(Last update: 19 Mar, 2025)

“Don’t worry if you made a mistake on your tax return or forgot to claim a tax credit or deduction. You can fix it by filing an amended return.” – The IRS

Made an error on your nonresident alien income tax return? Don’t worry, fixing it is not as difficult as you might think!

US tax can be tricky – especially if you’re a nonresident who is not familiar with the American tax system.

The Internal Revenue Service (IRS) knows the tax code is complex, and that people make mistakes.

A tax return can be considered ‘incorrect’ or ‘incomplete’ for a variety of different reasons. Simple things like forgetting to sign a form, to big issues like misreporting income, or incorrectly calculating a deduction can all affect the validity of a tax return.

While making a mistake on your return is not necessarily a big deal, it is important that you rectify the situation by filing an amended tax return, where appropriate.

If you realize that you made an error on a tax return you already filed, or you have come across new information (for example you received an additional W-2 or 1042-S), simply file an amended nonresident tax return to make a correction.

In this article we’ll cover:

- When you should amend your tax return;

- When’s there’s no need to;

- How to amend a tax return;

- Can I e-file form 1040-X?

- What happens after filing form 1040X

- Timelines for processing

Here are some key things you need to know in order to correctly re-do your taxes:

When to Amend a Tax Return That You Filed

When should you file an amended tax return?

The first thing you should know is that not all errors require an amended tax return.

You should amend your tax return if you need to:

1. Correct your income and tax figures

If you didn’t include all your payment documents when preparing your return, or if you receive additional tax documents for the tax year, you would need to file an amended tax return to report the additional income and tax.

For example, a Form W-2 arrives in the mail after the tax deadline, or you forgot to file it.

2. Claim all of the allowable tax deductions or tax credits

You should also amend your return to claim all of the allowable tax deductions, or tax credits that you did not claim when you filed your original return.

In previous years, there were a number of deductions that international students could use to reduce their overall tax liability.

However, in November 2017, President Donald Trump introduced a GOP tax reform bill, which brought widespread tax-related changes for most taxpayers.

3. If you need to correct your filing status

For example, if you filed as single but actually got married on the last day of the tax year, you will need to amend your return by filing your taxes under the appropriate status – married filing jointly, or married filing separately (note: nonresidents can file only as married filing separately).

4. Correct the number of dependents you claimed

An amended return will be needed if a taxpayer wants to claim additional dependents, or has claimed ineligible dependents, and needs to adjust the exemptions amount.

The general IRS rule states that a nonresident alien, whether single or married, may claim only one personal exemption, as long as they are not claimed as a dependent on any other US tax return (in which case their personal exemption was already used).

There are some exceptions to the general rule which allow specific groups of taxpayers to claim dependent exemptions for their family members:

- Residents of Canada or Mexico

- Residents of the Republic of Korea

- Residents of India

5. If you filed the wrong form for your tax return, or you filed under the wrong residency status

If you are considered a nonresident for tax purposes in the US, you should file form 1040NR.

If you filed form 1040 instead of 1040NR, this means you filed as a resident and your tax return is incorrect.

NOTE: Keep in mind that most of the online tax filing solutions like TurboTax and H&R Block do not support NRA tax returns. If you filed online, most certainly you filed as a resident alien.

What if I accidentally filed form 1040, instead of Form 1040NR?

Nonresidents who file their tax returns with form 1040 (which is for US citizens and residents) instead of the return for nonresidents (Form 1040NR) may claim credits or take deductions to which they are not entitled.

This means their tax return will be inaccurate and they could get into trouble with the IRS later on. This is another case when you will need to amend your tax return.

6. You received the CARES Act stimulus payment and you were not entitled to it

Stimulus payments were handed out in 2020 and 2021 in response to the COVID-19 pandemic, when the US government has introduced the CARES (Coronavirus Aid, Relief and Economic Security) Act. The CARES Act provided a number of financial supports that could be claimed by US citizens, permanent residents, and residents for tax purposes.

Nonresident aliens are not eligible to receive this stimulus.

If you believe that you have received this payment in error, it is likely that you should file an amended tax return and also return the payment to the IRS (the payment should be sent separately to your amended return).

You should also send a cover note with your amended tax return to outline why you are returning the payment.

If you realize that you need to make one or more of the corrections listed above use Form 1040X (Amended US Individual Income Tax Return) to amend the federal income tax return that you previously filed.

Need a hand filing your amended nonresident tax return? Start here

When Not to Amend a Tax Return That You Filed

In some cases, you don’t need to edit your tax return after filing.

The IRS usually corrects math errors when processing your original return, without the need for you to file further paperwork.

If you didn’t include a required form with your return, the IRS will write to you to request the missing item so that they can finish processing your tax return.

When you receive a notice about errors, there will usually be other ways to correct errors besides an amended tax return.

Usually, these misunderstandings can be quickly rectified by providing the correct information to the IRS. The notice that you receive will explain clearly what the issue is and how to respond.

How do I amend my federal and/or state tax return?

In order to amend your tax return you must:

- File a form 1040X

- Correct the errors on your previous tax return

It’s important to note that once you have sent off your tax return, you can no longer edit that specific return.

It’s very important to note that you should not attempt to correct the situation by filing another original Form 1040NR return. That will confuse things further and may cause additional headaches for you. If you want to amend your federal tax return, you will need to file a Form 1040-X, Amended US Individual Income Tax Return, even if you filed your original return only a few days ago.

You won’t have to correct the entire tax return, just outline the necessary changes and adjust your tax liability accordingly.

Your state will use a unique form to amend your tax return (Schedule X for California, for example) which you will need to attach to your federal state return.

Below we will show you how you can easily fill out 1040x tax form online and amend your tax return with Sprintax!

How to amend your tax return in 4 easy steps using Sprintax Returns

We’ve also prepared a step by step guide to amending your nonresident tax return with Sprintax:

Step 1

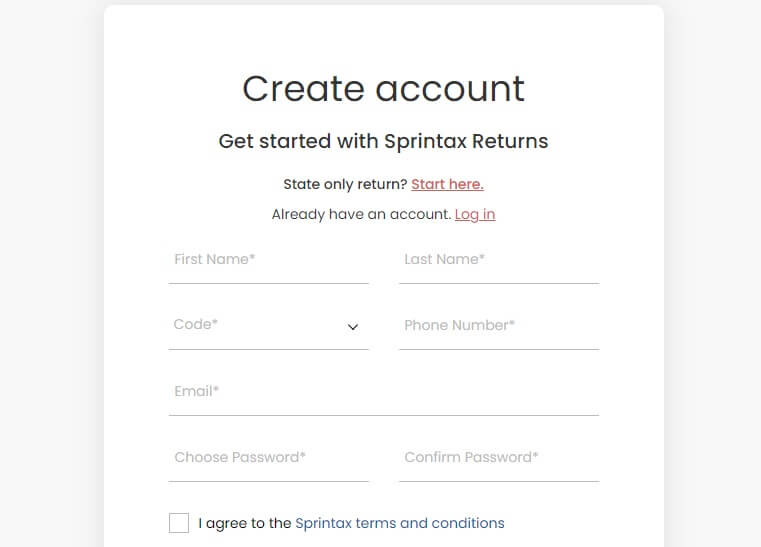

To begin the process of amending your tax return, all you need to do is login to your Sprintax account (or create one if you haven’t already!).

Step 2

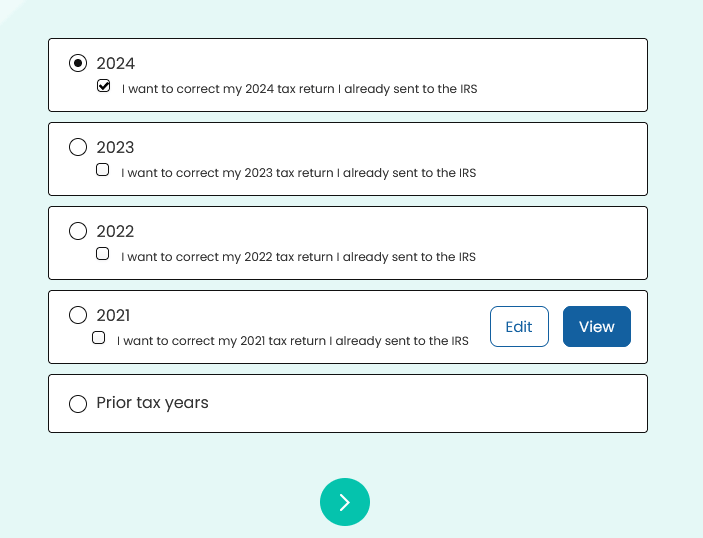

You will be asked to select the tax year that you would like to amend. Be sure to tick the box that says “I want to correct my 2024/2023/2022/2021 tax return I already sent to the IRS.

Step 3

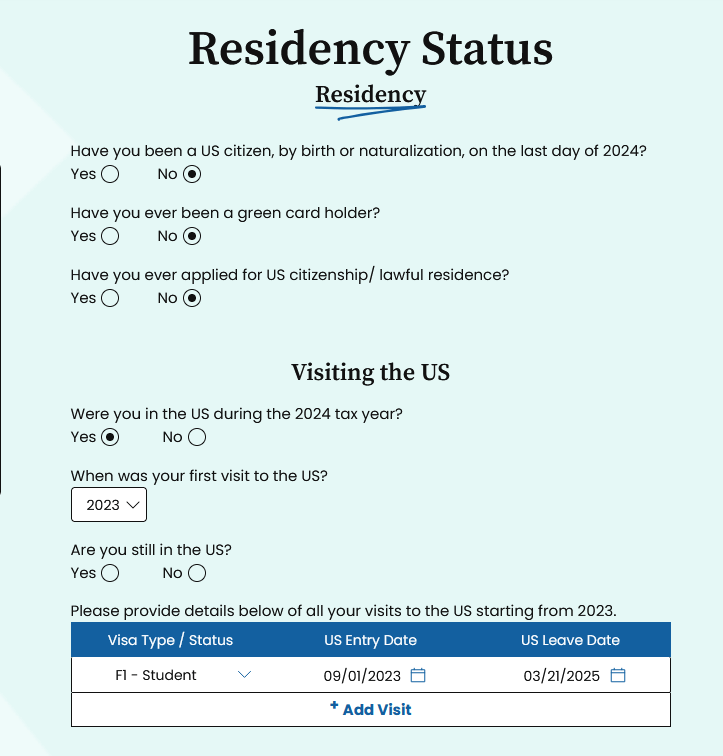

You will then need to complete a questionnaire, where you will be asked for some information including your residency for tax purposes and your income for that specific tax year.

Next, you will be asked if you filed your return to the IRS for this tax year. If the answer is ‘yes’ you will need to outline what tax form you sent.

You will need a copy of your original tax form in order to complete Step 3.

Step 4

Once you complete this step you will arrive at the checkout.

Sprintax will crunch the numbers and prepare your amended tax return which you will then need to print, sign and mail to the IRS.

It really is that easy!

And remember, if you have questions about how to amend your tax return, our Live Chat team are available 24/7 to support you!

Can nonresidents e-file an amended tax return with Sprintax?

No, you can’t file your amended tax return electronically with Sprintax. Amended returns can be prepared using our service but you will have to file by paper.

Once you complete the form, you’ll have to mail it to the IRS along with all the required supporting documents.

The normal processing time for form 1040X is between 8 and 12 weeks from the time the IRS receives your tax return.

If you are amending for more than one tax year, you will need to file Form 1040X for each tax year separately.

Many people find the prospect of dealing with the IRS and amending their tax return to be quite daunting.

If that sounds like you, amend your nonresident tax return the easy way with Sprintax!

Can I amend a tax return from 5 years ago?

In short, no.

The IRS only accepts amended tax returns that are dated within three years of when you filed the original return (or two years after the exact date you paid the tax for that year, whichever is later).

You will not be able to claim a tax refund from anything over this period.

If you owe the IRS money from this period, you should make a cheque out to them and post it.

What Happens After You Amend Your Tax Return

1. If you are claiming an additional tax refund

If you are filing an amended tax return to claim an additional refund, you’ll have to wait until you have received your original tax refund before filing a Form 1040X. Amended returns take up to 12 weeks to process.

You may cash your original refund check while waiting for the additional refund.

Also, you generally MUST file the amended return within three years from the date you filed your original return, or within two years after the date you paid the tax (whichever is later) in order to get the extra refund.

2. If you owe additional taxes

If you owe additional taxes, file Form 1040X and pay the tax as soon as possible to minimize interest and penalties. If your amended return shows you owe more tax than you reported on (and paid with) your original return, you’ll owe additional interest and probably penalties too.

Even though you might be amending a return from one or two years ago, the due date for your original return and for payment has already passed. The IRS may not penalize you for a small mistake, but it sure will collect some interest on the proper amount you didn’t pay on time in the first place.

The sooner you correct the error, the less interest you’ll pay.

The penalty for filing late is usually no more than 5% of the total unpaid taxes for every month that a tax return is late.

If you are penalized, it will start accruing the day after the tax filing deadline and will not be more than 25% of your unpaid taxes.

How long will my amended tax return take to process?

According to the IRS, it can take up to 16 weeks to process the 1040x once it is received.

How to check an amended tax return status

The IRS Where’s My Amended Return? tool allows you to follow the processing stages of your amended return from receipt until completion.

You can track if your return is in received, adjusted, or completed status.

How long does it take to get a refund from an amended tax return?

There is no set time that an amended tax refund will take to get to you, so you usually just have to be patient.

Calling the IRS will not speed up the processing of your amended tax return.

Is amending a tax return a red flag for the IRS?

You may be concerned that amending a tax return could trigger a tax audit.

Thousands of people have to amend their US tax returns each year, so don’t worry about whether you’ll receive an audit due to your amended tax return.

As long as you provide the IRS with the required information on your amended tax return, everything should be fine.

Need help correcting your nonresident tax return? Fill out form 1040X easily online with Sprintax!