Tax season can be a difficult time for nonresidents in the US. After all, you are filing taxes in an unfamiliar country!

However, it’s not all bad – Sprintax is here to help!

And while filing your taxes may seem like a big job, you can make the job easier by breaking it down into smaller tasks.

Step one is to gather all of the income forms and documents you will need in order to file your return.

In this blog post, we’ll cover how to get the forms you’ll need to file your taxes.

What documents will I need to file my nonresident tax return?

It’s hugely important you know how to correctly file your tax return.

By not filing correctly, you leave yourself open to fines and penalties from the IRS. You can also have trouble with future Green Card or visa applications.

However, once you get familiar with your tax documents, it’s usually smooth sailing!

What you’ll need:

- Your Passport

- All U.S. entry and exit dates for current and previous visits

- Any tax forms you received (Form W-2, 1042-S and/or 1099, etc.)

- Visa/Immigration status information, including Form DS-2019 (for J visa holders), Form I-20 (for F visa holders)

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- If you are using Sprintax for State Tax Return(s) preparation only, you will need a copy of your already prepared Federal Tax return

Read more:

W-2

Form W-2 (Wage and Tax Statement) is used in order to report all of the necessary wage and salary information along with other taxes withheld from the paycheck of the employee.

You’ll receive your W-2 form from your employer – and once you do you’ll know if you can expect a tax refund or if you will have to make any additional tax payments.

Your employer should provide you with Form W-2 on or before 31 January each year – as an example you should receive a W-2 form by 31 January 2025 for the year that ends on 31 December 2024.

They will fill the form out for you, and it will include:

- Business name and the address, EIN (Employer Identification Number) as well as state ID number

- Total amount of wages, tips and any other compensation

- Total amount for taxes

If you have not received this document by the end of January, be sure to contract your employer right away to request it.

Forms 1099

You will likely need to fill a Form 1099 if you earned any income that wasn’t employee salary. The form is usually used in order to report any rental income or for services for which you have been paid.

Depending on how you made your money – there are three different types of 1099’s that report the different types of income you earned throughout the year – 1099-NEC, 1099-DIV, and 1099- INT.

1099-NEC

The 1099-NEC will record any income you received if you worked as an independent contractor or as a self-employed person.

Your clients will issue you with this form if they have paid you at least $600 that year.

You can read more about your tax obligations as a self-employed nonresident here.

1099-DIV

You will be given a 1099-DIV form so that you can report any dividends and distributions from any investments you made during the year. You will need to file the form when doing your taxes.

1099-INT

You may receive a 1099-INT form if you have other forms of investments such as interest payments.

You’ll receive the form from the relevant financial institution.

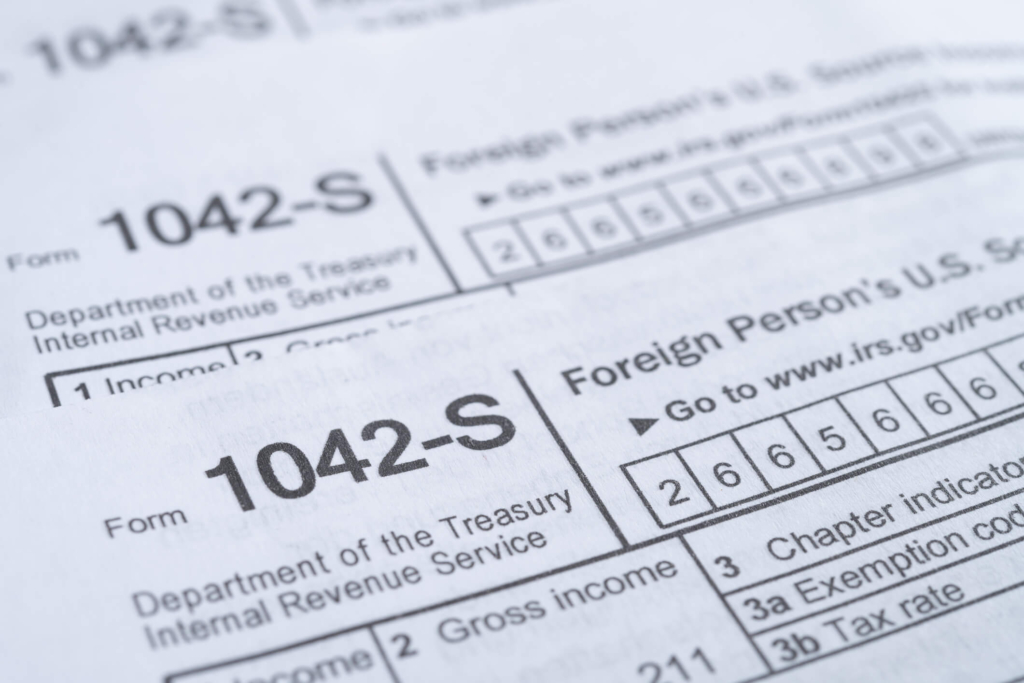

1042-S

Form 1042-S (Foreign Person’s US Source Income Subject to Withholding) is used in order to report payments made to nonresidents in the US.

Essentially, it allows institutions to report payments to a foreign person.

Both forms 1042-S as well as 1042 (Annual Withholding Tax Return for US Source Income of Foreign Persons) are forms that relate specifically to payments to any nonresident or other foreign persons.

A 1042-S is filed on your behalf and submitted to the IRS.

The deadline for filing Form 1042-S falls on 15 March of the next tax year.

It will be filed for you by your university or employer/business, therefore you should request a copy of your 1042-S if you have not received it by 15 March.

Any scholarship, personal service income, and royalty payments will need to be filed on the 1042-S.

You should receive a copy of your 1042-S once it is completed and filed.

SSN

SSN stands for Social Security Number.

You’ll need a SSN for many things, such as being able to work and file your taxes!

That’s why securing an SSN should be at the top of your priorities when entering the US. To secure it, you’ll need personal documents such as a Birth Certificate Passport, and Green Card.

Once you have your visa that allows you to work in the US, you can apply at your nearest Social Security Office.

A simple search will help you find the nearest one to where you live.

Nonresidents can fill out their SSN application easily online with Sprintax Forms.

ITIN

Another key document you’ll need is an ITIN (Individual Taxpayer Identification Number).

An ITIN is essentially a tax processing number that is given to you by the IRS.

If you don’t qualify for an SSN and think you will receive a taxable scholarship, fellowship or grant income you will need to apply for an ITIN.

It’s possible to apply for an ITIN at any stage of the tax year. However, it can sometimes take up to 2 months or even longer to obtain an ITIN, so you should apply for it as soon as you can.

You’ll need to submit a Form W-7 i.e. “Application for IRS Individual Taxpayer Identification Number,” along with a completed US tax return.

The good news?

Sprintax can guide you all the way through the process of applying for your ITIN!

To get started, simply register at Sprintax Forms here.

If you’re applying for an ITIN alongside your tax return, create your Sprintax Returns account.

Deadlines

You should file your tax return by the deadline of 15 April (this date may change to accommodate holidays or weather conditions).

The deadline for filing 2024 tax returns falls on 15 Apr 2025.

How can Sprintax Returns help me?

Sprintax Returns can help prepare both Federal and State tax returns, ensuring you receive your maximum legal US tax refund!

What’s more, if you did receive income in the US without having an ITIN or SSN, we can assist you in obtaining an ITIN and file your federal tax return.

We offer a 24/7 Live Chat service and our team is happy to assist you with your tax questions at any time.

Sprintax was created specifically for international students, scholars, teachers and researchers and other nonresident aliens in the US on F, J, M and Q visas, to make tax prep easy and ensure they are fully compliant with the IRS tax rules.

Prepare your nonresident federal and State tax return easily online.

Start my nonresident tax return

![IRS form 8843 instructions [2025]](https://blog.sprintax.com/wp-content/uploads/2025/01/How-to-file-form-8843-Instructions-380x220.jpg)