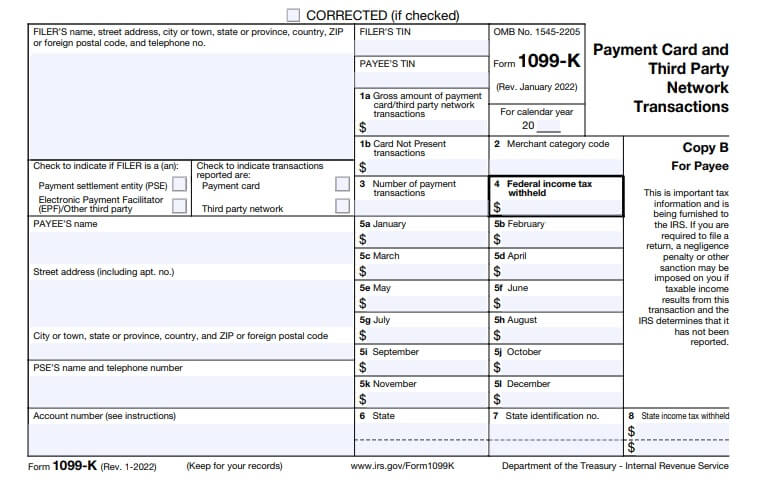

If you have received an IRS 1099-K form, you may be wondering whether the document has any implications for your tax requirements in the US.

You may receive a 1099-K document (also referred to as a Payment Card and Third Party Network Transactions form) if you received payments through credit or bank card transactions.

For example, if you sell products on the internet and earn income through PayPal, Venmo, Zelle, you may be issued this document.

Many nonresidents have questions about their 1099-K forms and we will answer some of the most common questions here.

What is a 1099-K form?

The 1099 series of forms enable taxpayers to report to the IRS the income they have received which was not part of their paycheck.

The 1099-K – Payment Card and Third-Party Network Transactions is part of the 1099 series.

The document is used in order to report electronic payments – credit and debit card payments, for example.

Essentially, 1099-K is an informational tax return that only shows the transactions made towards any entity.

Why have I received a 1099-K?

International students, scholars and other nonresidents who receive transactions through platforms like Venmo or PayPal may receive this document.

Such payments count as taxable income and must be reported to the IRS!

There are differing reasons why you may receive a 1099-K form, depending on the tax year.

For the 2022 tax year, you will receive this document if you received gross payments of more than $600.

Meanwhile, you would have received this document by 31 January 2022 if you accepted gross payments of more than $20,000 from more than 200 transactions.

There are a wide range of products and services which you may have sold online which triggered the issuance of a 1099-K form.

In recent years, more and more nonresidents have received this form having sold cryptocurrency online.

Under what circumstances should I report my 1099-K income to the IRS?

The form 1099-K details income you have earned through business transactions.

This income is fully taxable and should be reported to the IRS.

You should use the total amount of income detailed on your 1099-K when calculating your gross income during tax season.

It’s also important to note that – even if you have not received this form – you should always report all of your taxable income to the IRS.

Be sure to keep all additional documents (such as 1099 forms) safe after you file your taxes, in case the IRS require any additional information.

I earned income from cryptocurrency. Is this why I received a 1099-K?

Many nonresidents in the US earn income from cryptocurrency.

Popular websites such as Coinbase.com and Crypto.com allow users to buy, sell, and trade a range of different cryptocurrencies.

Nonresidents have been issued with 1099-K if they earned over the threshold and used third-party network transactions to do so.

The 1099-K can be seen as a necessary form to complete for any ‘hobby income’ you received – i.e. income such as gambling and cryptocurrency trading.

Therefore, you may also be issued with a 1099-K if you earned income through gambling.

Is a 1099-K revenue considered taxable income?

Yes, any income on a 1099-K is considered taxable.

However, income reported on 1099-K is considered non-reportable and non-taxable if you sold personal items, unless this is regularly done by you.

Also, if you used the items and then sold them on eBay or Amazon for less than you bought them for, then you owe no taxes on the sale.

There are various different types of 1099 forms. What is the difference between them all?

There are over twenty versions of Form 1099 – each listing a different type of income that needs to be reported.

There are three other 1099 forms in particular that all nonresidents should know about – 1099-DIV, 1099-NEC, 1099-INT, and 1099-MISC.

1099-DIV

This is issued in order to report dividends and distributions from any investments you made throughout the year. You’ll need to file this along with your tax return at the end of the tax year.

1099-NEC

This will record any income that you gained if you are an independent contractor or self-employed worker.

Your clients will issue you with a 1099-NEC if they have paid you $600 or more that year.

Read more: What are my tax obligations as a nonresident self-employed worker in the US?

1099-INT

This may be given to you from interest payments. For example, it’s likely you will receive the form from a bank where you have interest bearing accounts.

1099-MISC

The difference between Form 1099-MISC and 1099-K is that a 1099-MISC is usually given to you if you earn money through freelance work or contract labor.

What do I do with a 1099-K?

You will need to keep your form 1099-K with your other tax documents to submit as part of your tax return.

The 2022 tax deadline is 18 April.

This means that you will need to submit all of your relevant documents (including Form 1099-K where possible) to the IRS on or before 18 April.

You can prepare and file your nonresident tax return easily with Sprintax.

What happens if I don’t include 1099-K on my tax return?

It’s very important to file your taxes correctly.

After all, ignoring your tax obligations can leave you in hot water with the IRS.

Not including a 1099-K on your return, just like any other key document, can lead to fines and penalties from the IRS.

Will the IRS catch a missing 1099-K?

Yes, there is a high chance the IRS will catch a missing 1099-K.

There is no reason to leave this out of your tax return.

With the prospect of fines and penalties that can hurt your chances of future US visa and Green Cards, why leave it out?

Can Sprintax help me include 1099-K on my 1040-NR tax return?

Yes!

That’s why using a tax-filing expert like Sprintax Returns is a great idea!

We’ll ensure you are 100% tax compliant with the IRS – even ensuring you get any legal tax refund you’re due!

You can easily prepare your US nonresident tax return with Sprintax!

The process is quick, easy and stress-free.

However, should you have questions, you can always reach out to our live chat team today!

To get started and file your tax return today, simply create your Sprintax Returns account.

![IRS form 8843 instructions [2024]](https://blog.sprintax.com/wp-content/uploads/2020/01/how-to-file-form-8843.jpg)