People do not file their taxes for a variety of reasons. Perhaps you forgot or were unaware that you had to file. Perhaps you had a hefty tax bill that you could not cover.

Whatever the reason, if you did not file your tax return by the deadline, you should do it as soon as possible. Otherwise, you risk being hit by fines, and you can jeopardize your future visa applications.

As a nonresident, you probably know that you have the obligation to file a tax return if you were in the US for just one day, and even if you did not earn any income in order to stay compliant with your visa tax commitment.

This guide will outline everything you need to know as a nonresident if you did not file your prior-year tax return(s). So, keep reading!

What do I need to know about filing prior years’ tax returns?

If you did not file when you were obliged to do so, you may be pursued by the IRS.

If you have unfiled returns for the previous tax years, the IRS can levy costly penalties and withhold your tax refund.

In some cases, they can even file a return on your behalf, but without any deductions, tax treaties, and credits in your favor that you might be entitled to. This will result in you paying much more in tax than you need to!

If you are expecting money back, there is no penalty for not filing, but you will have only three years from the deadline in April to submit your tax return.

You could lose your refund if you don’t do it on time. Our advice – don’t leave your money in the US. Claim it back today!

What happens if you don’t file taxes? What can happen if I file a tax return very late?

As a nonresident, it’s crucial to know that failing to file your tax return may significantly jeopardize your future prospects of securing a US visa or a Green card.

The consequences vary depending on whether the IRS owes you money or you owe the IRS. In any case, you lose.

If you owe money to the American tax authorities, they can tack on penalties and fines which accumulate over time.

What are the late filing fines and penalties?

The penalty for failing to file a federal tax return by the due date, or extended due date, is usually 5% of the unpaid tax for each month, or part of a month that the return is late, with a maximum penalty of 25% of the unpaid tax.

However, a minimum penalty is imposed if the return is more than 60 days late. If no return is filed after 60 days, a minimum penalty of $510 (for tax returns required to be filed in 2025) or 100% of the unpaid tax, whichever is less, can be imposed.

In addition, you may also owe a late payment penalty on the amount of tax due, if any.

The late filing penalty differs from the late payment penalty – read more here.

How many years can you file back taxes?

Broadly speaking, the IRS does not impose constraints on the amount of time you have to file past-due returns. You are able to do it at any time and they won’t reject your return (even if it’s a decade old). Of course, the IRS wants your returns as soon as possible.

However, If you haven’t filed your return on time, the IRS can come to you at any moment.

As mentioned above, if you want to claim a tax refund for the past year, you have only three years to do it.

If you want to be in the tax authorities’ “good books”, you must have filed tax returns for the last six years.

How do I file old tax returns with Sprintax? Can I still file taxes for 2023, 2022, 2021, and other years?

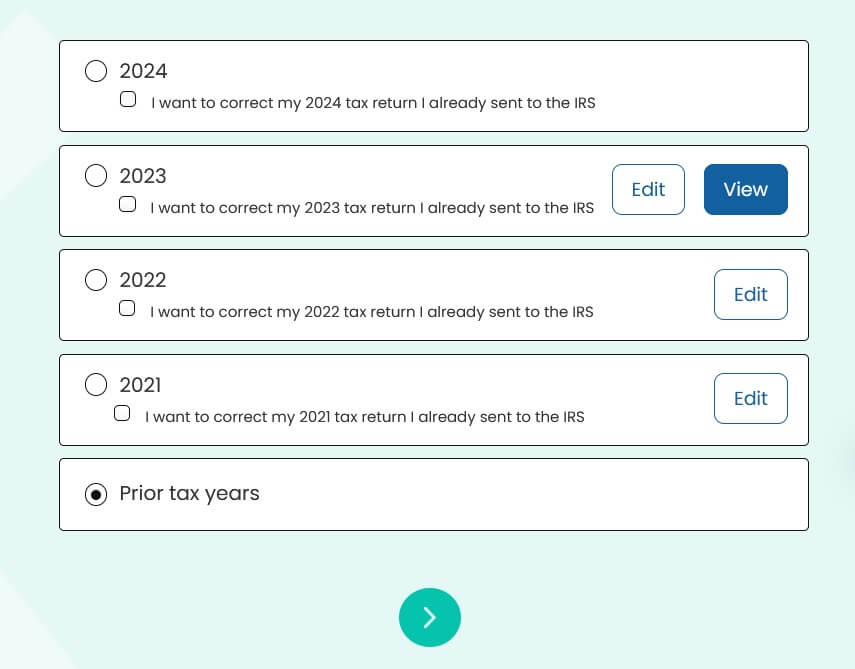

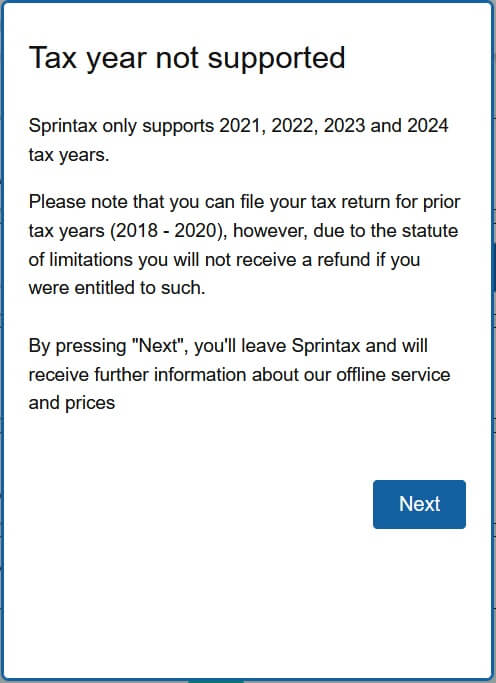

If you want to file a previous year’s nonresident alien tax return, you should know that you can use Sprintax to file for the last 3 years. However, if you need to file prior years’ tax returns, we have another option for you.

When you choose “Prior tax years”, you will be transferred to Sprintax’s sister company Taxback who has more than 20 years of experience in tax return services. The process with them is very simple and straightforward. You just need to follow the steps.

What’s the difference?

With Sprintax, you can use a software service to prepare your old tax returns online, while with Taxback.com, an experienced tax agent will help you complete and file your prior-year tax returns at affordable pricing.

Here is how to file back taxes with Sprintax in a few easy steps:

1. Gather your paperwork

То file your old tax returns, you will need the W-2, 1099, and 1042-S forms you received for those years in order to report your income. If you want to claim any credits or deductions that you might be entitled to, you will have to gather old receipts to prove your eligibility.

2. Make a request for documentation that is missing

If you are unable to find any of your tax documentation from the past 10 years, you can either get in touch with your employer or request a copy from the IRS by filing Form 4506-T, Request for Transcript of Tax Return. This process can take up to 45 days.

3. Prepare your back tax returns.

Back tax returns must always be filed on the original forms for each tax year.

4. Submit your forms

You will have to submit the filled forms at the address that you can find on the instructions for Form 1040NR.

Got questions? Do not hesitate to contact us! Our tax experts are ready to answer all your questions 24/7.

How to e-file prior-year tax returns

You can e-file your 1040NR tax return with Sprintax from 2020 onwards.

How to amend your prior-year tax return with Sprintax

If it turns out that you made an error on your nonresident alien tax return, you can easily fix it! Simply, follow the steps in the article above.

A tax return can be considered “incorrect” for many reasons. And while making a mistake is not such a big deal, it’s crucial to file an amended tax return, where appropriate.

When to file an amended tax return?

- you filed by mistake with the incorrect tax filing status

- you learned you forgot to claim a credit or a tax deduction you are entitled to

- you must either remove or add a dependent

- you neglected to include taxable income on your tax return.

- you found out that you claimed a cost, deduction, or credit for which you were not entitled.

Just bear in mind that the IRS restricts the period of time you have to file an amended return in order to get a refund to:

- Within three years following the initial filing deadline, or

- within two years after paying the tax owed for that year, whichever comes first.

If you’re outside of that time frame, you won’t be able to get a refund by changing your return.

Can I check the status of an amended tax return?

Yes, you can use the IRS tool “Where is my amended return?”

You will need your:

- social security number

- tax year concerned

- date of birth

- Zip Code

How to check the status of a prior-year tax return (how to get a copy of the tax return) after mailing the return to the IRS

There are different situations when you might be required to get a copy of your previous year’s tax return.

If this is the case with you, before going to the IRS website or getting in touch with their representative, make sure you have the following info:

- Social Security Number

- Date of birth

- Address currently on file with the IRS

- Zip Code currently on file with the IRS

- Type of transcript needed

- tax year concerned

- exact refund amount expected

- filing status

You need to check your tax return status using the “Where is my refund” tool, and only if you can’t find any information, you can contact the IRS directly and speak to a representative.

Why choose Sprintax for my previous year’s tax filing?

- Sprintax is a tax preparation software developed specifically for nonresidents

- We offer an easy online service and you will save time and stress!

- Sprintax will prepare a fully compliant US tax return

- You will receive your maximum legal tax refund

- Sprintax can determine your residency status for free

- 24/7 Live Chat facility with our tax experts

Prepare or amend your previous year’s tax returns with Sprintax.

Don’t hesitate to contact the Sprintax Live Chat team if you need help.