(Updated for 2025)

When preparing your tax return you will need to include some details from your income documents about the money you earned and taxes you paid in the US.

While it is not unusual for there to be differences between the taxation of federal and state income, it can be tricky for nonresidents to file their taxes in such cases.

The easiest way to prepare your tax documents online is by using Sprintax Returns (formerly Sprintax Tax Preparation)- the nonresident alien tax return software.

In this guide, we’re going to outline how you can enter your payment and tax details by completing Step 3 of the Sprintax tax prep process and what to do if you receive an error alert relating to your federal and state income.

Table of Contents Show

What you will need in order to complete Step 3 in Sprintax?

If you were working or earning US-sourced income, you will likely receive income documents at the end of the tax year.

In order to prepare your tax return, you will need to have your income documents close at hand.

The documents you receive will depend on the type of income you earned.

The three most common types of income documents are:

W-2

This is the most common type of income document for nonresidents. If you had wages, salary, or other types of employment income – they will all be reported on your W-2.

1042-S

If you received any scholarship, stipend, housing allowance, royalty payments, or other types of award that is paid to a nonresident, this is generally recorded on a 1042-S form.

1099

This is probably the least common income form for nonresidents.

It covers other types of income like rental income, investment income, and other fees and services that you might have paid for.

If you received an income that was not reported on any of these documents, you still have an obligation to report that income to the IRS. Within the Sprintax system, we will give you the opportunity to report your full income to the IRS for the tax year.

Sprintax Tax Prep process – How to complete Step 3?

At Step 3 of the Sprintax tax prep process, we will ask you about the income you earned during the year. You should replicate the information that is on your income document (W-2, 1042-S or 1099, etc) into the relevant fields on the Sprintax site.

Our software is designed so that the data you will be entering, and the screen that you are viewing should look very similar to the paper document that you have beside you.

But remember, if you are having any trouble completing Step 3, our Live Chat team is available 24/7 to help you. *

*If our Bot Stacy cannot answer your question, you will be able to chat with our Live chat agents.

My federal income is different from my state income. What should I do?

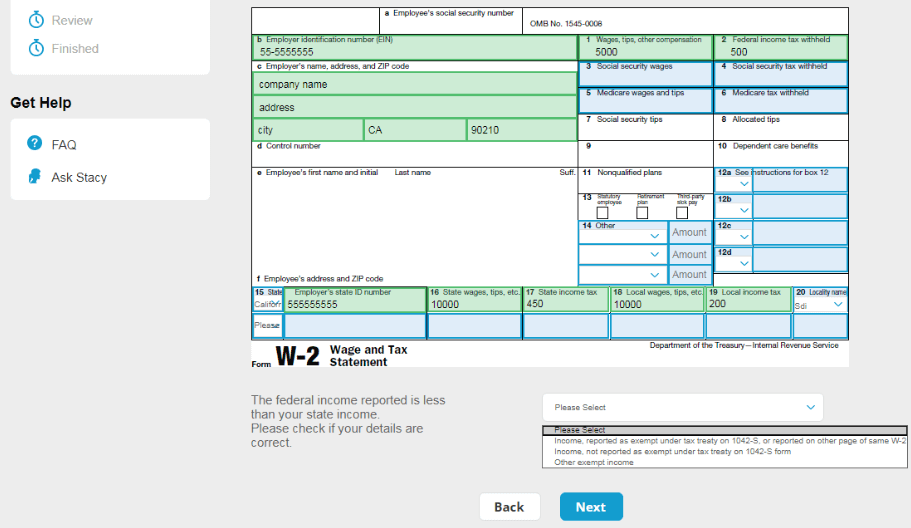

During the Sprintax tax preparation process, you may get one of the following alerts when you are completing the W-2 form (Wage and Tax statement) part of Step 3:

1. “The federal income reported is less than your state income. Please check if your details are correct”

2. “The federal income reported is higher than your state income. Please check if your details are correct”

This is simply an alert to make sure your details are correct.

Usually, the difference relates to what wage amounts are taxable in each case.

In certain States, items that can be excluded from federal wages (for instance contributions to some types of retirement accounts) are not deducted from state salaries.

California wages, for example, can be higher than federal wages (if you have deductions for contributions to an HSA- Health Saving Account), as California does not allow a deduction for those contributions.

The second reason for this difference might be the fact that your wages are exempt from the tax treaty between your country and the USA.

This income, covered by a tax treaty is often reported on 1042-S form and the rest of the income is reported as federal wages in box 1.

Many States do not allow federal tax treaty agreements and they tax the total income. In such a case, federal wages and state wages reported on W-2 form would differ.

Still have questions?

You can contact Sprintax Live chat to help you with the tax preparation process.*

Remember, you must file your 2024 tax documents before 15 April 2025.

*If our Bot Stacy cannot answer your question, you will be able to chat with our Live chat agents.

With Sprintax you can:

- Save time and stress!

- Determine your residency status

- Prepare a fully compliant US tax return

- E-file your 1040-NR (eligibility criteria)

- Maximize your State tax refund

- Avail of our 24/7 Vita Qualified Live Chat facility

Prepare your US nonresident alien tax return here.