/6 of the days you were present in the second year before the current year

Case study

Sam was present in the US for 120 days in each year from 2021-2023. To determine if he passes the substantial presence test for 2023 he can count his full presence in 2023, 40 days in 2022 (1/3 of 120 days), and 20 days in 2021 (1/6 of 120). Since the total for the 3-year period is 180 days, Sam will not be considered a resident under the substantial presence test for 2023.

Days of Presence in the United States

You are treated as present in the US on any day you are physically present in the country, at any time during the day. However, there are some exceptions to this rule. For example, you can’t count the following as days of presence in the US:

- Days you commute to work in the US from a residence in Canada or Mexico if you regularly commute from Canada or Mexico

- Days you are in the US for less than 24 hours, when you are in transit between two places outside the United States

- Days you are in the US as a crew member of a foreign vessel

- Days you are unable to leave the US because of a medical condition that develops while you are in the US

- Days you are an ‘exempt individual’ (more details below)

Exempt Individual

The term ‘exempt individual’ refers to anyone in the following categories:

- An individual temporarily present in the US as a foreign government-related individual under an A or G visa (other than individuals holding A-3 or G-5 class visas)

- A teacher or trainee temporarily present in the US under a J or Q visa, who substantially complies with the requirements of the visa

- A student temporarily present in the US under an F, J, M, or Q visa, who substantially complies with the requirements of the visa

- A professional athlete temporarily in the US to compete in a charitable sports event

What tax forms do I need to file?

Every international student will need to file a Form 8843 (which essentially proves that you’re a nonresident) and if you have received income in the last calendar year then you will most likely need to file a Form 1040NR also.

The 1040NR is used to declare your US source income and determine how much tax you owe on that income.

What information will I need in order to complete my tax return?

The first thing you will need is your US taxpayer identification number (TIN).

A US TIN for an individual is either a US Social Security Number (SSN) or an individual taxpayer identification number (ITIN).

Only foreign nationals who are authorized to work in the United States under the US immigration law are eligible to apply for a SSN. Foreign nationals not eligible to apply for a SSN may submit a Form W-7 (ITIN application) to the IRS.

Confused? Learn more about ITIN here.

To prepare your tax return you will also need your income documents like W-2’s, 1042-S forms, and/or 1099’s, which will be mailed to you by the university and your employer.

- W-2 – This document, provided by your employer, includes details of the wages you earned and the taxes withheld from your wages. You should receive this document by January 31. Read more about it here.

- 1099 – This document is a report from your bank on the interest you have earned on your accounts. You should receive this by January 31.

- 1042-S – This details wages paid to you if you already claimed a tax treaty benefit, and scholarship income that was used for expenses other than tuition and fees (such as room, board, or travel). You will receive form 1042-S by March 15.

- Don’t forget – if you don’t have taxable US-sourced income you won’t receive income documents and you won’t need to apply for a US TIN. In this case you’ll just need to submit form 8843 to the IRS.

How do I submit a nonresident tax return?

You can choose to fill out all of the paperwork and submit your tax return directly to the IRS yourself. Depending on the tax rules of the state in which you lived and /or worked you may also need to file a state return to your state tax office.

Many international students find the thought of submitting a tax return to be quite daunting.

If you’d like a hand with the preparation of your return, you can enlist the help of a tax agent like Sprintax. Preparing your tax return is easy with our 1040NR tax software and we guarantee to keep you compliant with the US tax authorities.

How can Sprintax help me?

Sprintax will take the stress out of filing your tax return by offering you step-by-step assistance throughout the entire process.

Sprintax can also help you to determine if you are considered a ‘resident’ or ‘nonresident’ for tax purposes and guarantees to maximize your tax refund.

- Online US tax prep solution for international students, scholars and nonresident professionals

- US tax compliance guaranteed

- Built-in knowledge of over 350 different types of tax deductions

- 65 international tax treaty agreements and exemptions covered

- Maximum legal tax refund for Federal, State & Medicare

Just complete the registration form here to get started.

What is the deadline for filing a tax return?

The filing deadline for US federal income tax returns for individuals is April 15. However, in the event that this date falls on a Saturday, Sunday or holiday, the first succeeding day that is not a Saturday, Sunday or holiday will be the deadline.

The deadline for filing 2023 tax returns is 15 April 2024.

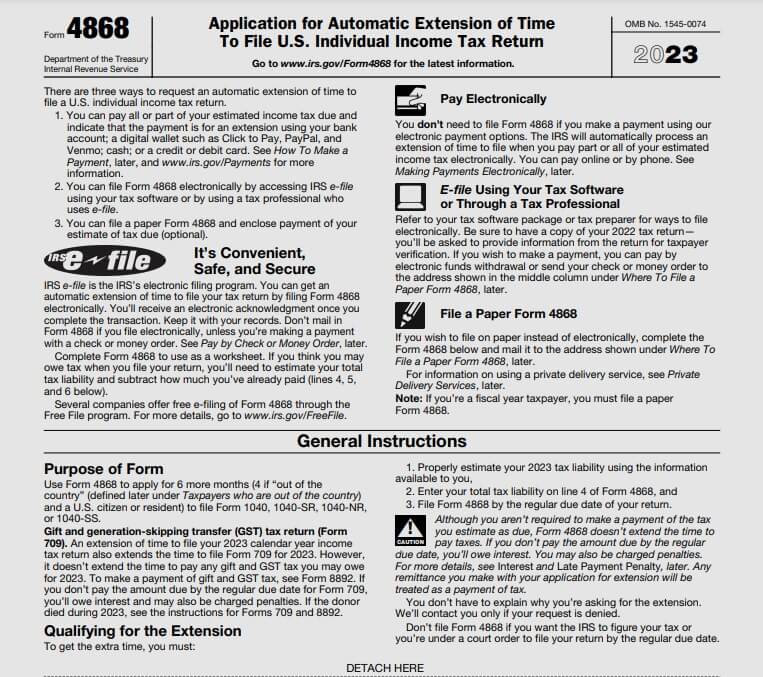

What should I do if I am unable to file my tax form by the deadline?

Need more time to complete your return? Simply file form 4868 (Application for Automatic Extension of Time

To File U.S. Individual Income Tax Return) to request an automatic deadline extension to August 15.

It’s important to note that you will not be notified if your extension request is approved – the process is automatic. If you owe any taxes, you must still mail the estimated tax payment by the April 15 deadline or you will have to pay penalties and interest on any payment owed.

Does it cost anything to file my nonresident tax return?

If you decide to file your tax return yourself, the process is free.

You can find Sprintax full pricing list here.

Am I entitled to any tax exemptions?

In previous years there were a number of exemptions and deductions that international students could use to reduce their overall tax liability.

However, in November 2017, President Donald Trump introduced a GOP tax reform bill which brought widespread tax-related changes for most taxpayers.

Check out our detailed article about the GOP Tax Reform and its effects on the taxation of foreign students and other nonresident aliens here.

Will I be entitled to a tax refund?

You may be entitled to a tax refund if you paid more than what you owed during the year.

Once your tax return has been completely filled in you will be able to determine if the US government owes you a refund.

The average Federal tax refund a Sprintax customer gets is $1,004.

Sprintax can help you to you to retrieve your maximum tax refund.

How can I claim my tax refund?

You can claim your tax refund when you file your nonresident tax return.

Alternatively, if you choose to file with Sprintax Returns, you’ll be guaranteed to receive your maximum legal tax refund.

Do I have to pay taxes on income I received from my home country?

No. The US will not tax your income from non-American sources.

Learn more about what income is taxable for nonresidents here.

There is a tax treaty between the US and my country. Should I file a tax form?

Yes. You will still be required to file a tax return for each year you spent studying in the US.

Learn more how to claim tax treaty benefits here.

I had no US income, should I still file?

Yes.

You are required to complete a Form 8843 with the IRS regardless of whether you received income. Every nonresident alien who spends any portion of the year in the US on an F or J visa must complete a Form 8843 and send it to the IRS.

This means, the following 2 examples below both need to file form 8843:

- I’m an F-1/J-1 student with no US income or scholarships for 2023. Do I need to file anything? – Yes, form 8843.

- I arrived in the US in December and I didn’t work. Do I still have to file Form 8843? – Yes.

You can fill out form 8843 easily with Sprintax. Simply create an account to get started.

What happens if I don’t file a tax return?

Payment of an income tax liability is required by law and complying with US tax law is one of the conditions of your visa. If you owe taxes and don’t file, the IRS can impose penalties and interest and there can also be consequences for future immigration.

For instance, if you apply for permanent residency (a green card) it’s likely that you will be asked to provide evidence of your tax filing for previous years in the US.

Filing a tax return is also the only way you can retrieve your tax refund. It would be a shame to leave money you’re entitled to behind!