Are you а nonresident starting a new job or CPT/OPT in the US?

If that’s the case, congratulations!

When you change jobs or start new employment in the US, there are important tax forms that you need to be aware of.

These forms ensure you don’t pay too much tax, and claim any tax treaty benefits you’re due.

In the US, you must fill out the forms correctly because otherwise, you may owe tax to the Internal Revenue Service (IRS) when you file your tax return, and then end up owing additional penalties or fines on top of this.

Not fun!

The tax documents can be tricky to fill out, especially if you haven’t done it before. To make it easier for you, we prepared this guide.

Here, we will discuss all of the tax forms a nonresident should be aware of when starting a new job in the US. You will also learn what’s the easiest way to generate them online, fill them out properly, and also how to claim a US tax refund online.

Now, let’s get down to business.

The most important tax forms a nonresident needs to fill out when starting a new job are – Forms W-4, 8233, and W8-BEN.

What is the W-4 form?

Form W-4 is a tax document used by the IRS to inform employers about an employee’s tax situation in the US.

When you start a new job, you will be required to fill it out, so that the employer can deduct the appropriate amount of federal income tax from your paycheck.

For more information, check out everything you need to know about Form W-4 in our blog.

Fill out online Form W-4 easily with Sprintax Forms

Note* Many nonresidents in the US may be exempt from FICA tax and if this is the case they must inform their payroll department. Learn how to determine if you are exempt from FICA here.

What is Form 8233?

Form 8233 should be filed immediately when you start a new job, before your first pay.

Nonresident aliens from countries with which the US has a tax treaty can have some or all of their income exempt from Federal Income Tax withholding under the conditions of the tax treaty between their home country and the US.

All nonresident aliens who seek a withholding exemption on compensation based on a tax treaty between the US and their home country must complete Form 8233.

The individual must fill it out whether the exemption is claimed as an independent contractor or for services as an employee.

Nonresidents must file Form 8233 if they receive a compensatory scholarship, personal services (compensation for provided services), or fellowship income.

Fill out Form 8233 easily online with Sprintax Forms

Form SS-5

In a nutshell, Form SS-5 is used to request a social security number (SSN).

Your Social Security number is crucial to getting a job, opening a bank account, getting medical treatment, and, certainly, receiving Social Security retirement benefits.

If you previously had a card but lost it, you’ll need a new one to prove your identity to your employer and others.

In any case, you’ll need to apply for a new one using the SS-5 form.

Fill out your SS-5 form easily online here

What is Form W-8BEN?

Many nonresidents in the US can potentially reduce their tax liability by claiming tax treaty benefits.

In order to avail of treaty relief, you must complete a form W-8BEN.

Foreign nationals who receive certain sorts of income in the United States must also fill out this form, including:

- Interest

- Rents

- Dividends

- Premiums

- Royalties

- Annuities

Fill out online Form W-8BEN easily with Sprintax Forms

What is Form W-9?

This form is necessary only for resident aliens or domestic businesses.

Form W-9 is a frequently used IRS form for providing information to a person or company that will be making payments to another company or a person.

A typical example is when someone works as an independent contractor for a business.

When you start working as a freelancer or as a contractor for a company, you may be required to fill out a W-9 and send it to the company that will be paying you.

You can generate Form W-9 easily online here.

How does Sprintax Forms work?

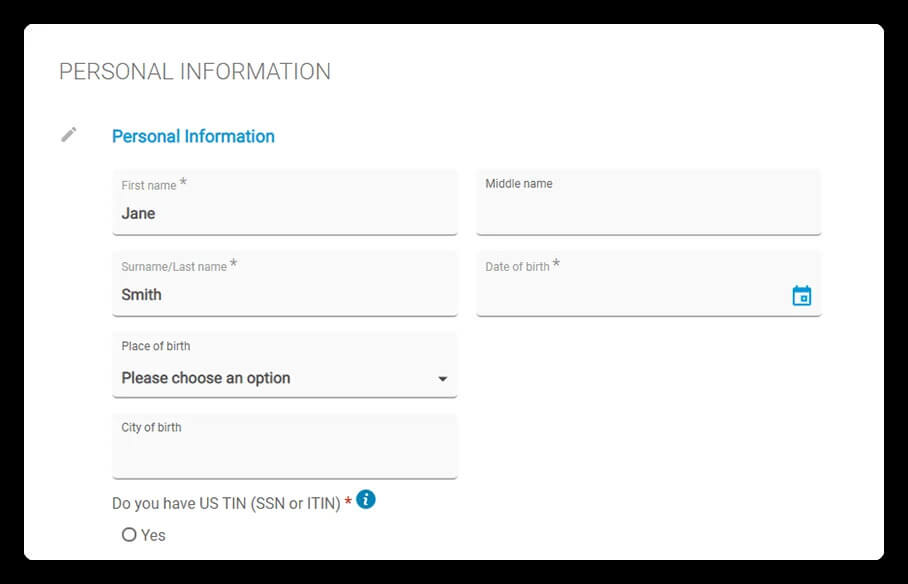

1. Create your Sprintax account

Simply enter your name and email address

2. Tell us a little about yourself

Quickly fill out our user-friendly online questionnaire

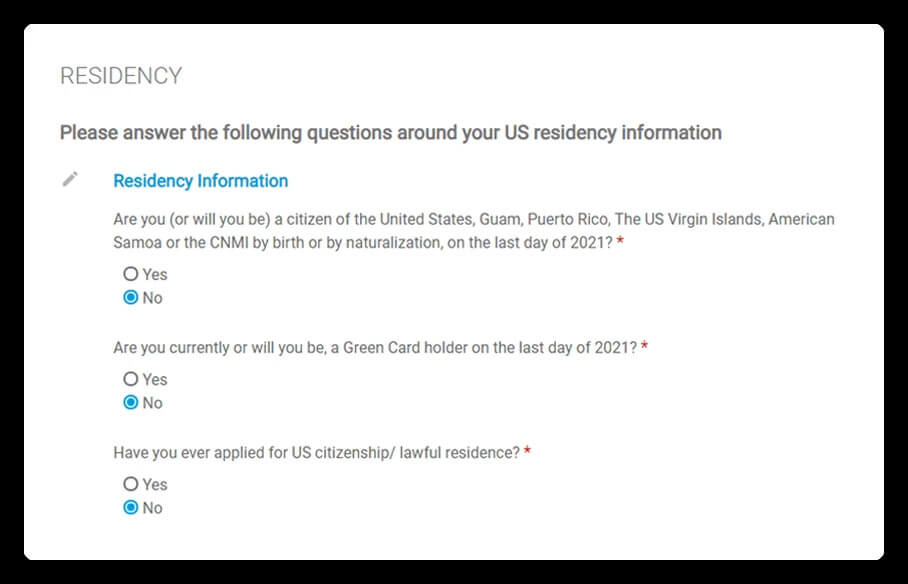

3. Creating your tax profile

We will determine your residency status and tax treaty eligibility, as well as create the necessary tax forms, such as W-4, 8233, SS-5, W-8BEN (E), W-7, and W-9.

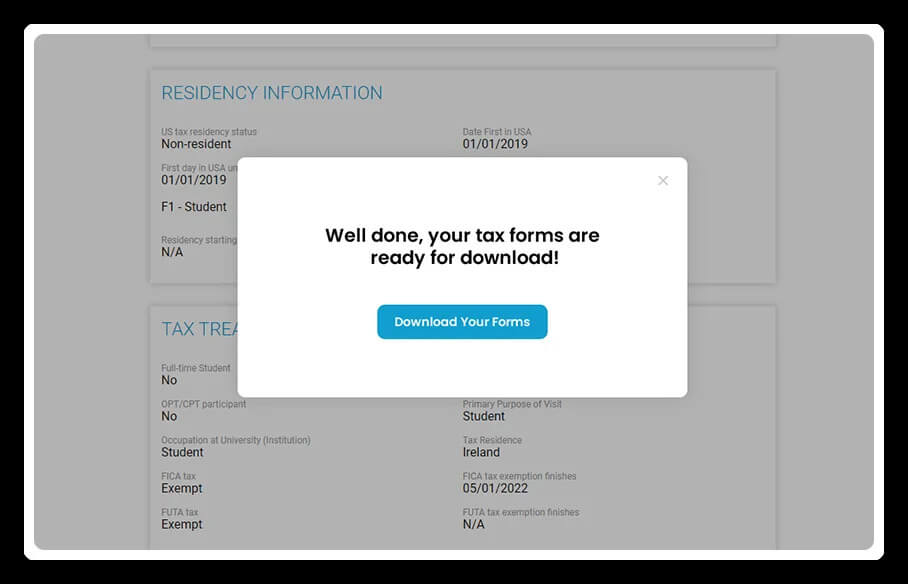

4. Download your completed forms

Download, print and sign the tax forms we‘ve completed for you and give them to your employer.

With Sprintax Forms, you can easily generate online the employment forms you need.

All you need to do is log in to your Sprintax account and answer some easy questions.

Our software will then automatically the correct forms required for your employment and ensure you do not pay any more tax than you need to.

Why choose Sprintax Forms?

- Automatic generation of pre-employment forms, such as the W-4, 8233, W-8BEN, W7, W9, and more.

- Pay the correct amount of tax – easily determine your tax residency status and ensure the right amount of tax is withheld from your salary

- Avail of your tax treaty benefits – our software will apply every tax treaty benefit you’re due

Got questions about your forms? Our live chat team is here to support you 24/7.