If you are a nonresident alien (NRA) who lived or worked in the US, you will have tax responsibilities, regardless of whether you earned income.

In essence, every nonresident is required to file their taxes.

When you sit down to file you may discover that you owe tax. But don’t worry, it is very common for nonresidents to owe money to the IRS.

In this guide we discover some of the reasons you may owe tax and how to file your tax return.

Table of Contents Show

Do nonresidents have to file taxes?

While US citizens and residents are subject to taxes on their income at a federal level on worldwide income, nonresident aliens are usually taxed only on any of their income from US sources.

You will have to file Form 1040-NR, officially known as the U.S. Nonresident Alien Income Tax Return, if you have any income from US sources that is subject to tax, like wages, tips, scholarship and fellowship grants, and dividends, for example.

If you are on exempt visas – F, M, J and Q and you did not earn any income, you will still need to file a tax form – Form 8843.

What are the tax rates for the money I earned in the tax year?

In most cases, any income you earned during the 2024 tax year from US sources will be taxed.

The rate at which this money is taxed will depend on some factors, such as how much you earned or if you are subject to a tax treaty.

Below are the federal rates of tax for any income earned in 2024:

| Income | Tax rate |

|---|---|

| $0 to $11,600 | 10% |

| $11,601 to $47,150 | 12% |

| $47,151 to $100,525 | 22% |

| $100,526 to $191,950 | 24% |

| $191,951 to $243,725 | 32% |

| $243,726 to $609,350 | 35% |

| $609,351 or more | 37% |

What is a 1040NR nonresident alien income tax return?

Form 1040-NR is the federal tax return form used by nonresidents in the US to report their income and to pay any outstanding taxes to the US government.

The 1040NR form is used to report any income that you earn in the US – this includes your wages.

Filing the 1040NR form can often be quite complex, especially if you are not familiar with US tax!

Why do I owe money on my tax return?

When it comes to April 15, many nonresidents are often left scratching their heads and wondering: “why do I owe taxes this year?”.

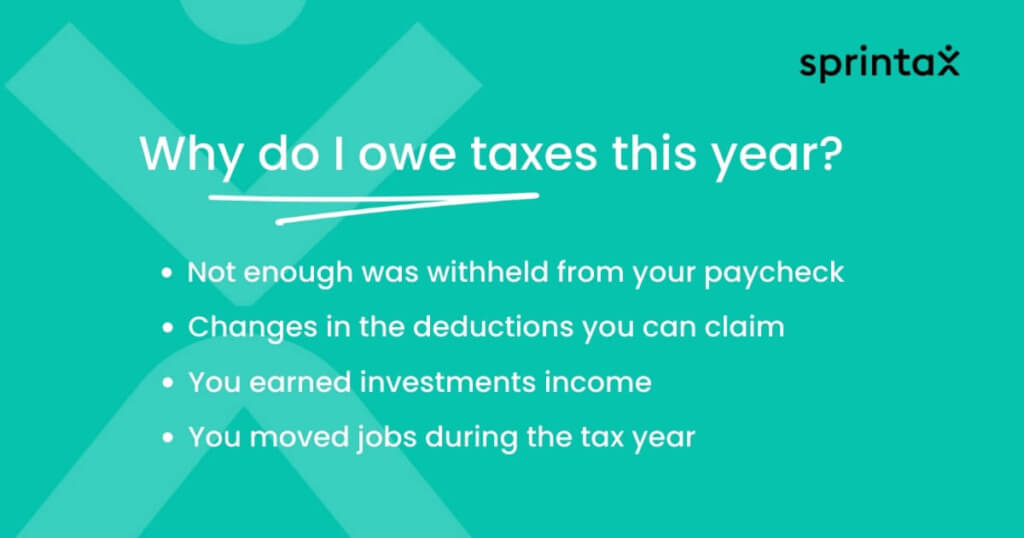

There are a few different reasons why you may owe the IRS money from the tax year.

Changes in the deductions you can claim

For example, if not enough was withheld from your paycheck, or there were changes in the deductions you can claim.

You earned investments income

Meanwhile, income earned outside of your job (such as investments) is taxable. So, if you earned income from things like investments, sold stocks or were involved in cryptocurrency trading, you will also owe taxes on any income earned from this.

Did you move jobs during the tax year?

Well, this can also affect how much tax you pay. If you earn more in your new job and are placed into a higher tax bracket, you’ll invariably end up paying more tax.

Why do I owe interest on my taxes?

What happens if you don’t file a tax return? Well, you could end up owing even more money to the IRS than you originally did.

Interest generally accrues on tax returns that have not been filed with the IRS on time.

The late-filing penalty issued by the IRS is usually 5% of the unpaid taxes for each month since the tax return is due. This will not exceed 25% of the total unpaid taxes.

However, if you still haven’t filed months or years later, you will have trouble securing future visas or Green Cards as these unpaid taxes are noted.

What deductions can I claim on 1040-NR?

Claiming tax deductions can often help you offset any tax liability you may have.

Many countries have a tax treaty with the United States that has a direct impact on taxes paid.

So, if your home country has a tax treaty with the US, it may allow a lower tax rate on certain types of income or even for you to claim certain credits or deductions.

How can I claim tax treaty benefits when filing?

When you start a job in the US, your employer will ask you to fill out some important forms to help with tax withholding (these include forms W-8BEN and 8233).

When these forms are completed, they will provide a clearer picture to your employer about which treaties are relevant to you.

It is important you take your time and complete these forms properly as they can be the difference between owing money and being tax compliant come filing time.

You can still claim tax treaty benefits on your tax return if you did not originally.

Why do I owe federal taxes but get a state refund?

Because taxes are different at a state and federal level, sometimes nonresidents find they can owe taxes at a federal level, but may be due a refund at their state level.

This can come down to a number of reasons, but the most common is that you paid more taxes than your tax liability stated that you needed to at state level, in which case you are due tax back.

Why do I owe state taxes but get a federal refund?

Meanwhile, you may have underpaid federal taxes, so you may owe the IRS money.

This can also be the case if you overpaid federal taxes but underpaid state taxes, in which case you will be due a federal refund but owe money to your state.

When do I file my tax return?

You are required to file a tax return for the 2024 tax year before 15 April 2025.

Who can help me file my taxes?

Sprintax Returns can help you out!

You can file your US nonresident tax return with Sprintax Returns easily online – no matter where you are in the world!

Sprintax Returns is the go-to software for the preparation of Federal and State tax-filing for nonresidents in the US!

Remember – nonresidents can’t file with TurboTax as they support residents and US citizens only. Sprintax is the official tax filing partner of TurboTax!

We will assist you in completing fully legal Federal and State tax returns to ensure you are 100% compliant with the IRS.

File your taxes with Sprintax!