The camp counselor program allows you to share your culture and ideas while working in a camp setting in the US.

To take part in the camp counselor program, you need a J-1 cultural exchange visa. This visa allows non-immigrant aliens to temporarily live in the US to participate in the summer camp.

Generally, J-1 camp counselors are considered nonresidents for tax purposes. You must fill out important tax documents when you arrive at the camp, and your camp director can help you with this.

Relevant documents

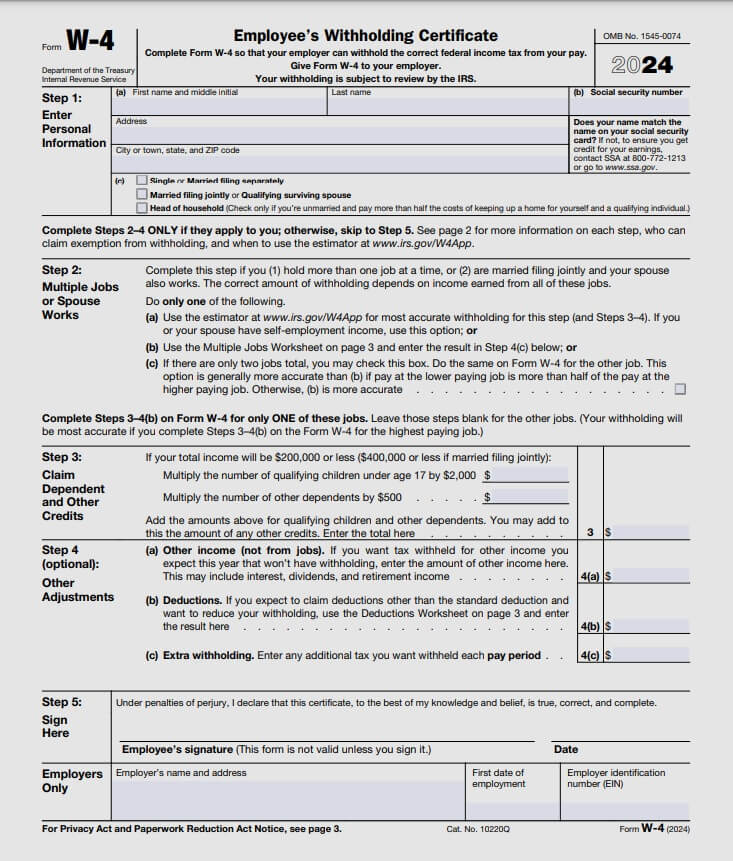

You are required to fill out Form W-4 when you start working as a camp counselor. This allows the IRS to calculate the correct amount of tax to be deducted from your income and your employer will withhold this amount from your paycheck.

Federal W-4

This determines how much federal income tax will be deducted from your wages. Everyone pays federal tax.

State W-4

States also have withholding information tax forms similar to the federal W-4. Your employer will provide you with any state forms you require to be completed on your behalf.

What you will need to fill out a W-4 form

Federal and State W-4 Forms both ask for the same information. The instructions to fill out the W-4 form on the back of the form is for residents only.

You can see the instructions on a separate document on the IRS website. We have also outlined them below to help you.

On the form, some information will be needed:

- Enter your personal information and Social Security number (SSN) in Step 1.

- Whether you are single or married filing separately in step 1(c)

- You don’t need to fill out step 2 unless you have more than one job.

- Only certain nonresident aliens should fill out Step 3.

- Nonresident aliens from Canada, Mexico, South Korea, or India may be able to claim the child tax credit or the credit for other dependents.

- Step 4 is optional.

Sprintax Forms can help you easily prepare a compliant Form W-4!

Using Sprintax Forms means you can quickly have your employment tax forms generated specifically for you. We’ll also identify your tax treaty eligibility and calculate your residency for tax purposes! Check out Sprintax Forms here.

Camp counselor tax obligations

The following taxes will be deducted from your pay while you are a camp counselor in the US:

Federal income tax

You will pay federal income tax depending on what your taxable income is.

There is no personal exemption amount for nonresidents in the US, so any nonresident earning income must pay 10% tax on it up to $11,600.

The 2024 tax brackets are (for taxes filed by 15 Apr, 2025):

| Income | Tax rate |

|---|---|

| $0 to $11,600 | 10% |

| $11,601 to $47,150 | 12% |

| $47,151 to $100,525 | 22% |

| $100,526 to $191,950 | 24% |

| $191,951 to $243,725 | 32% |

| $243,726 to $609,350 | 35% |

| $609,351 or more | 37% |

State income tax

43 states in the US have state income taxes. The nine states which don’t collect income tax are:

- Alaska

- Florida

- Nevada

- New Hampshire (tax investment income and not wages)

- South Dakota

- Tennessee (tax investment income and not wages)

- Texas

- Washington

- Wyoming

State income tax is a fixed or graduated rate on taxable income. The rate you have to pay depends on the state you are in. We recommend checking this before you decide where you want to go on your J-1!

Local or city income tax (if applicable)

16 states have city taxes, and counties can impose their own individual income taxes, as well as federal and state income taxes. Local tax is typically non-refundable, except for New York.

The states with local income tax are:

- Alabama

- Arkansas

- Colorado

- Delaware

- Indiana

- Iowa

- Kentucky

- Maryland

- Michigan

- Missouri

- New Jersey

- New York

- Ohio

- Oregon

- Pennsylvania

- West Virginia

As a nonresident you will not pay Social Security & Medicare tax (FICA) and Federal unemployment tax (FUTA). If you notice that one of these taxes is being paid from your wages, contact your camp director about it.

Taxable income

The income you earn in the US is taxable and your employer will withhold some of your wages for tax purposes.

Any tips you receive while working is considered taxable income, and is subject to federal income tax.

You must report tips you receive if they are over $20 per month. You should inform your employer in writing of how much you made in tips by the tenth day of the following month. The tips and your wages will be on your W-2.

If you receive cash for doing other jobs over the summer, it is taxable income.

What is a W-2?

A W-2 form is a summary of your total earnings and any taxes that were withheld. Your camp will send you a W-2 Form by 31 January of the filing year.

Tax filing requirement

Camp counselors are required to file a US federal and state tax return at the end of the year. If you fail to file your US tax documents before the deadline of 15 April 2025, you may face penalties and fines and also jeopardize your future US visa applications.

Check out this guide on what to do if you missed the tax deadline.

How to file your US tax return from summer camp

Every J-1 participant must file a federal tax return. You may also be required to file a state tax return, depending on your circumstances. You can check which forms you must fill out for your state tax return here.

You will need to file Form 1040NR for your federal tax return.

Documents you need to file this are:

- Passport and visa

- SSN

- W-2 Form

- Entry and exit dates

- DS-2019 Form

When do I need to file my tax return?

The US tax year is the same as the calendar year, it runs from 1 January to 31 December.

The federal tax deadline for filing 2024 tax returns is 15 April 2025.

Get help with your Camp counselor tax return

You can easily prepare your Camp Counselor tax documents online by using Sprintax Returns.

All you have to do is create a Sprintax account and complete our easy online questionnaire!

With Sprintax you can:

- Save time and stress!

- Determine your residency status

- Prepare 100% IRS compliant US federal & state tax documents

- Maximize your US tax refund

- Avail of our 24/7 Live Chat service

FAQs

Can Camp Counselors get a tax refund?

Yes, you may get a J-1 tax refund for some of the taxes that were withheld from your wages. The amount of tax you can claim back depends on a number of personal circumstances including:

- Your visa

- Your income

- Entitlement to tax treaty benefits

- The state you worked in

- How long you were in the US

Are camp counselors independent contractors?

Generally no. However, it depends on your job description. The IRS decides if you are an employee or independent contractor. Independent contractors in the camp environment include services like pool service companies, construction contractors or independent consultants.

Can I avail of a tax treaty?

A tax treaty is an agreement between the US and another country that allows you to claim back tax you paid while working abroad. If you’re a resident of a country that has a tax treaty with the US, you may be taxed at a reduced rate or exempt from US tax on certain income earned within the US.

Sprintax always checks if you’re eligible for an international tax treaty when preparing your US tax return.

How can I be a camp counselor?

If you are looking for an organization that coordinates such summer camps, you can check out the following:

Tax Tips for Students with a Summer Job

- Fill out a W-4 form once you get a job

- You MUST file a US tax return if you’re on a J-1 visa

- You should file your summer camp counselor tax return before the deadline to avoid any fines and penalties

- To claim your J-1 tax refund, you’ll need your W2 Form or final cumulative payslip and social security number/ITIN number

Sprintax can help nonresidents to e-file their federal tax return and prepare their state tax return.