Preparing tax forms for your nonresident employees can be a time-consuming and complicated process.

After all, when preparing tax documents there are different rules to follow for nonresidents than there are for residents.

Coupled with this, each nonresident is taxed differently – depending on their personal circumstances and their country of residence.

At the end of each tax year, nonresidents will need a number of different forms when they sit down to file their tax documents. The forms they need depend on the income they earned.

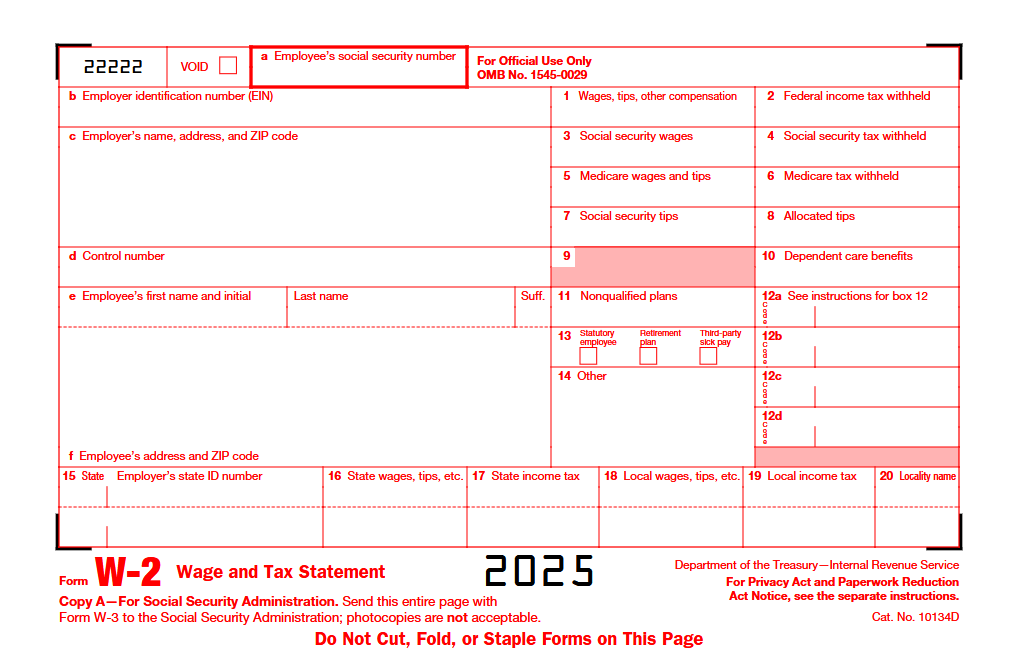

The W-2 is one of the most common forms that nonresidents require during tax season.

And in this guide we will discuss how to prepare W-2 forms if you employ nonresidents at your organisation.

Table of Contents Show

What is a W-2 form?

The main purpose of a W-2 (Wage and Tax Statement) form is to report wage and salary information along with other taxes withheld from the paycheck of the employee.

After receiving their W-2 form, the employee will also know if they can expect a tax refund or if they will have to make an additional tax payment.

When are W-2 forms due?

You should provide a filled out W-2 form to your employee by 31 January.

You must send the employee the W-2 form on or before 31 January to ensure that the employee has more than enough time to file income taxes before the tax deadline of 15 April.

Therefore, you will need to provide the employee and the IRS copies of the worker’s W-2.

You can give the employee their W-2 in person, or alternatively send them it via email or mail.

How to prepare a W-2 form

There are several things you will need to know before you begin to prepare a W-2 form for your employee.

It’s important that you gather this information in time, however.

You will need to have information for both the employee and the employer on hand.

What information is needed for W-2 form?

To create W-2s for your employees, you will need to include your Employer Identification Number as well as the employee’s name, address, Social Security Number and details of their wages.

Other information necessary to correctly fill out a W-2 form includes:

- The name of your business, the address, EIN (Employer Identification Number) and state ID number

- Total figures for wages, tips and other compensation

- Total figures for taxes

See below an image of a W-2 form for more information on what you will be asked for.

Can I fill out a W-2 form online?

Yes. You can use Sprintax Calculus to create W-2 forms for your nonresident employees.

Sprintax Calculus has been developed specifically with the goal of helping organizations to manage the tax withholding of their nonresident employees.

In fact, with Sprintax Calculus, your Payroll Department can easily manage the tax profiles of your nonresident employees all-in-one place, through a user-friendly dashboard.

Our software will enable your team to report the correct amount of tax from US payments to nonresident students and scholars as well as workers who are being paid scholarships, wages and stipends.

Sprintax Calculus can help you efficiently prepare W-2 forms for all of your employees, generating them in a matter of seconds and keeping them in a secure online location.

Great! But how does Sprintax Calculus work?

Login anywhere, anytime to manage your nonresident employees.

We will help you with the following common problems, and more:

Not sure who is a nonresident for tax?

Sprintax Calculus carries out residency tests for your employee

Having trouble preparing important tax forms?

Our software automatically generates key forms including – 1042-S, W-4, W-8BEN and more.

Not sure if the employee can claim a tax treaty?

Sprintax Calculus applies all relevant tax treaty benefits and reliefs to each employee.

Why Sprintax Calculus?

- Safe and automated tax solution based on the cloud

- Residency and tax treaty eligibility determination.

- Calculation of tax withholding rates

- Generation of key tax forms in a matter of seconds

- Simple to use admin & dashboards.

- Advanced Reporting tools