It has never been easier for US organizations to prepare and file their 1042 documents online.

The good news is that Sprintax Calculus has been approved to E-File Form 1042 on behalf of organizations in the US.

So, with Sprintax Calculus now live for Form 1042 E-Filing, check out this blog post with all you need to know about Form 1042, including who needs to file it and how Sprintax will help you!

Table of Contents Show

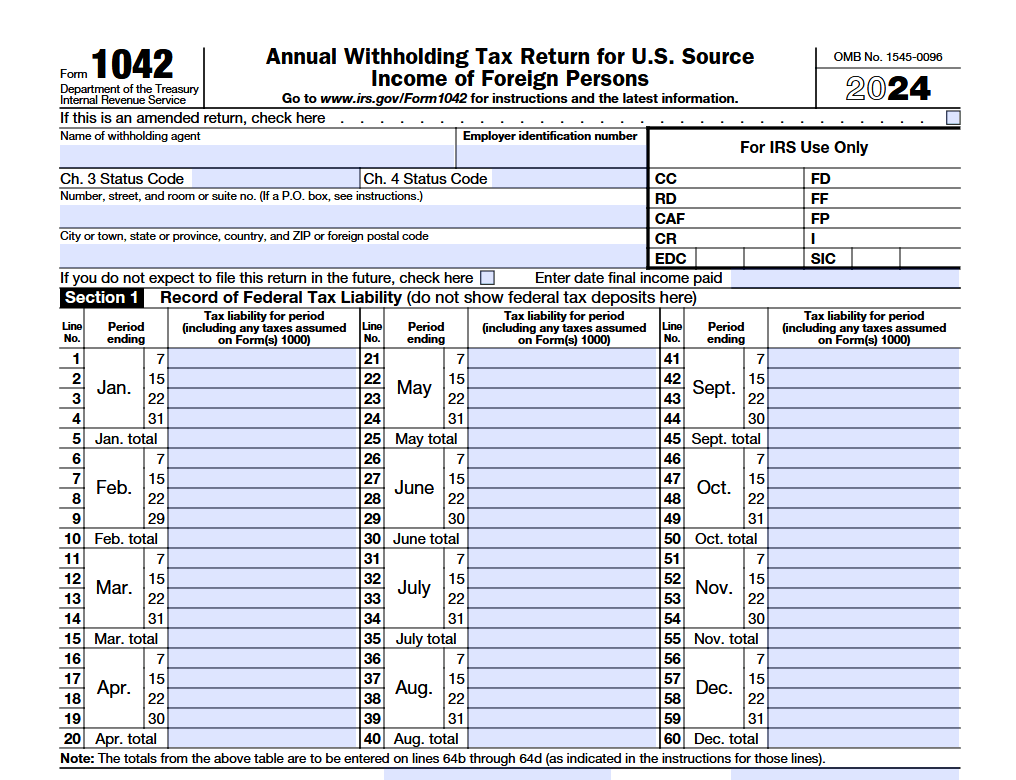

What is Form 1042?

IRS Form 1042 is formally known as the Annual Withholding Tax Return for US Source Income of Foreign Persons.

It is an informational tax return that the businesses acting as a withholding agent must file to report summarized income, tax deposits and liabilities for the foreign persons who are receiving income in the US.

Who must E-File a 1042 form?

Businesses that act as withholding agents for a nonresident are required by US law to file Form 1042.

Essentially, any organization must e-file if they have more than ten 1042 forms to be issued to nonresidents. The previous threshold was 250 forms.

NOTE: As of February 2024, The IRS amended the requirement to e-file Form 1042 for tax year 2023 and allowed for paper filing. Nonetheless, from 2024 onwards, you will need to e-file Form 1042.

This only applies to the 1042 and does not affect the mandate of 1042-S forms having to be sent electronically to the IRS if there are more than 10 forms.

Luckily, Sprintax Calculus’ e-filing service is an approved e-file provider for Form 1042 and our clients who prepare 1042-S forms through Sprintax Calculus will be able to e-file form 1042 directly to the IRS using Sprintax Calculus software!

Essentially, we assist companies in effortlessly managing their reporting obligations!

When is the Form 1042 deadline?

As part of the Form 1042 instructions, you will need to ensure the form is completed and filed by March 15 of the year following the income that is being reported.

So, to file for any 2024 income, the Form 1042 due date is 15 March 2025.

If you need more time for Form 1042 preparation, you will be able to e-file an extension of time – Form 7004 which is also supported by Calculus.

Form 7004 provides a 6-month extension to file only for a 1042 and does not provide an extension for the tax owed.

Form 1042 late filing penalty

The Form 1042 late-filing penalty is 5% of the tax that is unpaid for each month the return is late. This is up to a maximum of 25% of the tax that is unpaid.

Manage your 1042 requirements with Sprintax Calculus

Our easy-to-navigate platform offers a user-friendly interface that will guide you through the process of preparing your 1042 documents – ensuring accurate and timely submissions of the forms.

From inputting data to generating the final forms, The Calculus system simplifies the entire procedure, minimizing errors and maximizing efficiency.

With Calculus e-filing, institutions like you will have:

- Security: Safely input and store all necessary information for correct 1042 filings.

- Accuracy: Our system will process precise 1042 forms, reducing the risk of errors.

- Timeliness: Ensure timely filing during tax season, avoiding penalties or late fees.

Ready to make the process of filing taxes on behalf of nonresidents?

Sprintax Calculus will help you with navigating the complex landscape of US tax compliance.

Learn more about how Sprintax can simplify your tax journey or get started with e-filing here.