- The Nonresident Tax Clinic takes place on Wednesday 17 August

- This free-to-attend session will be a complete tax guide to hiring and paying foreign nationals

- Practical advice for payroll department & international office staff

- Fantastic panel of speakers confirmed

Register here to save your seat

The proper nonresident alien tax withholding has become a key issue for many organisations across the US.

If you work with an organisation which pays salary or scholarship income to foreign individuals, you may be interested in attending the Sprintax Nonresident Tax Clinic – Your guide to hiring and paying foreign nationals!

Taking place on 17 August 2022, our panel of speakers will share their tips on how to streamline the withholding of tax from nonresidents and examine common case study scenarios

This event is an ideal opportunity for a unique opportunity for payroll department and international office staff to proactively engage, network and offer guidance on the topic of nonresident tax compliance.

This event is brought to you by the Alien Sessions, a series of live events and online seminar sessions exploring key topics of influence for foreign nationals working and living in the US.

This event is completely free to attend. You can save your spot by register for the clinic here.

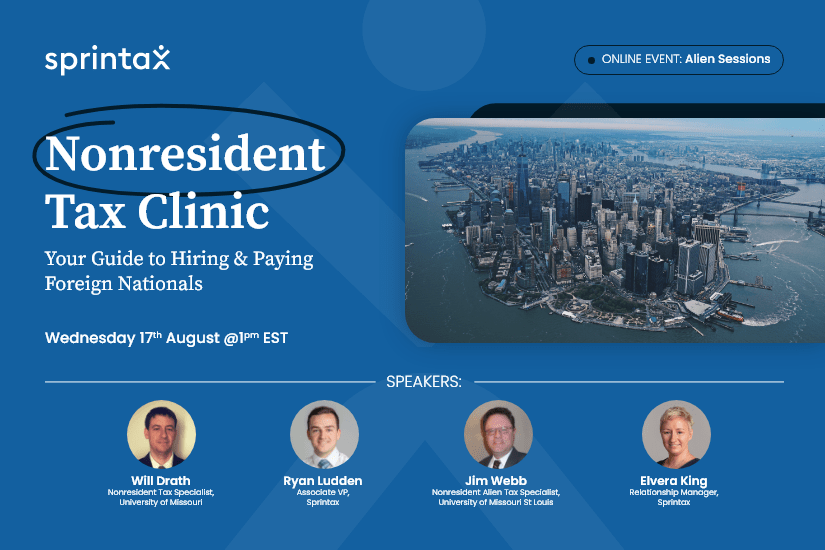

We are now delighted to announce details of our panel speakers…

Who is speaking at the Nonresident Tax Clinic?

We have a fantastic line up of panellists scheduled for the event, including:

Jim Webb

Nonresident Tax Specialist

University of Missouri – St Louis

Jim Webb is a 1996 graduate of the University of North Texas with a BS in Accounting and MS in Managerial Accounting Systems. He is a licensed CPA in the state of Texas. He has worked in higher education for 32 years with 24 years in nonresident alien tax. He has been with the University of Missouri-St. Louis since 2012.

Will Drath

Nonresident Tax Specialist

University of Missouri – Columbia

Will Drath is the Nonresident Tax Specialist for The University of Missouri – Columbia campus. He received a Juris Doctor from Elon Law in 2013, and received a Master of Accountancy from the Kenan-Flagler Business School at the University of North Carolina in 2018.

Ryan Ludden

Associate Vice President

Sprintax

Ryan Ludden has been supporting organizations across the US and around the world with nonresident tax compliance for over 5 years at Sprintax. During that time he has delivered more than 300 tax workshops and webinars to nonresidents and their employers, assisting with tax filing and process optimization to ensure NRA compliance.

Elvera King

Relationship Manager

Sprintax

Elvera King liaises with our Educational Partners across the US to deliver tax workshops and resources to assist their nonresident populations to file compliant US tax returns. Elvera has over 10 years of experience working in the tax and finance industry and has been part of the Sprintax team since 2015.

What is the Nonresident Tax Clinic?

The Sprintax Nonresident Tax Clinic is a unique opportunity for international office or payroll department staff to gather and converse about the latest developments and challenges surrounding nonresident taxation.

During the session, our panel of industry thought-leaders will offer guidance on nonresident tax compliance and share their tips on how to streamline the withholding of tax from nonresidents.

What will this event cover?

During our clinic, our fantastic panel of speakers will explore the latest developments in rules and regulations for taxation of nonresidents in the US.

Topics on the day will include:

- Who is considered a non-resident for tax in the US?

- Why the type and source of income earned matters for nonresidents

- Understanding FICA withholding for nonresidents

- How to correctly withhold taxation on scholarship or non-employment income from non-residents

- Exploring tax treaty eligibility for foreign nationals

- How to complete important tax forms

- Real-life, every day case studies

- And more

Who should attend this event?

This event has been created specifically for HR, international office and payroll department staff or anyone who is interested in learning about nonresident tax compliance.

How to register and attend the event?

It’s easy to attend this free virtual conference. All you need to do is join through your desktop, laptop, phone or tablet!

The clinic is taking place on Wednesday August 17 and starts at 1pm EST.

It’s really easy to attend. Simply register here to save your space.

But be quick! Places are limited. You can guarantee your entry by registering here.