(Last updated: 24 Mar 2025)

Here are the answers to some of the most frequently asked questions about U.S. taxes.

What we cover in this article:

- Do I need to file a tax return?

- Can I avail of a tax treaty?

- What’s a W-2 form?

- What is a 1042-S form?

- What is a Form 8843?

- What is Form 1098-T?

- Can I e-file with Sprintax?

- What is the April 15 deadline for?

- What if I miss the tax deadline?

- What if I don’t have SSN or ITIN?

- What documents do I need?

- Benefits of using Sprintax

- Who can use Sprintax?

- How to file a tax return for nonresident aliens

1. Do nonresident aliens need to file a tax return?

If you are a nonresident in the U.S. you must file a tax return to stay compliant with your visa’s tax obligations.

If you are any of the following, you must file a return:

- Nonresident alien engaged in a trade or business in the U.S. during the year.

- A nonresident alien individual not engaged in a trade or business in the U.S. and has U.S. income on which the tax liability was not satisfied by the withholding of tax at the source.

- Even if you had no income, you must still file Form 8843 (F, J, M, Q visa or other exempt individuals).

As well as federal tax, there are also state taxes and local taxes. The basis on which you must file a state tax return will depend on the tax rules of the state in which you lived and/or worked.

Sprintax can prepare your nonresident federal tax return and if required, will also prepare your state tax return.

2. Can nonresidents avail of a tax treaty?

You may be able to claim a tax refund under international ‘tax treaties’. Tax treaties are agreements between the U.S. and other countries allowing you to claim back whole or part of tax paid while working in the U.S.

Sprintax will check if you’re eligible for a tax treaty when preparing your U.S. tax return. You can check for tax treaties here.

3. What’s a W-2 form?

You’ll need a W2 form to file your tax return if you worked on or off-campus. Your employer will give you a W-2 by the deadline and it will detail your income from the previous year. This form is divided into state and federal sections and there are fields with employer information and details of income.

4. What is a 1042-S form?

If you received a scholarship, fellowship, grant, or any other source of U.S. income subject to tax, you’ll need Form 1042-S in order to complete your tax return. This form can also be used for other income types such as teaching, research, and investment income. You should receive Form 1042-S from your university’s payroll department or whatever party provided the income.

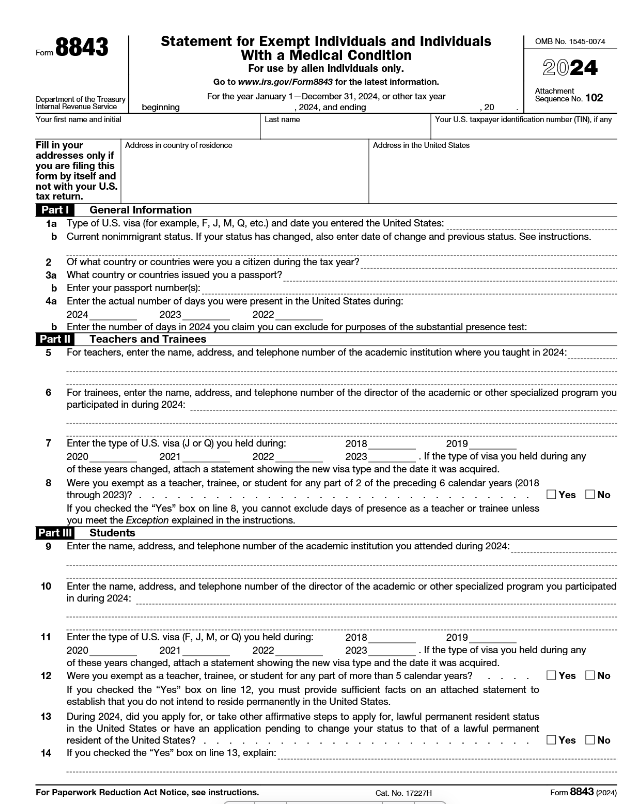

5. What is a Form 8843?

Form 8843 is not an income tax return. It is a statement for exempt individuals and individuals with a medical condition for the U.S. Government. You will need to file Form 8843 if you are a nonresident alien in the U.S. under F-1, F-2, J-1, or J-2 non-immigrant status and you are exempt for a certain period from substantial presence test. This applies whether you received U.S. income or not.

Nonresident aliens who are not required to file an income tax return (Form 1040NR), but are required to file Form 8843, do not need to get a Social Security number (SSN) or an Individual Taxpayer Identification Number (ITIN). But if an SSN has been assigned, the number must be included on Form 8843.

6. What is Form 1098-T?

Form 1098-T (Tuition Statement) reports qualified scholarships and relevant expenses in relation to the education credits that are available for US citizens and residents only.

I’m a nonresident studying in the US. Should I use a 1098-T when preparing my tax return?

No! Nonresident aliens are not eligible for these education credits even if they receive a Form 1098-T.

The IRS regulations state that, although no Form 1098-T is required for nonresidents, education institutions may create the form for all students for administrative purposes.

Sprintax is specifically for nonresidents, so you do not need this form in order to complete your income and tax details in our system.

7. Can I file electronically with Sprintax?

Yes, you can e-file your federal tax return with Sprintax.

Sprintax has been approved by the IRS to submit Federal tax returns electronically (E-Filing).

That means it has never been easier to file your US Federal tax return!

If you are also required to submit a state tax return, Sprintax can help you to prepare your fully compliant state tax return. Then all you need to do is download, print and sign your documents and send them to the tax office.

8. What is the 15 April tax deadline for?

The 15 April deadline is the date by which all tax returns must be filed for the previous year. If you owe money to the tax office and don’t file your tax return by this deadline, the U.S. tax authorities will impose late filing penalties and interest on the amount you owe.

The deadline to file tax returns for the 2024 tax year is 15 April 2025.

9. What happens if I miss the tax return deadline?

If you have no tax liability, you should not worry about penalties and fines – the IRS will not penalize you if you do not file a return although you must still file Form 8843.

If you owe anything to the tax office, however, you may incur late filing fees and/or penalties.

The penalty for not filing is a percentage of the taxes you didn’t pay on time.

Nonresidents can apply for their tax refunds even after the deadline, but a return has to be filed no more than 3 years after the original deadline in order for the IRS to issue a refund.

10. Can I file taxes without SSN or ITIN?

If you don’t have a Social Security Number (SSN) you will need to get a temporary number instead. This is called an Individual Taxpayer Identification Number (ITIN). Sprintax can organize this for you.

An ITIN must be provided on tax returns, statements, and other tax-related documents.

Learn more about how to apply for an ITIN here.

11. What documents/information might I need to prepare my tax return?

- Passport

- U.S. entry and exit dates for current and all previous visits

- All tax forms you’ve received (including Forms W-2, 1042-S and/or 1099, etc.)

- Visa/immigration status information, including Form DS-2019 (for J visa holders) or Form I-20 (for F visa holders) Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- If you are using Sprintax to prepare your state tax return(s) you will need a copy of your already prepared federal tax return

12. What are the benefits of using Sprintax?

- IRS compliance

- Step-by-step guidance

- ITIN applications

- User-friendly system

- 24/7 Live Help

13. I’m not a student, can I use Sprintax?

If you’re a temporary visitor to the U.S. on an H1B, H2B, L or B-1 working visa, Sprintax can prepare your U.S. income tax return.

However, you must be classified as nonresident for the entire tax year.

If you’re unsure, Sprintax can review your status.

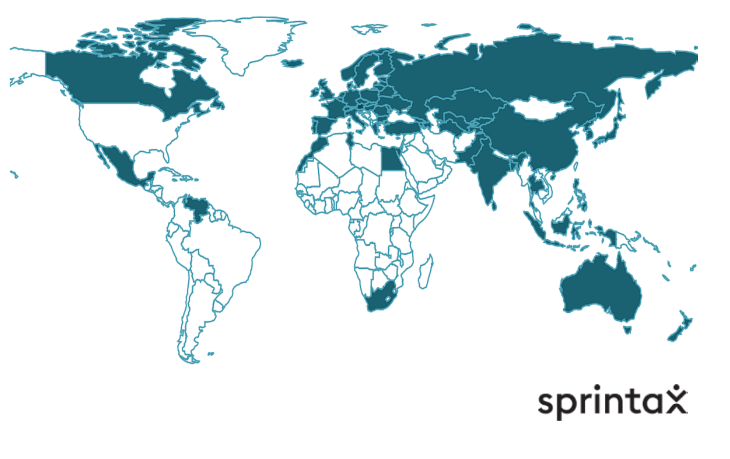

Who can use Sprintax?

Sprintax can be used by foreign professionals, international students, scholars, teachers and researchers, nonresident au pairs, camp counselors, and other nonresident workers and visitors with F, B, H, J, L, M, E visa types and Q immigration status.

14. How do I file a tax return if I’m a nonresident alien?

To get started with your U.S. nonresident tax return, create an account.

Get started with your nonresident tax return here.

Got other questions?

Check out these additional resources:

- 13 US tax questions every nonresident student asks us

- U.S. Tax guide for nonresident aliens

- Sprintax FAQs