The number of international students in the US spiraled over recent years.

With many of these students also working part-time at their chosen schools, the proper documentation and withholding on payments to nonresidents has become an increasingly important topic for educational institutions in recent years.

If you’re reading this blog, you’re probably all too familiar with the tax complexities of onboarding a nonresident at your school.

As a Withholding Agent, it’s your responsibility to ensure your nonresident employees have the correct amount of tax withheld from their pay.

In this guide, we’ll cover everything you need to know to ensure the process goes smoothly including:

- the forms your new employee must fill out when they start work

- how to handle tax treaty entitlements

- and what you can do to ensure you are withholding the correct amount of tax

We’ll also be sharing some tips and tricks which will make life easier for your entire payroll department!

So let’s get into it!

Table of Contents Show

Determining residency

The first thing you should do when you hire a new foreign student, scholar, researcher or professor is to determine their residency status for tax purposes.

Keeping in mind that it is against federal law to hire illegal aliens, there are three types of residency status categories to consider for any new employee:

- US Citizen or US Resident Alien

- Dual Status Resident

- Nonresident Alien

So how can you tell the difference between a Resident and a Nonresident Alien?

Resident aliens are taxed on their worldwide income (similar to US citizens).

Nonresident aliens are only taxed on US source income and certain foreign source income that is effectively connected with a US trade or business.

A dual status resident is a person that was both a resident alien and a nonresident alien in the same tax year. Respectively, dual status residents are taxed as nonresident alien for the part of the year they are nonresident alien and as a resident for the rest of the year.

There are three residency tests under which a person can be considered resident for US tax purposes:

US Citizenship Test

If the person has US citizenship by birth or naturalization, they are treated automatically as a resident taxpayer for tax purposes.

Green Card Test

A Green Card (USCIS Form I-551) is a permanent resident card.

It gives the holder the right to reside permanently in the US and to work without restrictions.

Your employee will be deemed a resident alien for tax purposes during a tax year if they are granted a Green Card at any time during that year.

Substantial Presence Test

Note: F-1 students will be considered exempt individuals for the first five calendar years of their time in the US.

If your foreign employee is not a US citizen and doesn’t have a Green Card, they can still claim resident alien status if they pass the Substantial Presence Test.

The test requires the person to have been physically present in the US for at least 183 days over a three year period including:

- The number of days in the US for the current year (must be at least 31)

- 1/3 the number of days in the US for the preceding year

- 1/6 the number of days in the second preceding year

It’s important to note that the following days don’t count towards the Substantial Presence Test:

- Days the nonresident was an exempt individual. These are most days the nonresident was in the US as a teacher, student, or trainee on an ‘F’, ‘J’, ‘M’, or ‘Q’ visa (five years for F visas and two years for the rest)

- Days commuted to work in the US from a residence in Canada or Mexico (as part of a regular commute from Canada or Mexico)

- Days that the nonresident was in the US for less than 24 hours when they are in transit between two places outside the US

- Days that the nonresident was in the US as a crew member of a foreign vessel

- Days that the nonresident was unable to leave the US because of a medical condition that arose while in the US

- Days in the US under a NATO visa as a member of a force or civilian component to NATO

If your new employee is not a US citizen, does not have a Green Card or can’t pass the Substantial Presence Test, it’s pretty likely that they should be categorized as a nonresident alien for tax purposes.

Identifying payment type

After you have determined the tax status of your new foreign employee, the next step is to work out their sources of income. This will help you to work out how much tax must be withheld from their income.

A resident alien’s income is generally subject to tax in the same manner as a US citizen.

They must report all of their wages, interest, dividends or other compensation for services, income from rental property or royalties, and other types of income (from all sources within and outside the US) on their US tax return.

A nonresident alien’s income (subject to US income tax) can be divided into two categories:

- Income that is effectively connected with a trade or business in the US

- Income that is not effectively connected with a trade or business in the US

The difference between these two categories is that effectively connected income, after allowable deductions, is taxed at graduated rates. These are the same rates that apply to US citizens and residents.

Income that is not effectively connected is taxed at a flat 30% (or a lower treaty) rate.

Below are some of the most common tax codes that nonresident aliens employed in US universities will be categorised under:

Income Code 18 – pay for dependent personal services

Dependent personal services are personal services performed in the US by a nonresident alien as an employee rather than as an independent contractor.

This code is for people that are not students, trainees, researchers or teachers.

Income Code 19 – pay for teaching

This code relates to compensation for nonresident alien teachers, professors, researchers and scholars by a US university or other accredited educational institution for teaching or research work at the institution.

Income Code 20 – pay during studying and training

Code 20 is a very common tax classification for nonresident aliens who are hired by US universities.

This code refers to pay (as contrasted with remittances, allowances, or other forms of scholarships or fellowship grant) for personal services performed while a nonresident alien is temporarily in the US as a student, trainee, or apprentice, or while acquiring technical, professional, or business experience.

Fixed, Determinable, Annual, or Periodical (FDAP)

This category is used to report US source income that does not come under any of the other income categories.

Examples of income that may be reportable under this category include:

- Self-employment

- Interest

- Commission

- Royalties

Withholding of Tax

If you employ international students in your university you are responsible for ensuring that the correct amount of tax is withheld from each nonresident pay check.

Salary paid to employees under Income Codes 18, 19 or 20 must be withheld and reported at graduated rates. You generally must withhold 30% on income reported under FDAP.

Sprintax Calculus simplifies nonresident tax withholding. Find out how

Tax Treaties

The US has bilateral income tax treaties with a number of foreign countries.

If you employ a resident of a country that has a tax treaty with the US, they may be entitled to lower tax rates or even exemption from withholding.

These reduced rates and exemptions vary among countries and specific items of income.

The US has tax treaty agreements with each of the following countries:

| Armenia | Australia | Austria | Azerbaijan | Bangladesh | Barbados |

| Belarus | Bulgaria | Canada | China | Cyprus | Czech Republic |

| Denmark | Egypt | Estonia | Finland | France | Georgia |

| Germany | Greece | Hungary | Iceland | India | Indonesia |

| Ireland | Israel | Italy | Jamaica | Japan | Kazakhstan |

| Korea | Kyrgyzstan | Latvia | Lithuania | Luxembourg | Malta |

| Mexico | Moldova | Morocco | Netherlands | New Zealand | Norway |

| Pakistan | Philippines | Poland | Portugal | Romania | Russia |

| Slovak Republic | Slovenia | South Africa | Spain | Sri lanka | Sweden |

| Switzerland | Tajikistan | Thailand | Trinidad | Tunisia | Turkey |

| Turkmenistan | Ukraine | Venezuela | United Kingdom | Uzbekistan | Belgium |

Employing a nonresident who is a citizen of one of the above countries? You can find more information about their tax treaty entitlements here.

Sprintax Calculus can help you manage your nonresident’s tax treaty entitlements. Learn more here

Key documents

Every nonresident employee is required to fill out certain tax documents in order to ensure tax is withheld correctly from their pay. The type of document that must be completed depends largely on the employee’s personal circumstances.

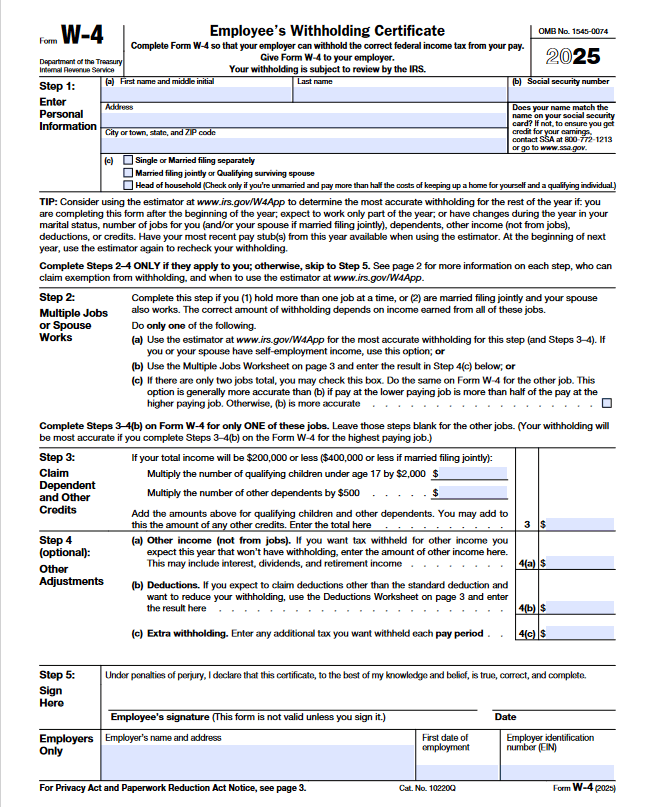

Form W-4

You should provide your new nonresident alien employee with a Form W-4 on or before their first day of work. The purpose of this form is to determine how much tax should be withheld from their pay check.

It’s crucial that the employee’s Form W-4 is completed correctly. Incorrect W-4s can result in a build of tax liability.

Form 8233

Form 8233 must be filed by all nonresident aliens who receive non-compensatory scholarship or fellowship income and personal services income (including compensatory scholarship or fellowship income) from the same withholding agent. Form 8233 is used to claim a tax treaty withholding exemption for part or all of both of these types of income.

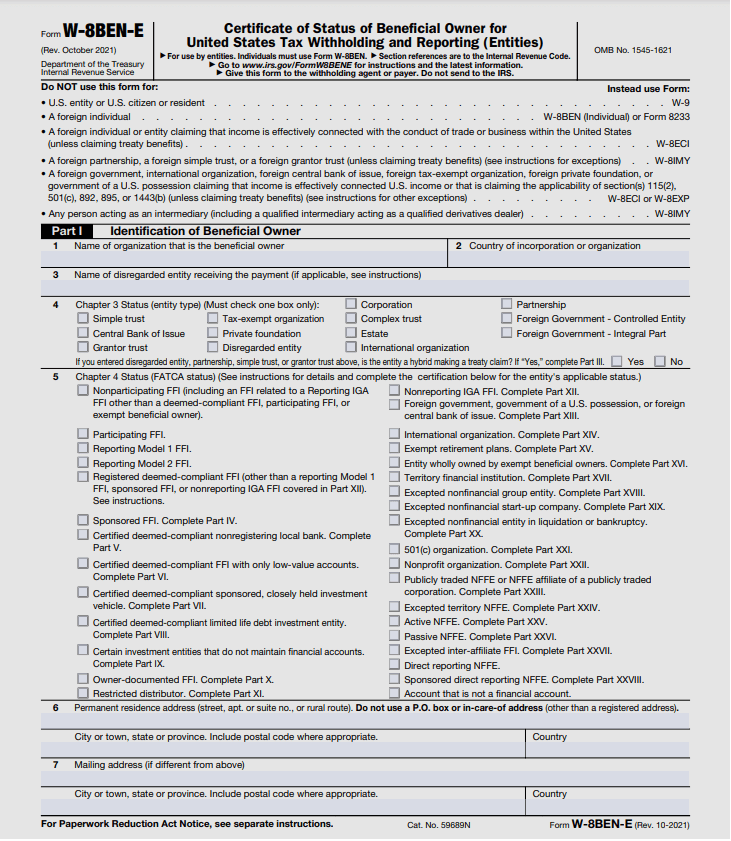

W-8BEN

Nonresident aliens that earn income from one or more US sources can utilize the W-8 form in order to claim tax treaty benefits. The point of this form is to notify the IRS that the nonresident should not be taxed in the traditional way.

There are a variety of W-8 forms and each is fairly complex. The W-8BEN is the most common type used by nonresident employees.

Other important documents

Form SS-5

Nonresidents can use this form in order to request a Social Security Number (SSN) and card. You will need your nonresident employee’s SSN in order to report their wages to the government.

Form W-7

This form is used by nonresidents to apply an Individual Taxpayer Identification Number (ITIN). Nonresidents who aren’t eligible to receive a Social Security Number, but need to file a federal tax return, require an ITIN.

Form W-9

This form certifies that a taxpayer identification number (TIN) is correct and confirms that a US citizen/resident is not subject to backup withholding.

All of these forms can be prepared easily online with Sprintax Calculus.

How Sprintax Calculus will make your life easier

Let’s face it. Managing the tax obligations of your nonresident student employees is tricky.

The solution?

Sprintax Calculus!

With Calculus, you can seamlessly manage the tax profile of your nonresidents all in one user-friendly and affordable platform.

Our system ensures that students and scholars have the correct amount of tax withheld from earnings and reported to the IRS.

How does Sprintax Calculus work?

With customizable user reports, you can determine in real-time the tax residency of your nonresidents and their entitlement to tax treaties. It also gives you instant access to the relevant tax forms you need such as W4, 1042-S, 8233, W-8Ben, and more.

Sprintax makes life easy for foreign students, scholars, teachers, researchers, and trainees too. A simple questionnaire will collect all of the necessary tax information from your nonresident employees. And if any queries arise for your students, our live chat team are available 24/7 to offer support – leaving less work for you and your team.

Based on the information provided by your nonresident employees, Sprintax Calculus will calculate the correct tax withholding and determine whether they are eligible for tax treaties or deductions.

Each user also has the option to transfer their information from their individual account (Sprintax Forms) into our Sprintax Returns (our tax preparation system which will seamlessly prepare their Federal and State tax returns – eliminating the stress of end of season reporting.

Benefits of choosing Sprintax Calculus

- Calculates tax withholding for non-resident international students, scholars, and professionals

- Determines residency for tax purposes

- Calculates tax withholding rates

- Generates tax forms such as 1042-S, 8233, W-4, W-8BEN and more

- Tax treaties built-in

- Cloud based product – no software installs necessary. Simply log in to your account from anywhere at any time.

Over 400 schools have chosen Sprintax to manage the tax compliance of their nonresidents.

Find out how Sprintax can make a big difference to your University.

Contact us today to book a Free Demo