Due to the Coronavirus (COVID-19) outbreak, the IRS have announced a 90 day extension to the deadline to file and pay your federal taxes.

When are taxes due in 2020?

The IRS filing deadline for federal income taxes has been extended from 15 April to 15 July 2020. The tax payment deadlines have also been extended to 15 July.

This extension applies to all taxpayers (both resident and nonresident), including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax. Taxpayers are automatically eligible for the new deadline – you don’t need to file for a tax extension to be eligible for the new deadline.

Is the deadline for state taxes also extended?

The following states* have also extended their filing deadlines to 15 July:

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Georgia, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, Utah, Vermont, District of Columbia, West Virginia and Wisconsin.

Hawaii has extended its tax deadline to 20 July, Idaho has extended to 15 June, Iowa has extended to 31 July, and Virginia to 1 June.

The Sprintax team will keep you updated on any further state deadline extensions announced in the coming days.

(*lists up-to-date on 11 May)

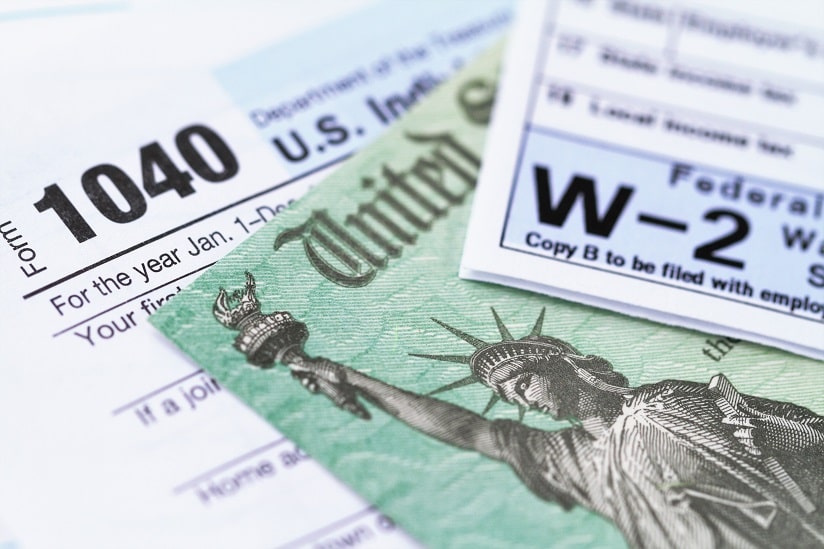

What you will need in order to file your taxes during the COVID-19 pandemic

In order to prepare your tax documents, you will need your:

- Passport

- Form I-20 (F visa) or DS-2019 (J visa)

- SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number)

- Income documents (W2, 1042-S and/or 1099)

- Bank account information (if you are eligible for a tax refund)

Are there any penalties or interests for late filing?

Taxpayers who are finding it difficult to file by the new deadline will need to request an extension. If you don’t get an extension and fail to file by the new due date (15 July) then you will be penalized.

When are taxes due if you file an extension?

If you are deferring your payment beyond the 15 July deadline, you can file a federal extension until the later date of 15 October 2020. The IRS applies late payment and filing penalties if you don’t file by the deadline. The penalties and interest are based on each different case and how many days have passed the due date.

What if I am expecting a refund?

The extension won’t delay tax refunds. The IRS is still accepting returns and processing refunds. They usually issue most refunds within 21 days of processing a return.

Will the extension delay tax refunds?

No, if you file now, you will receive your refund without delay. If you file closer to the deadline you may experience delays as the IRS will be dealing with a larger volume of returns.

Can I file my tax return today?

Of course!

We recommend that you prepare your taxes as soon as you can. By filing your tax return now you will receive your refund earlier and without delay!

The Sprintax team will be on hand to guide you through the entire tax prep-process and our Live Chat team is available to support you 24/7 and answer your tax questions.