The W-8 forms can be challenging for nonresidents to navigate.

However, understanding these forms is essential, particularly if you plan to earn income in the US.

To make things easier, we’ve compiled all the essential details about W-8 forms in this helpful guide.

Let’s dive into what the W-8 forms are used for and why they’re important!

What is a W-8 Form and what is it used for?

The purpose of a W-8 Form is to gather information from nonresident taxpayers and allow nonresidents to claim any benefits from tax treaties their home countries have with the US.

Typically, nonresidents are taxed at a 30% rate on income earned from US sources. However, the W-8 forms help nonresidents lower this tax rate if a tax treaty exists between their country and the US.

Without a completed W-8 form, nonresidents are subject to the full 30% tax rate, even if they qualify for a lower rate through a treaty.

W-8 vs W-9 forms – what’s the difference?

The W-8 and W-9 forms serve different purposes and apply to different groups of people.

While W-8 Forms are used by nonresidents only, W-9 Forms are used by US citizens, permanent residents, and businesses to provide their taxpayer identification information to employers, banks, or other financial institutions.

The W-9 form is not associated with any tax treaty benefits, as it is only for US taxpayers. It is commonly used for contractors, freelancers, and vendors who need to report their income for US tax purposes.

So, in summary, W-8 forms are for nonresidents who may qualify for tax treaty benefits, while W-9 forms are for US taxpayers.

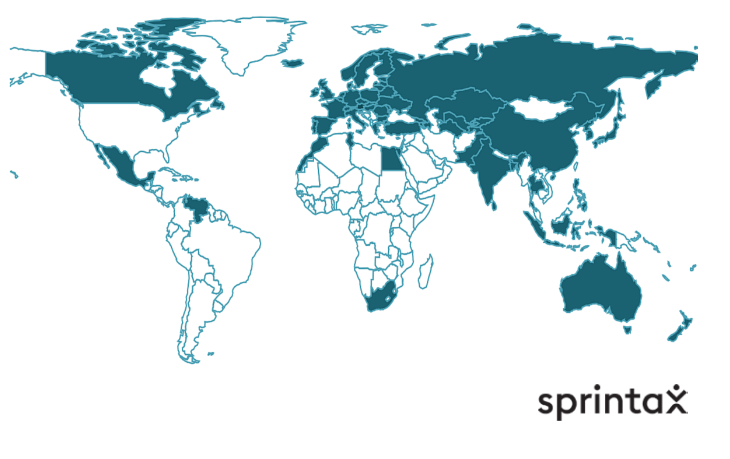

Which countries have tax treaties with the US?

The US has tax treaties with over 65 countries, aimed at preventing double taxation and lowering tax burdens on residents of treaty countries who earn income in the US.

Some countries with US tax treaties include Canada, the United Kingdom, Germany, India, Japan, and South Korea.

These treaties allow residents from these countries to benefit from reduced tax rates on certain types of income, like wages, scholarships, and investment income.

For example, a student from Germany may qualify for a lower tax rate on their US-based income, or even a complete exemption in some cases.

Eligibility varies by country and income type, and individuals must file a W-8BEN form (for individuals) or W-8BEN-E form (for entities) to claim these benefits.

Sprintax can help determine if a tax treaty applies to your situation and guide you through the process of claiming treaty benefits!

Who needs to complete W-8 forms?

W-8 forms are required for nonresident aliens who work in the US or earn income from US sources. Some foreign businesses will also need to complete W-8 forms.

There are five types of W-8 forms, each with specific purposes:

W-8BEN

For individuals to claim tax treaty benefits and reduce tax withholding.

This is the most commonly used W-8 form. Read more about form W-8BEN here.

W-8BEN-E

The W-8BEN-E is similar to the W-8BEN but instead of individuals, it is used by entities, such as businesses, to claim tax treaty benefits.

Read more about form W-8BEN-E here.

You can complete forms W-8BEN and W-8BEN-E online with Sprintax Forms

W-8ECI

This is used to file for income that is effectively connected with a trade or business in the US.

W-8EXP

For foreign governments, tax-exempt organizations, and certain other foreign entities to claim tax exemption.

W-8IMY

For intermediaries, partnerships, and other entities that receive income on behalf of others.

Do I have to complete a W-8 Form?

That depends.

In many cases, a W-8 form will be required for nonresidents if they receive income from US sources.

This form serves as a declaration to the IRS that the individual or entity is a nonresident taxpayer and is therefore subject to different tax rules compared to US residents.

When is the W-8 Form not required?

A W-8 form may not be necessary for nonresidents who do not have any income or financial transactions connected to the US, or if their income is exempt from withholding.

In short, if you’re a nonresident in the US earning income from US sources, filing a W-8 form is crucial to ensure proper tax treatment and avoid higher withholding rates.

When and where should I file a W-8 Form?

Nonresidents should submit their W-8 forms before receiving any income from a US source in order to ensure the correct withholding tax rate is applied.

Typically, this means providing the form to the US payer or institution that will be making the payments, such as an employer, university, or financial institution.

It’s essential to complete and submit the form in advance, as failing to do so may result in automatic withholding at the standard 30% rate, even if you qualify for a lower rate under a tax treaty.

For example, students and scholars should submit their W-8 form to their university or payroll department if they are receiving a stipend, scholarship, or wages.

W-8 Form validity period

Once submitted, W-8 forms are generally valid for three years. However, if there are changes to your residency status or other relevant information, you may need to complete a new form.

Who can help me with my taxes?

Sprintax Forms can help you!

Here are some examples of what we can offer you:

- Online generation of forms, such as W-8BEN, W4, 8823, and more!

- Tax residency determination – ensuring you are paying the right amount of tax

- Our software will apply every tax treaty benefit you’re due

Ready to simplify your tax paperwork?

Whether you need help with W-8 forms, tax treaty benefits, or nonresident filing, Sprintax has you covered.

Get started today to make sure you’re compliant, save on taxes, and avoid unnecessary withholdings!