(Last updated: 16 Jan 2025)

Are you an OPT/CPT program participant?

While doing your taxes might not be the most exciting aspect of international student life in the US, the importance of filing your federal tax return correctly cannot be underestimated.

With this in mind, we’ve created this handy tax guide for international students on OPT.

What is OPT?

Optional Practical Training (OPT) is an opportunity for international students under an F-1 visa to work in the US for 12 months. After this, STEM students (Science, Technology, Engineering and Mathematics) can extend this period up to 24 months.

Most students complete OPT after graduating from university. Others participate after they have been pursuing their degree for more than nine months and are entitled to work and gain practical knowledge in the field of their studies.

Types of OPT

There are three types of Optional practical training:

Pre-completion OPT

This type of OPT is authorized before graduation if CPT (Curricular Practical Training) is not an option. Students can work part-time, during their university semester. The work experience must be related to their studies.

Post- Completion OPT

This is the most common type of OPT. It is authorized for 12 months after graduation.

STEM OPT Extension

This is a 24-month extension for students in STEM (Science, Technology, Engineering and Mathematics) programs.

Do OPT students pay taxes?

One of the most common questions we receive is: “Do I have to pay taxes on OPT?”.

In short, yes, if you earn income while in the US for OPT you are required to pay your Federal and State income taxes.

You must also complete a W-4 tax form with your new employer when you start a new job.

The US tax deadline in 2025 falls on 15 April.

It’s vitally important you file your taxes in time for the deadline. By not filing you risk having issues with future Green Card and visa applications as well as fines and penalties.

Sprintax Forms tax software can help prepare a W-4 for international students on OPT.

Are you an F-1 visa student on OPT working as a self-employed or a freelancer? Read our tax guide here.

Residency status of OPT students

It’s crucial to determine your residency status for tax purposes. Usually, a graduate/ student in F-1 status that has been in the USA for less than 5 years is considered a nonresident alien for tax purposes.

If you have been in the USA for more than 5 years, you will be typically considered a resident alien for tax purposes.

You can determine your Residency status for FREE with Sprintax by taking the Substantial Presence Test.

Tax rates for OPT students (federal and state tax)

The IRS requires federal income tax withholding on all U.S. source payments to nonresident alien students.

OPT as well as individual students are taxed on their wages at graduated rates from 10% to 37% (it depends on your income level).

2025 tax brackets and rates

| Income | Tax rate |

|---|---|

| $0 to $11,925 | 10% |

| $11,926 to $48,475 | 12% |

| $48,476 to $103,350 | 22% |

| $103,351 to $197,300 | 24% |

| $197,301 to $250,525 | 32% |

| $250,526 to $626,350 | 35% |

| $626,351 or more | 37% |

The tax percentage withheld on scholarships and grants for F-1 and J-1 visa holders is 14%.

You may also have to pay state tax on your income depending on where you live in the U.S. and your personal circumstances.

Each state has different rules involving their tax laws. In fact, there are nine states that don’t charge tax on income:

- Alaska

- Florida

- Nevada

- New Hampshire (taxes only investment income, not earned income)

- South Dakota

- Tennessee (taxes only investment income, not earned income)

- Texas

- Washington

- Wyoming

Find out more on state taxes at our guide here.

OPT student tax exemptions

As an F-1 visa holder, you are exempt from FICA (Social Security and Medicare) taxes.

This means that no matter whether you are doing OPT, OPT extension or CPT (Curricular Practical Training), you are exempt from paying Social Security and Medicare taxes unless you’ve been in the United States for more than 5 years.

Read more about the student FICA tax exemption and how to claim a FICA tax refund here.

As a nonresident, you may be eligible for OPT tax deductions.

While there is no specific OPT tax relief, you may be able to claim the following credits should you qualify for them:

- Child tax credit

- Child and dependent care tax credit

- Foreign tax credit

- Retirement savings contribution credit

- Credit for other dependents

- Adoption credit

How to file a tax return while on OPT in the US?

As a student, you will need to file Form 8843 and 1040NR.

Sprintax is the only self-preparation tax software for nonresidents. The process is fast and simple.

After answering a few questions, the system will estimate your personal circumstances, determine your residency status and prepare the tax forms that you need to file.

You can contact Sprintax Live Chat, our tax agents will answer all your questions and help you with the tax preparation process.

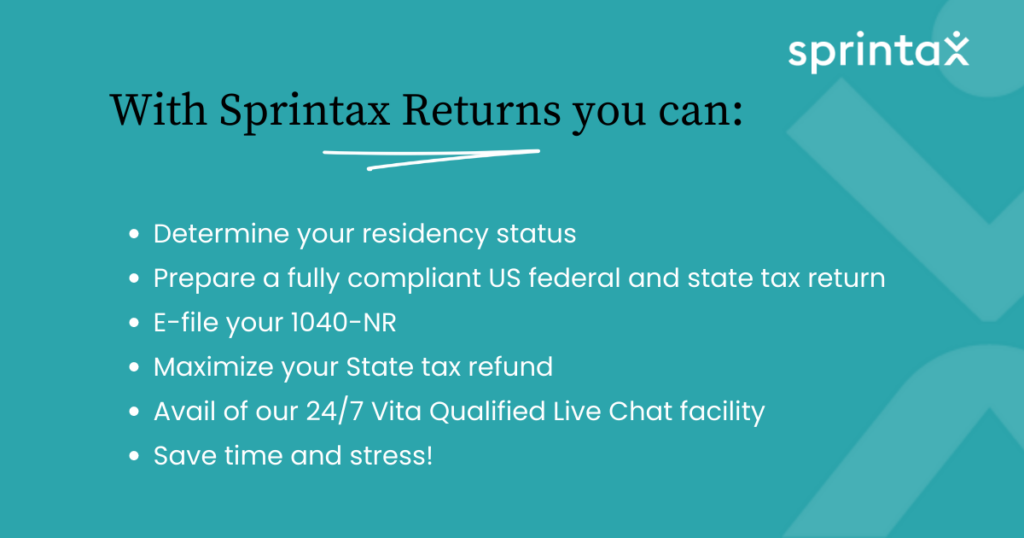

With Sprintax Returns software you can:

- Save time and stress!

- Determine your residency status

- Prepare a fully compliant US federal and state tax return

- E-file your 1040-NR

- Maximize your State tax refund

- Avail of our 24/7 Vita Qualified Live Chat facility

Prepare your OPT student tax return here

OPT to the H1B tax filing

H-1B status is not exempt from the Substantial Presence test and very often H1B visa holders become residents or dual-status residents in the year of visa change.

Depending on their personal circumstances, F-1 students on OPT may claim a tax treaty that can partially reduce or fully exempt their income from paying taxes.

However, H1B visa holders must pay FICA tax and are usually not entitled to use tax treaty benefits for students and scholars. Check out this detailed guide on filing taxes on an H1B visa.

Remember, if you have questions about your personal tax situation, our Live Chat team is online 24/7 to support you.

Key tips for OPT students starting a new job

At Sprintax, we know that OPT students sometimes need an extra bit of help with understanding their tax obligations.

As previously stated, you should know your residency status so that you are able to claim any reliefs applicable to your country.

If you are starting a new job, our first bit of advice would be to fill out tax forms for the new job to update your withholding status.

This can be tricky, of course, but familiarizing yourself with the forms can ensure you are ready to do this.

If you missed filing a tax return for a certain previous tax year, we also heavily advise filing one.

That’s because it will ensure you are tax compliant for that tax year, while also allowing you to claim your MAXIMUM tax refund too!

Do OPT students get a tax refund?

Yes.

Every year, thousands of OPT participants overpay taxes in the USA and are entitled to a tax refund when they file their tax returns.

Sprintax will help you with the preparation of your tax documents and will make sure you claim the maximum legal tax refund.

The average federal tax refund a Sprintax Returns customer receives is $927!

Form W-9 on OPT

Sometimes, an OPT participant may become a resident for tax purposes.

In this case, you will need to complete a W-9 form (Request for Taxpayer Identification Number and Certification) and provide it to your employer.

Prepare your OPT student tax return with Sprintax easily online.