The US tax system and the relevant tax forms can be challenging to understand at times, especially for foreign entities.

An important form that is relevant to foreign entities operating in the US, is Form W-8BEN-E.

It’s crucial to have a good understanding of this form if you are operating a foreign entity in the US.

With that in mind, we have gathered everything you need to know about Form W-8BEN-E, including its purpose, who needs to fill it out, and instructions for completing the form.

Table of Contents

- What is Form W-8BEN-E and what is its purpose?

- Who needs to fill out a W-8BEN-E?

- What is the difference between Form W-8BEN and Form W-8BEN-E

- Claim of tax treaty benefits – W-8BEN-E

- How to fill out Form W-8BEN-E

- How long is W-8BEN-E valid?

- When and where to submit W-8BEN-E forms

- What happens if the company files incorrectly on my behalf?

- Who can help me complete Form W-8BEN-E?

What is Form W-8BEN-E and what is its purpose?

Form W-8BEN-E is an official Internal Revenue Service (IRS) tax form which is used by foreign entities to claim tax treaty benefits.

This form is officially known as the “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting.”

In order to claim tax treaty benefits, foreign entities – such as corporations, partnerships, trusts and international organizations – in the US must complete Form W-8BEN-E.

Who needs to fill out a W-8BEN-E?

Form W8-BEN-E should be filled out by non-US corporations that receive payments from American businesses to avail of tax treaty benefits, such as reduced withholding tax.

Non-US entities can pay up to 30% withholding tax on income received from US sources.

However, if your country has a tax treaty with the US, you may be eligible to avail of a reduced tax rate.

Form W-8BEN-E purpose is to enable foreign entities to claim applicable tax treaty benefits.

You can complete Form W-8BEN-E easily online.

What is the difference between Form W-8BEN and Form W-8BEN-E

One key difference between Form W-8BEN-E and Form W-8BEN is that Form W-8BEN-E is for ‘entities’.

Entities refer to any type of business or other type of institution that has more than one owner, such as corporations, partnerships, exempt entities, foundations – public and private, international organizations and even foreign governments.

Foreign entities are subject to a 30% withholding tax in the US. Similar to Form W-8BEN, Form W-8BEN-E will allow taxpayers to receive a tax treaty deduction where applicable.

While there are similarities between the two forms, such as their layout and the details required. The main difference is that W-8BEN applies to income from individuals or single owner entities like independent contractors and sole proprietors and Form W-8BEN-E is for income from entities.

In other words, W-8BEN is only for individuals, while entities are required to fill out W-8BEN-E.

Claim of tax treaty benefits – W-8BEN-E

Foreign entities must file Form W-8BEN-E in order to claim their tax treaty benefits.

By doing so, it can either reduce or eliminate the US withholding tax, which can be up to 30%.

How to fill out Form W-8BEN-E

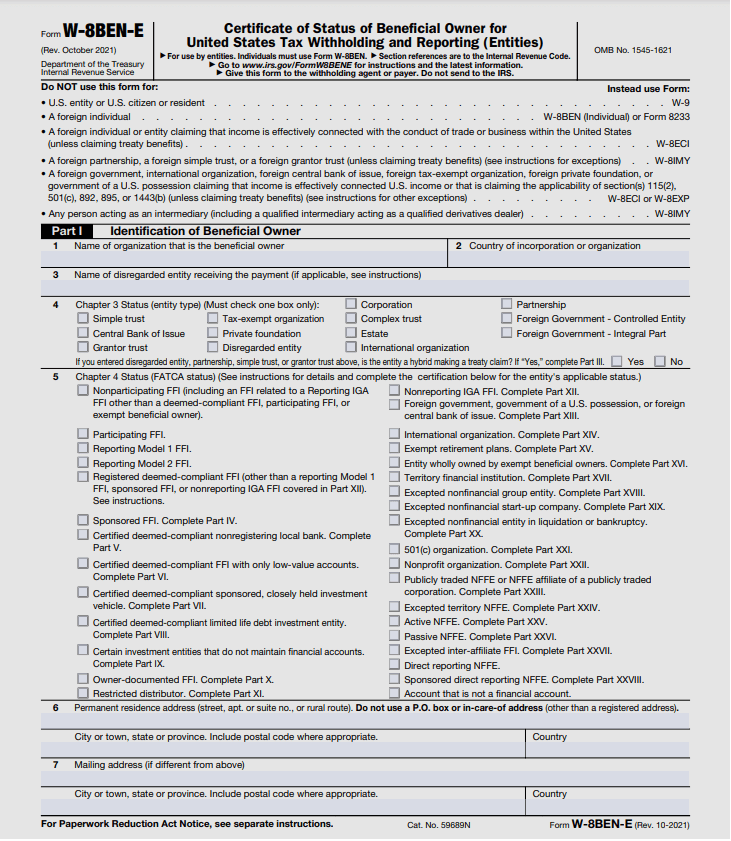

When completing Form W-8BEN-E, you’ll notice that it is significantly longer and more detailed than Form W-8BEN and the information required is different.

At the beginning of the form, there is a section that lists who should not use Form W-8BEN-E and the relevant forms they should use instead.

Instructions for Form W-8BEN-E will be provided at each section of the form, however, below we have provided some brief instructions for each part of the form.

Part I, it will ask questions about the beneficial owner, such as the name of the organization and the country of origin.

You will also identify Chapter 3 Status and Chapter 4 Status in this section. Chapter 3 Status refers to the entity type – corporation, partnership, trust etc.

Chapter 4 Status is related to the FATCA (Foreign Account Tax Compliance Act). In this section, you will have to classify the foreign entity based on FATCA status and regulations – Participating FFI, Non-participating FFI, etc.

Identifying both Chapter 3 and Chapter 4 Statuses are essential to determine how much tax is withheld.

Part II is relevant to disregarded entities. This refers to a business entity that has a single owner and is not classified as a corporation. It is disregarded as an entity separate from its owner.

You will then proceed to the next section where you will fill out information to claim eligible tax treaty benefits. For non-FATCA payments, this form helps clarify your entity’s status and eligibility for reduced withholding rates or exemptions in the US. However, Form W-8BEN-E is not a substitute form for non-FATCA payments.

The final section of the form, Part XXX, will require you to provide your signature to certify that all of the information you have provided on the form is correct.

In total, there are 30 sections, the vast majority of which are short.

However, depending on your entity type, FATCA status, and other relevant factors you may or may not need to fill out certain sections. It’s important to review the form to ensure you have answered all sections relevant to your entity.

You can complete form W-8BEN-E online with Sprintax Forms

How long is W-8BEN-E valid?

Form W-8BEN-E will remain valid for three years and will expire on the last day of the third calendar year.

For example, if Form W-8BEN-E is signed in August 2024, it will remain valid until 31 December 2027 giving that there is no change in circumstances.

When and where to submit W-8BEN-E forms

Is it important to submit Form W-8BEN-E before receiving any US sourced income. By doing so, the correct amount of tax will be withheld from the start, helping you to avoid the 30% withholding tax.

If there is a change in circumstances from when you first submitted Form W-8BEN-E, you must resubmit your form.

What happens if the company files incorrectly on my behalf?

This is a relatively common occurrence, so you shouldn’t panic if it happens.

If this happens, you can simply file a tax return in the US (Form 1040-NR) along with Form 8833 to outline that you are in fact applicable for a treaty.

You should receive a tax refund on any overpayments you may have made shortly after this.

You can also choose to file Form 1040-NR with a tax expert such as Sprintax Returns!

When you use our service, you can rest assured that you’ll be 100% tax compliant.

Who can help me complete Form W-8BEN-E?

Sprintax Forms can help you!

We can offer you:

- Online generation of forms, such as W-8BEN-E, W-8BEN, W4, 8823, and more!

- We’ll easily determine your tax residency status, thus ensuring you are paying the correct amount of tax

- Our software will apply every tax treaty benefit you’re due

Complete W-8BEN-E form with Sprintax here.