J-1 visa taxes explained – the ultimate US tax return guide for J-1 visa holders

Tens of thousands of people flock to the US on J-1 student visas each year.

Every J-1 participant has a tax filing requirement, it’s the law!

Many J-1 visa holders are confused by the often tricky US tax jargon. However, it’s not as bad as it seems, and knowing even a little about your filing requirements can go a long way!

With this in mind, we’ve created a blog post that will answer some common queries from J-1 participants in the US!

Table of Contents:

- Do J-1 visa holders pay tax?

- Residency for tax purposes

- How to file a J1 visa tax return

- J1 Tax forms

- J-1 visa tax exemptions

- Tax treaty benefits

- Can J-1 visa holders claim dependents?

- Where to mail tax return

- Can J-1 file a joint tax return if you’re married

- Claim a J1 tax refund

- Direct deposit for J1 tax refund

- How to speed up my J1 tax refund

- Need help with your J1 tax return?

- Can I e-file my J-1 visa tax return?

- Tax treaty FAQs for J-1s

Do J-1 visa holders have to pay taxes in the US?

One of the most common questions we receive is: “are J-1 students exempt from taxes?”.

J-1 holders in the US have to pay tax on any US-sourced income they receive during their stay in the US.

How much tax you will pay will depend on a number of factors, such as how much you earn, the rate of tax in your state, and if your country of residence has a tax treaty with the US.

There are different J-1 visa tax rates, depending on factors such as your income.

All non-residents must pay 10% on any income tax up to $11,600 (2024 Tax Brackets).

If you earn more than this amount on your J-1 program, you must pay 12% in income tax on the amount between $11,601 and $47,150.

As nonresident aliens, J-1 participants must pay federal, state and local taxes.

J1 visa holders will be taxed on:

- Wages and compensation

- Salaries

- Tips

- Interest

- Dividends

- Some scholarships/fellowship grants

- Prizes/awards

Determining your U.S. tax residency status on a J-1 visa

It’s vital to determine your residency status in order to file a compliant tax return.

Most J-1 visa holders in the US are considered nonresident aliens for tax purposes. This is determined by what’s known as the substantial presence test, which is used by the IRS to decide whether an individual who is neither a US citizen nor a US permanent resident should be taxed as a US citizen or a nonresident alien for a specific year.

The difference between the two is that US citizens are taxed on their worldwide income while nonresident aliens have to report only their US-sourced income.

When you prepare your tax return with Sprintax, our software will determine your residency status based on the information that you provide.

Complete the Substantial Presence Test for free with Sprintax.

How do I file my J-1 tax return?

The 2024 deadline for filing your US tax return is 15 April. Every J-1 program participant has a tax filing obligation.

If you earn income in the US, you must file a tax return. It’s hugely important that you file correctly when completing your tax return. Failure to file or filing a non-compliant tax return can lead to fines or penalties. It can also jeopardize your future US visa green card applications.

When preparing your US tax documents you will need:

- Passport

- US entry and exit dates for current and all previous visits

- All tax forms you’ve received (including Forms W-2, 1042-S, and/or 1099, etc.)

- Visa/immigration status information-Form DS

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

The 1040NR can be particularly confusing for nonresidents to complete, so it’s important to take your time and follow the instructions. It’s important to remember that many of the boxes on the form won’t apply to you and the majority of the information required is your personal information, earnings, amount of tax you paid, and the amount you are to be refunded (if this is applicable to you).

J-1 visa holders can prepare and e-file form 1040NR with Sprintax stress-free.

Simply create an account to get started.

File my nonresident tax return

I have a J-1 visa. Which forms do I have to fill out?

1. If you received a US source income

If you have received US-sourced income during the year then it is extremely likely that you will need to file ‘Form 8843’ and ’Form 1040NR’ to complete your tax return.

You will be required to enter your name, current address, and social security number (SSN) or IRS individual taxpayer identification number (ITIN) as well as other general personal information.

Form 1040NR is your US tax return and you can file it along with a copy of your W2 at the end of the tax year.

If you earned US-sourced income you will also need to send off a Form W2 ‘Wage and Tax Statement’ or 1042-S form ‘Foreign Person’s U.S. Source Income Subject to Withholding’ with your tax return. This is an IRS tax document used by your employer to report wages paid to employees and the taxes withheld. It is divided into state and federal sections and there are fields with employer information and details of income. Your employer must complete a Form W2 or 1042-S and they will send it to you typically by 31 January.

2. If you did not receive a US source income

If you are in the US and had no US-sourced income then you will still need to file a Form 8843 “Statement for Exempt Individuals with a Medical Condition”.

You can prepare your nonresident alien tax documents online with Sprintax.

Are there any tax exemptions for those on a J-1 visa?

There are certain tax exemptions for J-1 visa holders.

As a nonresident, you will be exempt from certain taxes, such as Social Security and Medicare (FICA tax). Your country of residence will also have a bearing on what taxes you will pay, as you may be entitled to tax treaty benefits. It is important to note, as a nonresident J-1 participant, it is illegal for you to claim American Opportunity Tax Credit (AOTC).

Are there different exemptions based on whether you are a J-1 student, teacher, or trainee?

No, the exemptions are the same. Currently, the only deduction if there is no tax treaty entitlement, which is available to all J-1 participants if the deduction for state and local taxes they paid during the year, capped at $10,000.

These also apply to J-2 visa holders. These visas are given to spouses and dependents of J-1 visa holders.

How much tax will you pay?

For the 2024 tax year onwards, all nonresidents must pay 10% in income tax up to $11,600. And if you earn more than this amount on your J-1 program, you must pay 12% in income tax on the amount between $11,601 and $47,150.

Can I deduct my J-1 visa renewal fee on my tax return?

No. Unfortunately, any costs associated with J-1 visa applications are not eligible as tax deductions.

Can J-1 visa holders avail of tax treaty benefits?

Most J-1 participants (for example work & travel and au pairs) can’t avail of tax treaties.

However, students, teachers, researchers, scholars and treasurers can avail of certain tax treaties if they meet the requirements.

Claiming dependents on your J-1 tax return

Citizens of Canada, Mexico, and South Korea and J-1 students and trainees from India who use the India-US tax treaty are allowed to claim their dependents on the 1040NR form.

The US has income tax treaties with various foreign countries, which may affect your tax filing if your country of residence is included in them. For nonresident aliens, these treaties can often reduce or eliminate U.S. tax on various types of personal services and other income. This can range from anything such as pensions, interest, dividends, royalties, and capital gains.

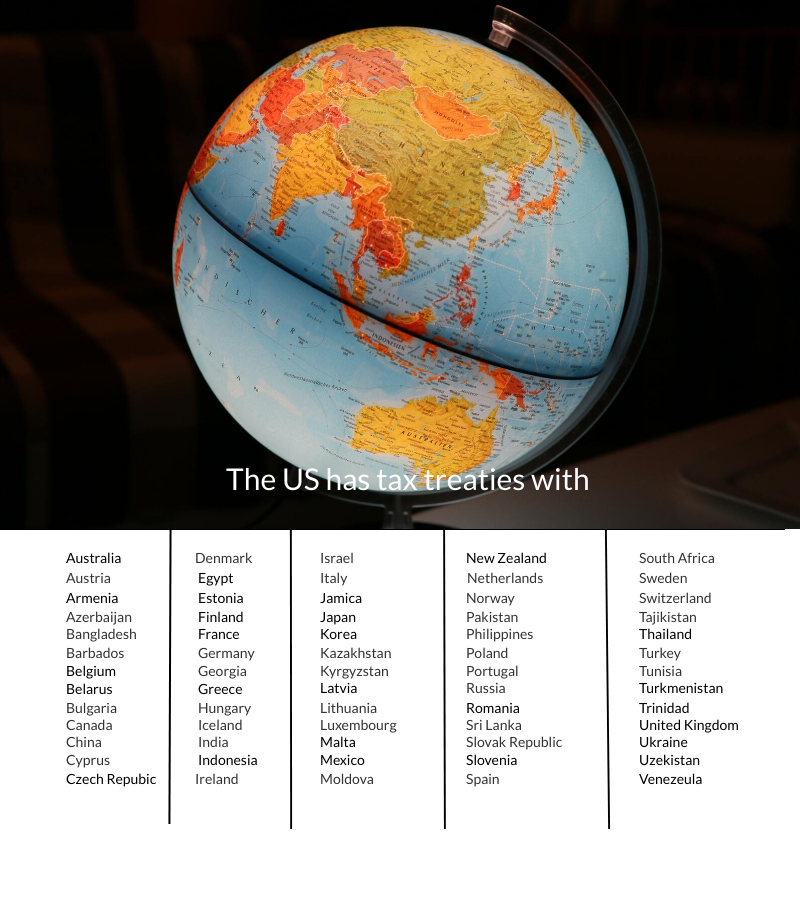

The below countries shaded in dark blue have a tax agreement in place with the US:

The US has tax treaties with each of the following countries:

Usually, for students, apprentices, and train on J-1 visas, the benefits of the tax treaties are applicable for 4-5 years. For teachers and professors, the limit is around 2-3 years.

If your country does not have a tax treaty with the US or the treaty doesn’t cover the type of income you earn, then you must pay tax on this income.

Learn more about:

- India – US tax treaty

- Germany – US tax treaty

- South Korea – US tax treaty

- Spain – US tax treaty

- Mexico – US tax treaty

- Venezuela – US tax treaty

- Portugal – US tax treaty

Where do I send my J-1 tax return form?

The address you send your relevant tax forms will depend on where you stayed during your time in the states.

In general, you will send your tax forms to the Department of the Treasury Internal Revenue Service in whichever state you were in. You should check the IRS website if you are still unsure where to send your forms.

Not filing a tax return

If you don’t file your tax forms after your J-1 program, you may be subject to penalties and interest.

The late filing penalty is 5% of the additional taxes owed amount for every month your return is late, (up to a maximum of 25%). If you file more than 60 days after the due date, the minimum penalty is $485 (after 31 Dec, 2023) or 100% of your unpaid tax, whichever is less.

Failure to comply with your tax obligations may also result in you being denied a US visa in the future.

Filing a joint J1 tax return when married

Nonresident aliens who are married cannot choose to file married filing jointly under any circumstances. They should always file separate returns even if they have the right to claim dependents.

Dependents may be claimed on only one of the returns of the spouses. See section “Can you claim dependents on your J-1 tax return?” above for more details.

Can J-1 and J-2 visa holders file jointly?

J-1 and J-2 visa holders cannot choose to file their taxes jointly. That’s due to the fact that nonresidents in the US can not file their taxes together.

Also read: J-2 Visa Holders Comprehensive tax guide

How much tax do J-1 visa holders get back?

There are many reasons why a J-1 participant may be due a tax refund.

That’s why it’s always a good idea to file your tax return and check how much you can claim.

In fact, the average federal J-1 tax refund is $665.

What’s more, you may also be entitled to a state tax refund – depending on the state in which you lived and worked.

Sprintax can help you to determine if you’re due a US tax refund.

How do I claim J-1 tax refund?

Many J-1 international students are entitled to claim refunds on both federal and state taxes. You can do this by filing your tax return.

Doing it by yourself can often be stressful, but Sprintax makes claiming your J-1 tax refund easy!

Easily prepare your tax return with Sprintax – the online tax filing software for nonresident aliens.

How long does it take to get a direct deposit for a J-1 tax refund?

Exact timelines are determined by the IRS and are different for each refund, so it is difficult to put an exact timeline on your refund. The tax return processing time for paper tax returns is estimated at 4-6 weeks from the moment when the tax return is received by the IRS. You should allow a further 1-2 weeks for mailing.

Do you get your taxes back faster with direct deposit?

The length of time for processing paper tax returns is the same as it is online. However, receiving a direct debit is faster than cashing a cheque in your bank.

Can I speed up my J-1 tax refund?

Yes, if you file before the 15 April 2024 deadline, your 2023 tax return is likely to be processed faster than if you were to leave it to the last day.

This is due to the volume of tax returns that will need to be processed when the deadline comes.

Who can help me with my J1 visa tax return?

Sprintax is the nonresident partner of choice for TurboTax and the only online federal and state self-prep tax software for nonresidents in the US.

By creating a Sprintax account you can easily prepare fully completed and compliant form 1040NR (nonresident alien tax return) and form 8843 tax documents.

Sprintax will also help you to claim your maximum legal tax refund.

With Sprintax you can:

- Save time and stress!

- Determine your residency status

- Prepare a fully compliant US tax return

- E-file form 1040-NR (eligibility criteria)

- Maximize your State tax refund

- Avail of our 24/7 Live Chat facility

Prepare your J1 tax documents with Sprintax today

Can I e-file my J-1 visa tax return?

Every year, Sprintax helps many J-1 participants to E-File their federal tax return.

To find out if you are eligible to E-File your taxes, check out our guide to E-Filing here.

If you’re not eligible to E-File, Sprintax can help you to file a paper tax return instead.

To get started, simply get started or login here.

What does the ‘Tax Cuts and Jobs Act’ mean for J-1 students?

The ‘Tax Cuts and Jobs Act’ has wide ranging effects for all US taxpayers – but particularly for those venturing to the States to study, for an internship or to work and travel.

As most of these changes were activated in January 2018, it’s vital that all nonresidents understand their US tax obligations and entitlements.

The primary change for nonresidents relates to what’s known as the ‘personal exemption‘.

Prior to the bill’s introduction, every nonresident who was working in the US was entitled to a personal exemption of $4,050. In other words, if you were working in the US on a J-1 visa in 2017 you could earn up to $4,050 without paying tax. The personal exemption was also the main means that nonresidents could use to get their Federal tax refund.

However, as of 1 January 2018 (and up to 2025) the personal exemption was reduced from $4,050 to $0. The removal of the personal exemption means that overall taxable income has increased for all nonresidents.

It’s important to note that these amendments do not affect the 2017 (and previous) tax return filing season. So, if you were working in the US on a J-1 visa in 2017, you can still avail of the personal exemption.

Tax treaties – other Frequently asked questions

Article 21(2) of the India-US Tax Treaty

Article 21(2) of the India-US Tax Treaty allows international students from India on a J1 visa to claim Standard Deductions in Form 1040NR.

The US has had a tax treaty with India for many years.

One of the many benefits of this treaty is the lack of double taxation, allowing an Indian citizen to avoid being taxed in both India and the US. This minimizes the amount of tax paid on the same income.

How is the tax treaty between Germany and the USA relevant for J-1 holders?

There are two different paragraphs in the Germany tax treaty document covering J-1 visitors. One paragraph is related to teachers and visiting professors which exempts them for 24 months from the date of arrival in full income for teaching and research if they are invited to the US on a program for no more than 2 years.

The other paragraph allows full-time students at US universities, academic and business trainees to claim $9,000 per year for four years if they are paid for personal services (employment) in the US. They are also entitled to full exemption of tax on scholarships and grants they receive from US educational institutions.

How is the tax treaty between South Korea and the USA relevant for J-1 holders?

This tax treaty agreement contains many sections which are relevant to J-1 visa holders from South Korea.

For example, J-1 participants who travel to the US for training, study or an internship will be exempt from tax on their first $2,000 in earnings for five years.

Meanwhile, those that are in the US as a participant in a US Government sponsored training, research, or study program can be exempt from tax on the first $5,000 – $10,000 (depending on length of course) of earnings from these activities.

Lastly, if you have been invited (either by the US Government or a recognized educational institution) to come to the US as a J-1 teacher, researcher, professor or scholar for a period of no more than two years in order to teach or take part in a research project, income generated from these activities will be exempt from tax.

Why is the tax treaty between Spain and the USA important for J-1 visa holders?

Under the Spain – US tax treaty, J-1 visa holders who are in the US as a student, research grant recipients, or trainee are exempt from tax on scholarship/grant income (if they meet all other conditions of the tax treaty) and up to $5,000 personal service income for a period of five years for students and two years for other individuals.

Note; this tax exemption does not apply to income from research which is not conducted in the public interest.

How is the tax treaty between Mexico and the USA relevant for J-1 visa holders?

The Mexico – US tax treaty ensures that Mexican citizens are not taxed twice on income they earn during their J-1 in the US.

Mexican J-1 visa holders are generally liable to pay US tax on the income earned during their time in the US and they must also file a tax return with the IRS.

However, J-1 visa holders can also receive dependent personal services (employment) income free of tax provided they stay in the US for less than 183 days and the payment is made by a Mexican employer.

The treaty also allows for a tax reduction on royalty income. When availing of this benefit, royalty income will be taxed at a reduced rate of 10%.

Can J-1 visa holders from Venezuela claim any tax treaty benefits when earning income in the US?

Under the Venezuela – US tax treaty, J-1 visa holders who are in the US as a student, research grant recipient, or trainee are exempt from tax on income received from scholarship or grant (if they meet all other conditions of the tax treaty) or personal services (up to $5,000) for a period of five years for students and two years for other individuals.

Meanwhile, teachers and researchers (research scholars) are also exempt from income tax for their first two years in the US. However, in order to claim these treaty benefits, visa holders must not be in the US for longer than five years.

Note; this tax exemption does not apply to income from research which is not conducted in the public interest.

The tax treaty also states that income earned from copyright royalties should be taxed at no more than 10%.

Does the Portugal – US tax treaty contain any benefits for J-1 visa holders?

Portuguese citizens who are in the US on a J-1 visa at the invitation of the US Government or a university (or other accredited educational institution) or recognized scientific research institution or as part of an official cultural exchange program for the purpose of teaching or carrying out research are entitled to a tax exemption for their first two years in the US.

In addition, individuals who are in the US for the purpose of study or training will be exempt from tax on their scholarships/grant income and up to $5,000 dependent personal service (employment) income. The exemption lasts for their first five years for students and two years for trainees.

Meanwhile, the treaty also states that if Portuguese J-1 visa holders receive royalty income during their time in the US, this income will not be taxed at a rate higher than 10%.