Need to file a US nonresident tax return from outside America?

Don’t worry. You’re not alone! Countless nonresidents face this very predicament every year.

Filing from outside the US can pose its own unique set of challenges. But, with some planning, organization and a little help from your friends at Sprintax, filing your documents can be easier than you think!

In this handy guide, we’ve got 5 top tips to follow if you’re filing your nonresident tax documents from outside the US.

1. File your 1040-NR early!

Firstly, even if you are outside the US you are still required to file your US tax documents with the IRS by the tax deadline.

Filing is one of the conditions of your visa. It’s also the law.

By not filing you risk being hit with fines and penalties. You may also jeopardize your future US visa or green card applications.

The deadline for filing 2024 US tax returns is 15 April 2025.

We recommend that you prepare your tax documents as soon as possible.

By preparing your tax documents early you can ensure that you receive your tax refund without delay.

If you are mailing your documents to the IRS from outside America, delivery times may take longer than what you would expect if you were mailing from within the US. This is why it’s a good idea to file your documents as soon as possible to ensure they reach the tax office on time.

Give yourself plenty of time to locate everything you will need in order to prepare your documents. This includes your:

- Passport

- form I-20 (F visa) or DS-2019 (J visa)

- SSN (Social Security Number) or ITIN (Individual Taxpayer Identification Number)

- Income documents (W2, 1042-S and/or 1099)

- Bank account information (if you are eligible for a tax refund)

Here’s how nonresidents can apply for an ITIN before tax season.

2. Figure out what you need to file

The type of tax forms you must file will differ depending on a number of personal circumstances including whether or not you earned income in the US.

In short, if you earned an income (this includes wages, tips, scholarships that cover living expenses and fellowship stipend) in the US, you must file a federal tax return – Form 1040 NR.

You may also need to file a state tax return in addition to your federal tax return, depending on the amount of income you earned and the state in which you received it. Each state has its own separate tax regulations.

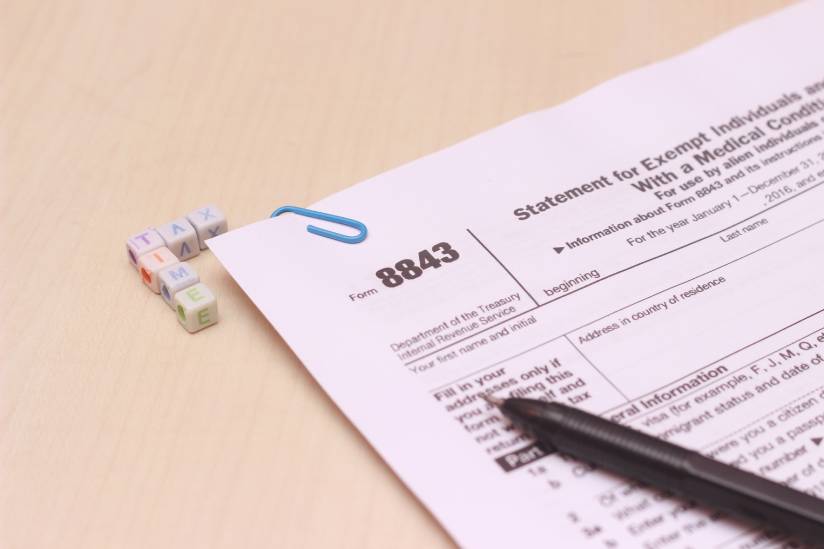

And even if you did not earn any US-sourced income, you must file form 8843. It is an informational statement required by the IRS for nonresidents for tax purposes. It should be submitted for every nonresident present in the US at any point during the previous calendar year, including spouses, partners, and children.

3. Use a registered delivery service

In order to file your tax forms, you will need to mail a hard copy of the completed documents to the IRS.

The first step is to print a copy of your completed documents. You will then need to sign the forms and mail them.

As you will be sending your documents from overseas, it’s always a good idea to use a registered mailing service.

This way you can track the delivery and enjoy peace of mind when your documents successfully reach their destination!

Note: With Sprintax, you can e-file your federal tax return directly with the IRS. No paperwork, no hassle. Just complete the easy-to-follow Sprintax questionnaire, and you’re good to go.

4. Keep your bank account open

You can choose to receive your tax refund either as a bank transfer, check or forward the amount to your next return.

However, every year countless nonresidents who file their tax documents from outside the US experience difficulties in accessing their tax refunds.

There are two common reasons for this.

Firstly, the IRS does not transfer tax refunds into overseas bank accounts.

And secondly, if you receive your refund as a check, you may find that banks in your home country will not cash them.

The solution?

By keeping your US bank account open after you leave you can ensure you have fast access to your tax refund after you file your return!

5. How to prepare your nonresident tax documents

You can always choose to prepare your tax return directly with the IRS.

The main advantage of filing on your own is that it’s free (aside from the mailing costs). The main disadvantage is that, by filing on your own, the burden of ensuring that your tax return is fully compliant will lie solely with you.

And, if you file an incorrect tax return you may be hit with fines and penalties. You may even jeopardize your future US visa or green card applications.

And it’s for this reason that many nonresidents seek help from Sprintax when preparing their tax documents.

We are the nonresident partner of choice for TurboTax and the only online federal and state self-prep tax software for nonresidents in the US.

When you create your Sprintax account you can:

- E-file your fully compliant federal return

- Prepare your state tax return and form 8843 online in minutes

- Claim your maximum legal tax refund

- Discuss your US tax questions with our Live Chat team anytime 24/7

Prepare your nonresident federal & state taxes here