(Last updated: 20.11.2024)

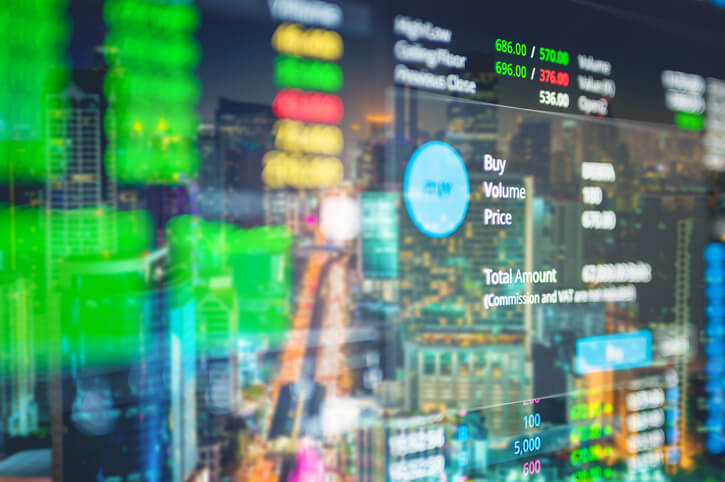

Although Bitcoin was invented in January 2009, from a taxation point of view, cryptocurrency is still a relatively new phenomenon.

Since its inception, investors in cryptocurrency have been unsure of their tax and reporting requirements. And many important questions on the topic have gone unanswered for years.

Is cryptocurrency considered taxable in the US? If so, how much tax is deducted from gains? What type of tax should be deducted and how should this be reported to the IRS?

The situation is even trickier for nonresidents in the US. While every nonresident is required to file tax documents to account for their time in the US, it can be hard to declare your cryptocurrency profits for taxation when you are unfamiliar with IRS tax law.

The overall market value of digital currencies has increased hugely over the past five years.

In fact, the current value of the cryptocurrency market, as of November 2024, is $3.2 trillion, according to CoinGecko. This represents a more than a $1 trillion rise from the $2 trillion mark back in April 2021. Bitcoin is the most popular digital currency – representing approximately 50% of this $2 trillion.

With this in mind, it is easy to see why so many investors are attracted to these virtual, volatile currencies.

In years past, it had been somewhat easy to avoid declaring your crypto-gains for tax. However, times are changing.

If you are in the US as a nonresident – for example as an international student on an F-1 visa – and you are earning income from cryptocurrency, in this guide, you will find out everything you need to know about your tax reporting requirements.

Do I need to report Cryptocurrency on my US tax return?

Yes. If you have made a profit from cryptocurrency (which you traded from a US exchange or broker) while you were living in the US, you will have to declare this income.

In short, cryptocurrency is treated as property by the IRS.

That means any profit you make on it will be subject to Capital Gains Tax at 30% and must be included on your 1040-NR tax return.

If you dispose of your investment for a loss, you will not need to pay tax. However, as a nonresident, you will not be able to use your losses against any tax liabilities in future years.

While the lines may seem slightly blurred in regards to cryptocurrency and tax filing now, this will unlikely be the case in future years.

Crispian Robinson, Strategic Partnerships at Koinly, says that cryptocurrency is high on the agenda of tax authorities globally:

“It’s clear that Tax Authorities around the world are increasingly applying pressure on the Crypto Industry in order to drive tax compliance, ranging from partnering with exchanges to gain user trading data to developing new legislation bills.

For example, President Biden’s latest $1 trillion infrastructure bill has specifically singled out tighter tax regulation over the Crypto industry as a key source of funding, expecting to raise $28 billion over 10 years as a direct result.”

It appears inevitable that tighter regulation and tax compliance is coming and will be key in helping to further legitimize the cryptocurrency industry in the eyes of regulators.

Crypto investor? We’ve teamed up with Koinly to calculate the tax you might owe on your cryptocurrency capital gains and income.

How much tax will I pay?

Firstly, all of the following cryptocurrency transactions are considered taxable:

- Sale of cryptocurrency, mined personally, to a third party.

- Sale of cryptocurrency, purchased from someone else to a third party.

- Using mined cryptocurrency in order to buy goods or services.

Nonresidents will pay tax at 30% on their income from cryptocurrency. And unlike residents, nonresidents are not entitled to use losses from previous years to offset their tax liability.

As we mentioned above, the IRS considers cryptocurrency to be property. That means they are taxed in a similar fashion to gains made from stocks, shares and bricks and mortar property.

In other words, if you sell some stock for a profit of $1,000, this is considered a “taxable event” and you must declare this money for Capital Gains Tax.

But things aren’t always that straightforward when it comes to cryptocurrency. For example, if you use your Bitcoin to purchase Ethereum, does the IRS consider this to be a taxable event?

What about if you pay for dinner or buy basketball tickets with Litecoin?

The answer is yes!

Every time you purchase something with cryptocurrency, the IRS will treat this as an instance where the asset was liquidated. And if you have made a profit, you must declare that for tax.

However, if you have made a profit from cryptocurrency, it’s important to know that even if your home country has a tax treaty with the US, the gain is not covered by the treaty and will still be taxed accordingly.

How do I determine the correct amount of cryptocurrency income to declare for tax?

Many investors struggle to work out exactly how much they made or lost from their cryptocurrency investment.

If you trade stocks or shares through a brokerage, the brokers should issue a Form 1042-S which documents your transactions, you may need to request this though.

However, this form is often not generated to account for cryptocurrency transactions.

Meanwhile, some exchanges have begun to issue a 1099-K form to account for cryptocurrency transactions. This is typically done where there are at least 200 transactions worth an aggregate of $20,000 or more. However, this form only reports the total value of transactions and does not detail how much the investor put in at the outset.

As a result, many investors over-report their gains and pay more tax than they need to. With this in mind, it is advisable to properly document each cryptocurrency investment that you make and keep these records in a safe place.

It’s important to remember that the purchase of digital currency is not a taxable event. Instead an investor must determine their tax liability when they sell their cryptocurrency for a profit.

Some cryptocurrency exchanges will provide you with an excel summary of all your trades. This document will enable you to determine the amount you originally invested as well as the profit that you have made, so be sure to keep them safe.

Alternatively, if the sale involves the disposal of assets from a variety of sources, the investor will need to know the fair market value of the asset on the day of sale.

David Kremmer, bitcoin expert and CEO of CoinLedger, outlines that transactions may be difficult to report if assets are sent from wallet-to-wallet. He says:

“Due to the transferable nature of cryptocurrencies, it’s easy for investors to send their assets from wallet-to-wallet or from one exchange platform to another.

This creates difficulties when reconciling transactions for tax reporting.

To help calculate your total profit, you should keep records of your cost basis (the original purchase price) for each cryptocurrency when you first acquired it. Having these records will dramatically help you when tax time comes around.”

Sprintax Returns can help you file your tax return no matter where you are in the world!

What happens if I don’t report my Cryptocurrency income?

The IRS is taking the taxation of virtual currency seriously and has recently stepped up its efforts to crack-down on cryptocurrency tax-dodgers. The agency is liaising with crypto exchanges for information regarding non-compliant taxpayers.

In fact, over the last two years, the IRS announced it was sending letters to more than 10,000 people who potentially failed to report cryptocurrency income. The letters state that individuals have 30 days to respond to the IRS. The result of non-compliance? Usually a tax audit for the investor.

The message from the IRS is clear: file your taxes.

This US tax deadline falls on 15 April each year, so you should know before then whether or not you need to file.

If you do not file and declare all of your income, you leave yourself open to penalties and fines from the IRS. The late filing penalty is generally 5% of the unpaid taxes for each month or part month that it is late.

However, if you still haven’t filed more than 60 days after the due date or extended due date, the minimum penalty is $485 or 100% of the unpaid tax, whichever is less.

As a nonresident, failure to comply with your US tax obligations can also jeopardize your future US visa and Green Card applications.

I earned a profit from bitcoin in previous years. Can I retrospectively declare this income to the IRS?

2019 was the first year that the IRS included a reference to cryptocurrency on their tax documents.

Citizens and resident aliens were asked on Form Schedule 1: “At any time during 2019, did you receive, sell, send, exchange or otherwise acquire any financial interest in any virtual currency?”

Schedule 1 is used to report income that is otherwise not listed on Form 1040. This typically includes capital gains, alimony, or gambling winnings.

However, Schedule 1 which nonresidents received did not reference cryptocurrency. Instead, nonresidents were expected to report their gains on Schedule NEC along with their Form 1040NR.

In 2020, the IRS recognized that the process needed to be simplified as millions of dollars of cryptocurrency slipped through the net. With this in mind, the IRS moved the virtual currency question to the main 1040 tax return form.

If you have earned income from cryptocurrency which has not previously been reported, it is advisable to declare this income to the IRS.

Despite the IRS only beginning to update their tax documents in 2019 in relation to cryptocurrency, the US tax authority had issued notices as far back as 2014 and many of the rules outlined at that time are still in force today.

In summary, if you were paid for personal services with cryptocurrency such as Bitcoin, it’s advisable to report it on your tax return, the same as ordinary income.

Case Studies

Case study 1 – Mike buys 3 Bitcoin

Mike, who is on an F-1 visa in the US, purchases 3 Bitcoin for $9,000 and later sells it for $11,000, meaning he made a profit of $2,000.

In this case, Mike’s profit of $2,000 will be taxed at 30%. This means that he will have a federal tax bill of $600 on his cryptocurrency income.

Case study 2 – Sachin purchases multiple Bitcoin at different times

Sachin is in the US on an F-1 visa. He purchased five Bitcoin in 2010 for $5,000 ($1,000 each), and three Bitcoin in 2018 for $12,000 ($4,000 each). He then sells six Bitcoin three years later for $20,000 in 2021.

How should Sachin calculate his tax liability?

The IRS says that if you can identify the Bitcoins that have been sold, their cost basis can be used. For example, Sachin sold three Bitcoin of $1,000 ($3,000 in total) from his wallet created in 2010 and three Bitcoin of $4,000 ($12,000 in total) from his wallet from 2018.

In this case, the cost basis is $15,000 and the profit is $5,000 ($20,000 sales price minus the aforementioned $15,000 cost basis).

So, the tax due in this case will be $1,500 ($5,000 at a tax rate of 30%).

If it is difficult for Sachin to distinguish which Bitcoin are sold, the IRS advises that he should use a ‘first in, first out’ (FIFO) method to calculate his liability.

Therefore, the first five Bitcoin would be based on the oldest cost basis of $1,000 ($5,000), followed by one Bitcoin of $4,000 – the newer purchase.

As a result, the basis would be $9,000 and the profits under FIFO method would be $11,000 with tax bill of $3,300.

How should nonresidents declare their cryptocurrency gains to the IRS?

Simply put, it depends on how you use cryptocurrency.

If you invest in cryptocurrency and you earn a profit from it, it will be taxed as Capital Gains Tax, and you will need to report it as a capital gain on the table at the bottom of the Schedule NEC page and transfer the same total as capital gains on the relevant line on your 1040NR form.

If you were paid in bitcoin for work done as a self-employed person, this will count as personal services income – and you will need to report it on 1099-NEC.

It is important to know that you may not need to pay tax on any profit until you purchase something or sell your investment. When you do this, you will need to pay Capital Gains Tax.

Does the source of income matter?

Yes.

If you earned income from cryptocurrency from a US source you will need to pay tax on the amount of profit gained.

If you earned your cryptocurrency profit from a different country, you will not have a US tax liability but may have tax requirements in the country where the digital currency was bought and sold.

How can Sprintax help me?

In short, Sprintax can help you organize your tax responsibilities ahead of the US tax deadline.

If you are earning income from cryptocurrency, or from other types of investments, we will ensure that your income is properly declared to the IRS and that you don’t pay any more income than you need to.

Sprintax is the only online Federal and State self-prep tax software that is available for nonresidents in the US.

To get started, simply create your Sprintax account here.