Want to work while studying in the US? It’s important to be aware that tax rates differ greatly from State to State.

Every year, more and more students select the US as the destination in which they want to continue their education. And it’s easy to see why. The US boasts a world-renowned university system and an outstanding program offering in virtually all fields.

But with so many universities in such a vast country, how can students choose the college and course that is right for them?

The truth is that there are many different factors that go into deciding where to study and which college to attend. While lifestyle, history, and climate are always important elements for students, cost and financing college fees usually come out on top of their list of considerations.

Expenses and college fees vary from state to state and can have a big impact when choosing where to study.

Even though many US colleges and universities make financial aid and scholarships available, most international students must still rely on their own sources of funds in order to pay for their education – family funds, loans and savings etc.

It’s no surprise then that so many international students are interested in securing employment in the US during their time in college in order to earn some much needed cash.

Work & study programs for International Students

These programs are known as ‘work & study’. If you are a full-time student in the US and want to be a member of a work & study program, you must either have an F-1 or M-1 visa – the two non-immigrant visa categories available for international students.

Federal and State Tax obligations for International students

Every international student is legally obliged to file a tax return for each year they were in the US. If you worked in the US during your time in college you must detail your earnings on your tax return.

Many students are unaware that the State they choose to work in can affect their monthly tax withholding.

In the US, taxes withheld on wages by employers include Federal income tax, State income tax, and certain other levies by a few States.

While Federal tax withholding is required no matter which State you choose, not all States have an income tax on earned income. There are nine States that have no personal income tax:

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Note: Tennessee and New Hampshire only tax dividends and interest.

This means that if you chose to study and work in one of the States mentioned above, you will have one less tax deduction to worry about!

In other words, you can potentially receive a higher wage every pay period.

Entitlement to State tax refunds

If you do study and work in a State where there are State tax deductions, it’s important to note that it’s likely you’ll be entitled to a refund of a significant portion of your contributions.

You can claim your refund when you file your end of year state tax return.

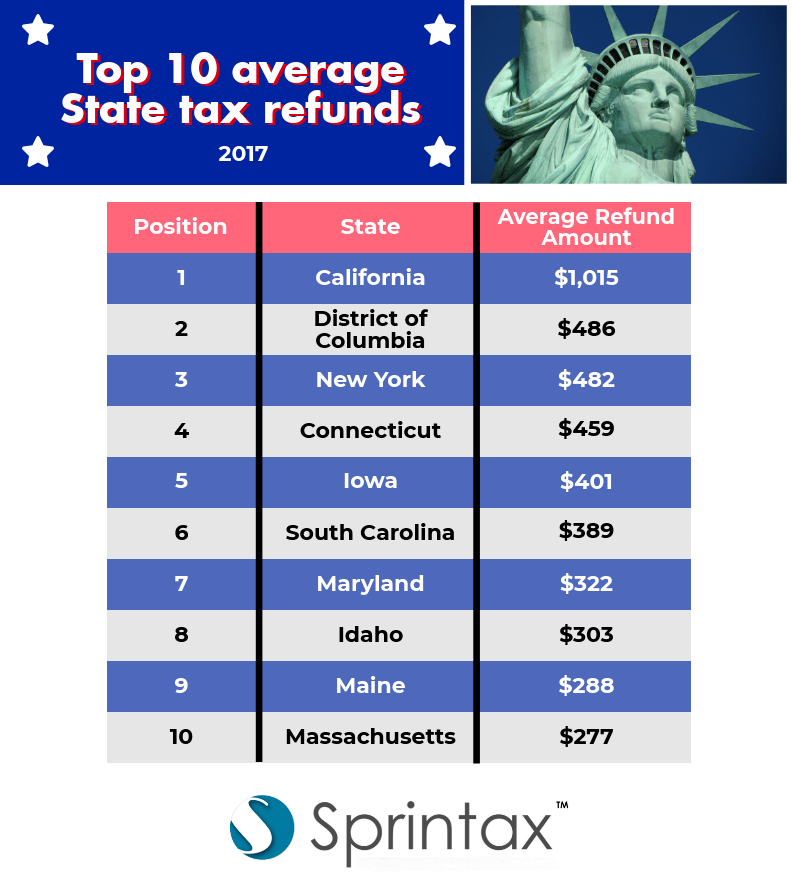

The State that you study in affects the amount of money you’ll be refunded.

At Sprintax we help hundreds of thousands of international students to file their tax returns and claim their State tax refund every year.

We’ve crunched the numbers and can reveal, as detailed below, that, in 2017, students who studied and worked in California received a larger State tax refund ($1015) than anywhere else in the US!

Prepare your State tax return with Sprintax

Top 10 average State tax refunds

Claiming your State tax refund

The easiest way to file your US tax return and claim your State tax refund is to choose Sprintax.

Sprintax is the only online Federal and State self-prep tax software for international students and nonresidents in the US. It will help you prepare your US tax return in minutes and enable you to receive your maximum legal tax refund!

Sprintax is the ‘go-to’ tax filing software for numerous major universities in the US including NYU, Columbia, Arizona State University, Illinois Institute of Technology and Cornell. We’re also the nonresident partner of choice for Turbo Tax.

To file your Federal and State tax return the easy way, get started here!