US tax is tricky and it is easy to make a mistake when filing your tax return.

Such mistakes can be frustrating and lead to delays in both processing your tax return and retrieving your tax refund.

In this guide, we’ll highlight the five most common mistakes made by nonresidents while filing their tax return and provide top tips on how to avoid them!

1. Filing as a ‘resident’ instead of a ‘nonresident tax alien’

This is easily one of the most common tax errors.

Every year thousands of nonresident aliens mistakenly file resident tax documents.

In short, a resident should file a Form 1040 and a nonresident should file with a Form 1040NR.

Even if you are living full-time in the US and working or going to school, this does not necessarily qualify you as a resident according to the IRS.

Before you file your tax documents, it’s a good idea to double-check your tax residency status by completing the substantial presence test.

You can work out your residency status for free using Sprintax Returns!

What happens if I file a Form 1040 instead of a 1040NR?

Filing the wrong form can lead to complications when applying for a future US visa or for a Green Card. If an amended tax return is not filed in this case it can lead to problems with the IRS later in the year and you could be hit with fines and penalties. If you’re confused about your tax residency, don’t hesitate to contact our Live Chat team with your questions anytime 24/7.

2. Failing to include all income on your return

What if you forgot to include something on your taxes?

Failure to include all your income or entering the incorrect income figure on your tax return is another common mistake made by tax filers. It is essential to declare all of the income you earned from US sources on your tax return.

When you sit down to prepare your tax documents, be sure to have your income forms – such as your W-2, 1042-S and/or 1099 – at hand.

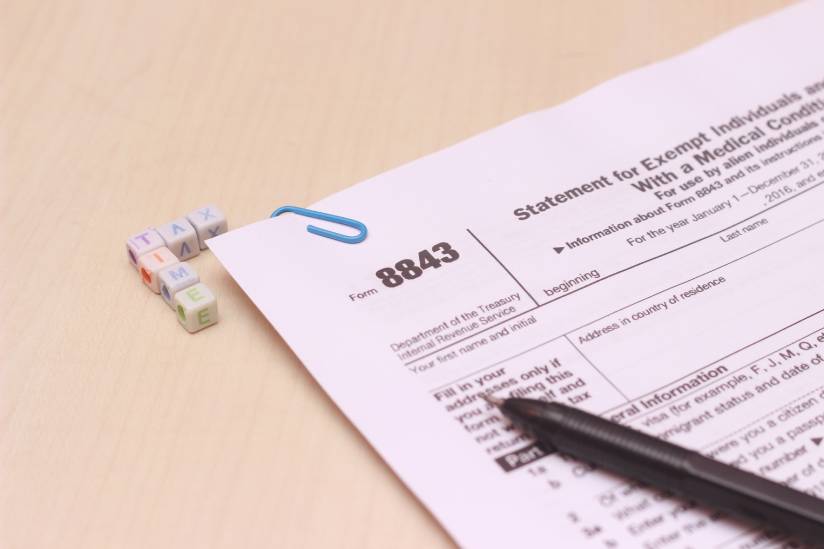

3. Students on F or J visas forgetting to file a Form 8843

Every nonresident in the US has a tax filing requirement.

Nonresident aliens in the US under J or F visas must file a Form 8843 “Statement of Exempt Individuals and Individuals with a Medical Condition” even if they received no income in the US.

Form 8843 is used to support your claim and to exclude your days of presence in the US for the substantial presence test. The Form is not an income tax return.

4. Not claiming a tax treaty benefit

Unsure of their tax entitlements, many nonresidents miss out on claiming their tax treaty benefits.

The US has income tax treaties with 65 countries. For nonresident aliens, these treaties can often reduce or eliminate US tax on personal services and other income, such as pensions, interest, dividends, royalties, and capital gains.

5. Filing under an incorrect marital status

This is a common mistake made by filers. For example, if you filed as a single person but got married on the last day of the tax year, you will be required to amend your tax return by filing your taxes under the appropriate status of married filing jointly or married filing separately.

How to amend your tax return with Sprintax

If you realize that you made an error on a tax return you already filed or you have come across new information, you should file an amended tax return.

For more on this and a step-by-step guide to amending your tax return, check out our guide here.

Got questions about US tax?

At Sprintax, we know tax can be confusing.

That’s why we developed our tax preparation software to help nonresidents prepare their tax documents easily online.

By using Sprintax you can:

- Prepare your nonresident federal & state tax documents and form 8843 easily online

- E-file your 1040NR (eligibility criteria here)

- Claim your maximum US tax refund

- Determine your residency status for free

- Discuss your US tax questions with our Live Chat team anytime 24/7

Simply create a Sprintax Returns account to get started with your nonresident alien tax return.