Curricular Practical Training (CPT) is an excellent opportunity for F-1 students to gain practical experience in their field of study.

Although, one thing you might not have considered is the tax implications of CPT income as a nonresident in the US.

In this guide, we provide a comprehensive overview of what you can expect when it comes to CPT taxes.

What is Curricular Practical Training?

Curricular Practical Training (CPT) is a type of off-campus work authorization for F-1 students.

It allows students to gain practical experience directly related to their major or field of study.

CPT can be part-time or full-time and must be an integral part of the curriculum, such as an internship, cooperative education, or any other type of required practicum.

Authorization for CPT is provided by the Designated School Official (DSO) at your institution and must be completed before starting your employment.

Do I have to pay taxes on my CPT income?

Yes, CPT income is subject to federal and state income taxes.

The amount of tax you owe depends on your earnings and the tax rates applicable in the state where you work.

It’s important to have the correct amount of tax withheld from your paycheck to avoid any penalties or underpayment issues.

What is the tax rate for CPT students?

As an F-1 student on CPT, your income is taxed at the same rate as other US residents.

However, as a nonresident alien for tax purposes, you may not be eligible for the same deductions and credits as US citizens and resident aliens.

This can result in a higher CPT tax rate. It’s crucial to understand your tax obligations and plan accordingly.

Below are the tax rates for the 2024 tax year (taxes that will be filed in April 2025).

| Tax rate | 2024 TAXABLE INCOME BRACKET (Taxes filed in 2025) |

|---|---|

| 10% | Up to $11,600 |

| 12% | $11,601 to $47,150 |

| 22% | $47,151 to $100,525 |

| 24% | $100,526 to $191,950 |

| 32% | $191,951 to $243,725 |

| 35% | $243,726 to $609,350 |

| 37% | $609,351 or more |

Am I exempt from paying tax while on CPT?

While you are not exempt from federal and state income taxes, you are generally exempt from paying Social Security and Medicare taxes on your CPT income.

This exemption is based on your F-1 visa status and your nonresident alien status for tax purposes.

Be sure to inform your employer about this exemption so that these taxes are not mistakenly withheld from your paycheck.

If you are taxed incorrectly, you may end up paying too much in tax.

Alternatively, you could end up being undertaxed, which can potentially lead to future issues, such as visa/green Card rejections.

Prepare your tax return as an international student on CPT with Sprintax Returns

Are F-1 students on CPT entitled to a tax refund?

Whether you are entitled to a tax refund depends on several factors, including the amount of tax withheld from your paycheck and your total income for the year.

Essentially, if more tax was withheld than you owe, you could be eligible for a refund.

However, nonresident aliens are not eligible for certain tax credits and deductions that US citizens and residents can claim, which may impact the size of your refund.

Tax filing for CPT students

As an international CPT student, you must file Form 8843 and 1040NR.

You can use Sprintax Returns to prepare your tax return. The process is fast and simple. After answering a few questions, the system will estimate your personal circumstances, determine your residency status and prepare the tax forms that you need to file.

How can Sprintax help me?

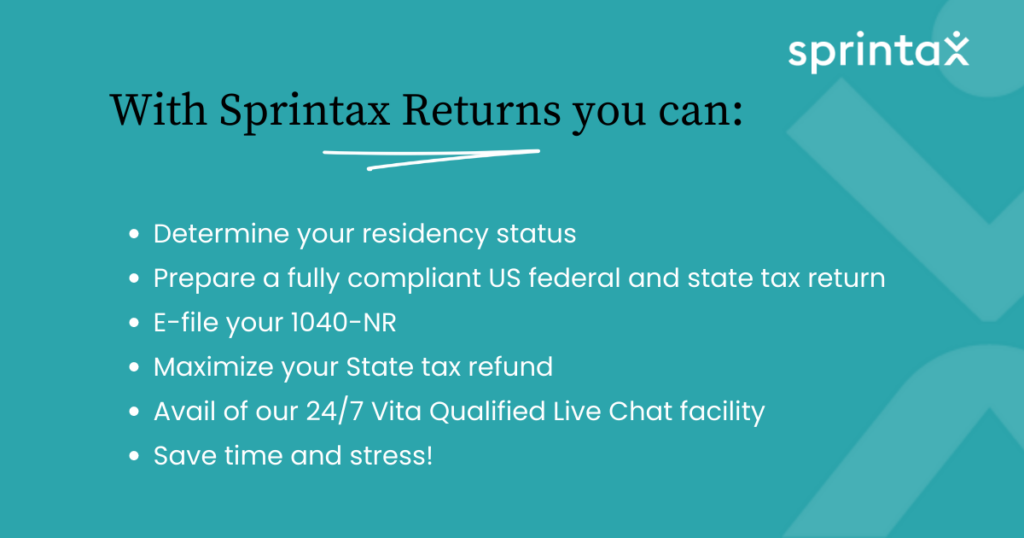

Sprintax Returns is a specialized tax preparation service designed to assist nonresidents, including F-1 students on CPT, with their US tax obligations. Here’s how Sprintax can help:

- Tax return filing: Sprintax provides clear instructions and support for understanding and completing all necessary tax forms, including Forms 8843, W-2, and 1040-NR.

- Compliance: We will strive to help you better understand your tax obligations and ensure you are compliant with US tax laws.

- Maximizing refunds: By accurately preparing your tax return, Sprintax helps ensure you receive any refund you are entitled to.

- 24/7 customer support: Sprintax offers customer support to answer any questions you may have throughout the tax filing process.

Using Sprintax can both simplify the tax filing process and give you peace of mind that your taxes are handled correctly and efficiently.

Prepare your tax return as an international student on CPT with Sprintax Returns

By understanding your tax obligations and utilizing the resources available to you with Sprintax, you can begin to get to grips with the US tax system!