The deadline for filing your 2024 US tax return is April 15, 2025, and it’s never too early to start preparing.

There’s no doubt that, whether you have filed a tax return before, or this is your first year with a filing requirement, the tax season can be a real headache.

In this blog, we’ll look at 5 things every nonresident alien in the US can do to ensure their tax season runs as smoothly as possible.

1. Organize your documents

The first thing you should do to prepare yourself for tax season is to organize everything you’ll need to prepare your tax return.

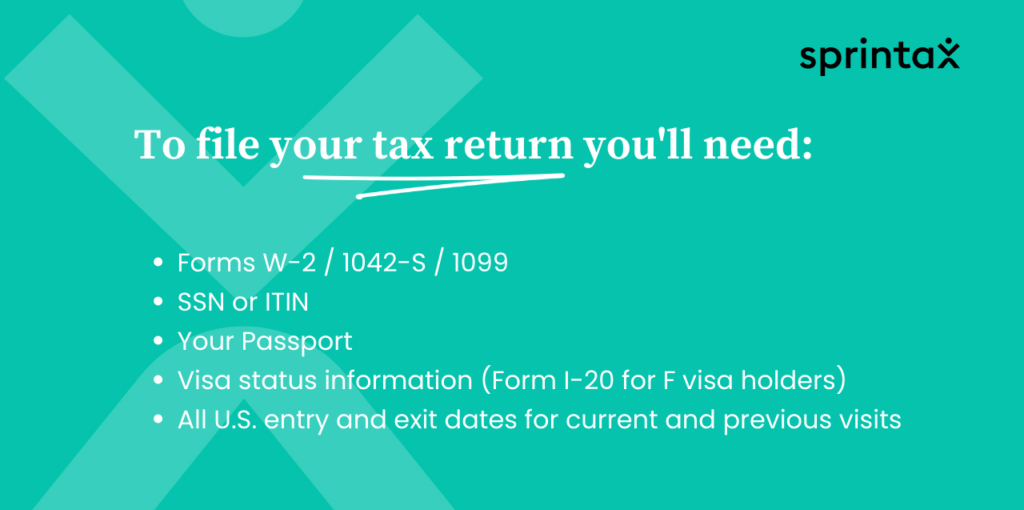

In order to complete your tax return, you will need to have the following documents on hand:

- Your passport

- Your Visa/Immigration Status information, including Form DS-2019 (for J visa holders) or Form I-20 (for F visa holders)

- All income forms: W2 forms, 1042-S and/or 1099

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN). If you do not have an ITIN, Sprintax can help you get one!

- A copy of last year’s return (only if you filed one with the US tax authorities)

Tip: Make a note of any missing documents and then start to track them down. For example, if you haven’t received your payment documents, make sure to contact your employer to request them.

2. Determine the right forms to file

Every nonresident in the US has a tax filing obligation, including:

- International students and scholars

- J1 Work and travel participants

- Interns and trainees

- Au Pairs and Camp Counsellors

- Nonresident working professionals

Anyone who earns US income, for example, income through royalties or investment must file a tax return.

In order to file your tax return accurately, you must file the correct tax forms.

For example, If you didn’t earn any income during the tax year, you still must file a Form 8843 with the IRS.

If you earned US-sourced income during the year, you must file a Form 8843 and a Federal tax return (form 1040NR).

You may have to file a State tax return also, depending on your personal circumstances and other factors.

Tip: Sprintax Returns is the only online Federal and State self-prep tax software for nonresidents in the US. We will help you to figure out whether or not you have to file a State tax return.

3. Work out your residency status

This one is very important.

It’s impossible to file a compliant tax return without first determining your tax residency status.

The most common tax residency statuses are ‘resident’ and ‘nonresident alien’.

Any international students who are studying in the US on F, J, M, or Q visas are considered nonresident aliens for tax purposes.

Tip: Not sure if you’re a resident or nonresident? When you create a Sprintax Returns account, our system will automatically detect your tax residency status!

4. Don’t delay filing your tax return

Let’s face it, leaving important stuff until the last minute is never a good idea!

So why leave filing your tax return until the deadline?

There is no reason why you can’t start prepping for the 2023 tax season now.

And, by doing so, you can ensure that you file on time and receive any tax refund you’re due sooner!

Complete your nonresident tax return here

5. Get help with your nonresident tax return!

With so much complicated paperwork and so many confusing questions, filing a US tax return is not exactly the most simple task, especially as a nonresident.

Fortunately, Sprintax is here to help!

When you create a Sprintax account, our system will assist you in preparing fully-compliant Federal and State tax returns and also enable you to use any tax deduction and benefits that will allow you to claim your maximum legal tax refund.

Sprintax will guide you through the tax filing process, firstly determining your tax residency status and then identifying which forms you need to complete based on your own personal circumstances.

You’ll be asked a few easy questions and based on the information you provide, you will then be able to download your fully completed and compliant form 1040NR (nonresident tax return).

Benefits of using Sprintax

With Sprintax you can:

- Save time and stress!

- Determine your residency status

- Prepare a fully compliant US tax return

- E-file your 1040-NR

- Maximize your State tax refund

- Avail of our 24/7 Vita Qualified Live Chat facility

Sprintax is the nonresident partner of choice for Turbo Tax.

File your nonresident tax return