Sprintax Calculus (formerly Sprintax TDS) launch new Tax Treaty Engine

Every year, the proper documentation and withholding of tax from nonresident aliens becomes a bigger issue for organizations around in the US.

Exactly how a nonresident should be taxed depends on a number of unique circumstances including where they’re from, the type of income they are earning and the amount of time they have spent in the US.

Staying on top of these requirements has become a significant challenge for payroll office staff in a plethora of different industries.

The correct determination and application of tax treaty benefits to employee paychecks is particularly challenging.

After all, the US has signed tax treaty agreements with 66 different countries.

And exactly how these treaty agreements are applied depends on the circumstances of each individual employee.

Sadly, there is no ‘one-size-fits-all’ approach that can be taken and looking up tax treaty articles via IRS website can take a very long time if you’re not sure where to look for this information!

With that in mind, at Sprintax Calculus (formerly Sprintax TDS), we are delighted to launch a brand new Tax Treaty Engine within our Tax Determination System.

By using this tool, you can easily discover the availability of a tax treaty for your nonresidents within seconds.

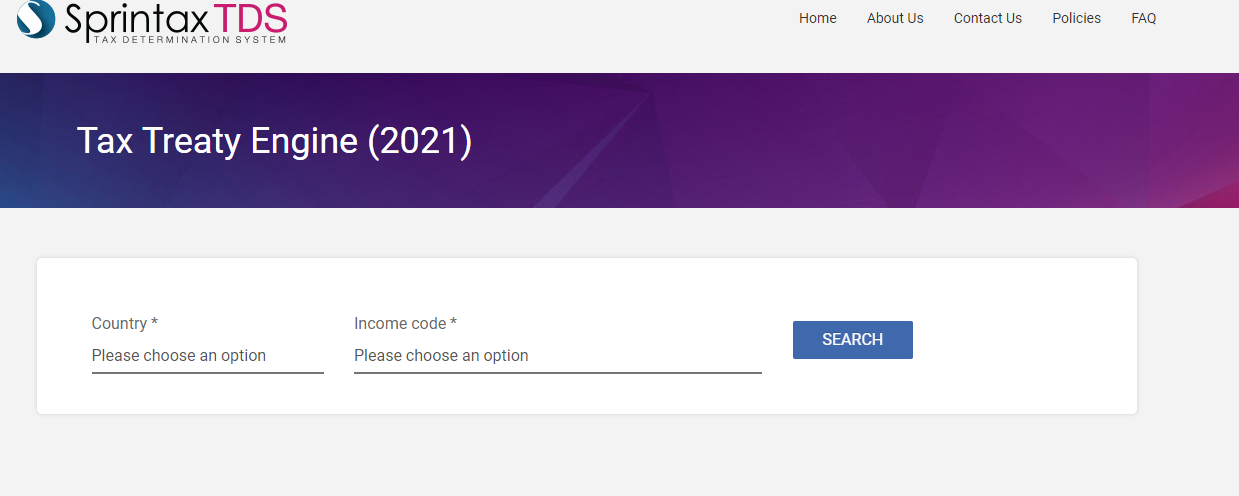

What is the Sprintax Calculus Tax Treaty Engine?

The Tax Treaty Engine is now available to all Sprintax Calculus (formerly Sprintax TDS) users.

This is an invaluable tool in the identification of potential tax treaty benefits for your nonresidents.

To identify if there is a tax treaty available, all you need to know is the correct income code and country of residency for the relevant employee/nonresident.

Once you enter this basic information, our Tax Treaty Engine will provide you with an outline of whether there is a potential tax treaty available to them, as well as including the article, limit and time period involved.

We will also direct you to the specific passage of the treaty agreement, should you require any further information.

Let’s take a look at some examples.

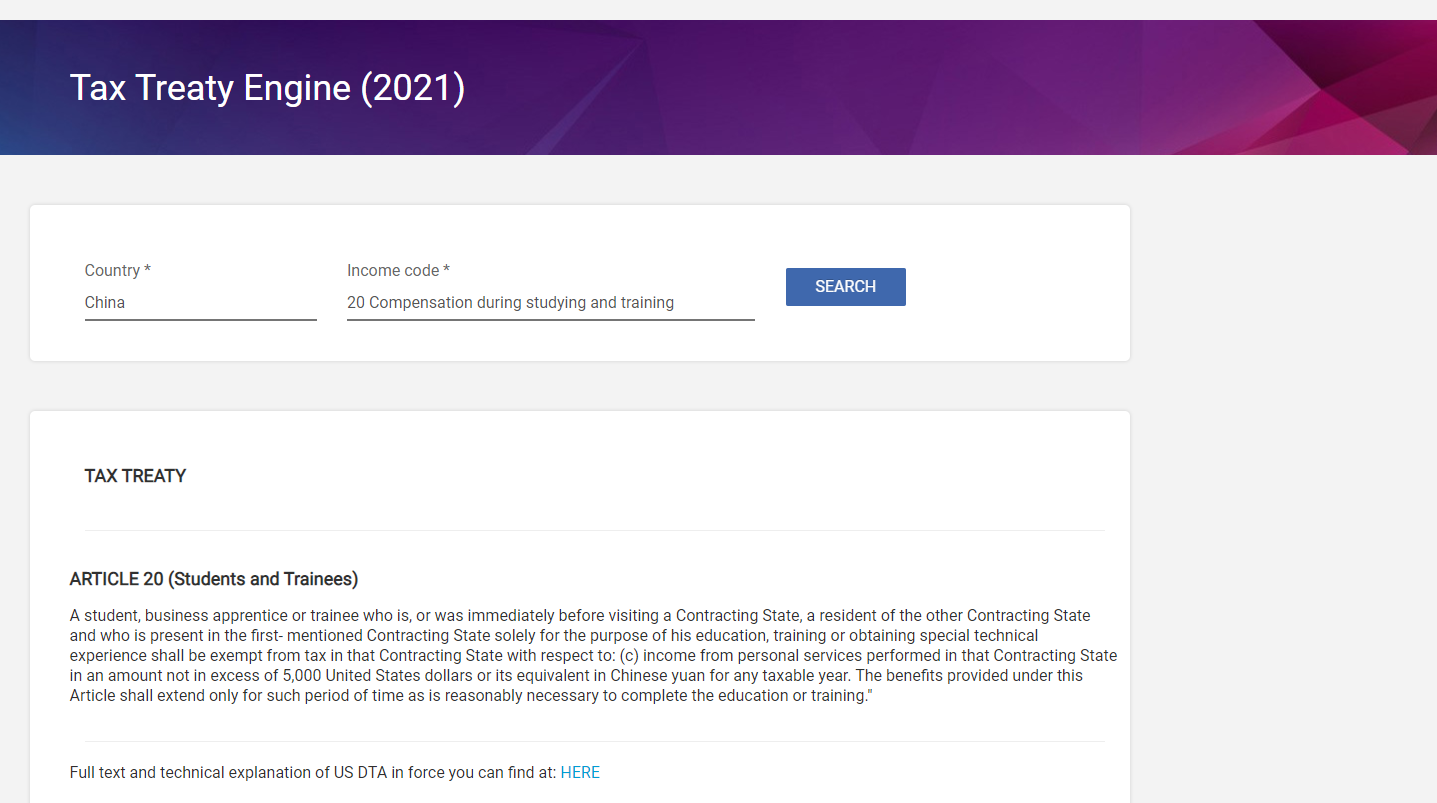

Case study – F-1 student

Lin is a Chinese F-1 student working in a new position in California.

By entering some basic details into the Tax Treaty Engine, payroll staff can check whether or not Lin may be entitled to any benefits.

In this case, China should be selected as the relevant country and income code 20 (compensation during studying and training) should be chosen from the drop down menu.

And, as we can see in this case, our engine has correctly determined that Lin may be entitled to benefits if she meets the treaty article conditions.

As Lin is a student who was living in China before arriving in the US, she may well be exempt from tax on the income (not in excess of $5,000) she earns from her job in the US according to the treaty article.

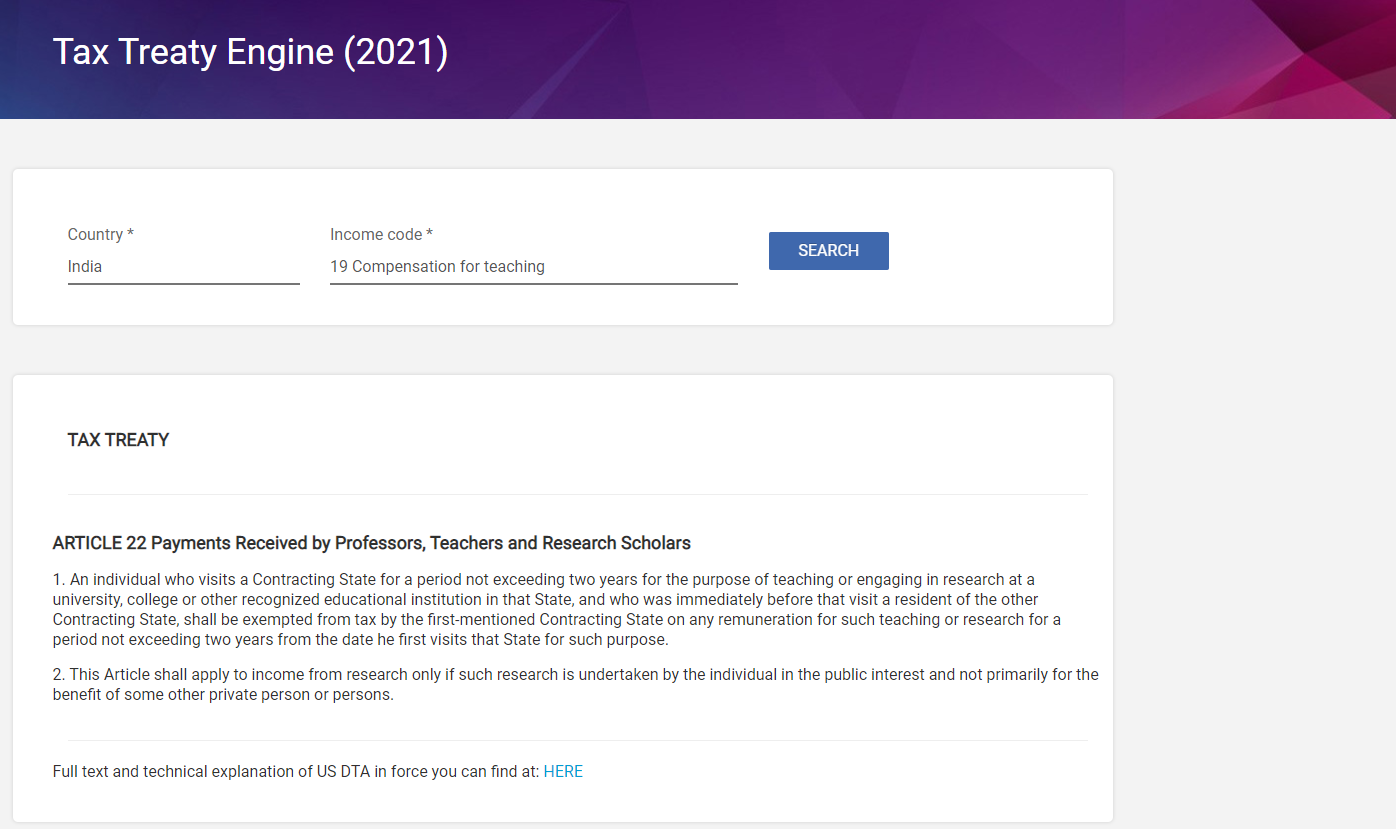

Case study – J-1 teacher

Ishan arrived in the US in January on an J-1 visa. He is now teaching at a University in New York.

Staff at the university can quickly check whether or not Ishan may be entitled to any tax treaty benefits.

To do so, they can enter India in the country field and select income code 19 (compensation for teaching) from the drop down menu.

Our Tax Treaty Engine quickly determines that there is a tax treaty available for this type of income between India and the USA.

As he has not been in the US for more than two years for teaching purposes, he may be entitled to claim a tax exemption on his income.

Register for a FREE SprintaxTDS demo here

If you hire nonresidents at your organization, Sprintax Calculus can help you to manage their tax profile.

Sprintax Calculus is a tool that ensures nonresidents are taxed correctly from their first day working in the US – so that the right amount of tax is withheld from their earnings and reported to the IRS.

A cloud-based payroll software, Sprintax Calculus is already working with hundreds of educational institutions all over the US.

Why Sprintax Calculus?

- Cloud-based, secure and automated nonresident tax solution

- Determine Residency and Tax Treaty Eligibility. Calculate tax withholding rates

- Instant generation of tax forms (such as 1042-S, W-4, 8233, W8-BEN and more) in seconds

- Easy to use admin & dashboards. Advanced Reporting tools

To find out more about how Sprintax Calculus can help your organization, why not register for a free, no-obligation demonstration here.