Getting to grips with US tax forms is important for when tax season rolls around.

One of the most important forms that nonresidents should know about is Form W-8BEN.

It’s crucial to have a good understanding of this form – especially if you intend to earn income while in the US.

So, with that in mind, we have gathered everything you need to know about Form W-8BEN into this guide!

Table of Contents

- What is a W-8BEN form?

- Who needs to fill out Form W-8BEN?

- Claiming tax treaty benefits

- Is Form W-8BEN required?

- How to fill out W-8BEN

- How long is a W-8BEN valid?

- When and where to submit W-8BEN

- When not to use Form W-8BEN

- Should I file Form 8823 or a W-8BEN?

- Should I file Form W-9 or W-8BEN?

- What is the difference between W-8BEN and W-8BEN-E?

- Form W-8BEN or W-8ECI

- What happens if the company files incorrectly on my behalf?

- Sprintax Forms can help you complete Form W-8BEN easily online

What is a W-8BEN form?

Form W-8BEN is officially known as the “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).”

It is used by nonresident aliens to claim an exemption or reduction of US withholding tax if their home country has a tax treaty with the US.

The usual rate of withholding tax is 30%. Form W-8BEN’s purpose is to reduce or eliminate this withholding tax payment.

Essentially, if you fail to complete a W-8BEN form, you can expect to be taxed at a rate of 30%, even if your home country has a tax treaty with the US!

Who needs to fill out Form W-8BEN?

If you are a nonresident receiving income (except personal services income) in the US, you should fill it out.

Nonresident aliens pay US tax at a rate of 30% on income earned from US sources.

However, if you are from a country which has a double taxation treaty with the US, you can avail of a reduced tax rate.

To avail of this, you must fill out a Form W-8BEN.

You can complete form W-8BEN online with Sprintax Forms

Claiming tax treaty benefits

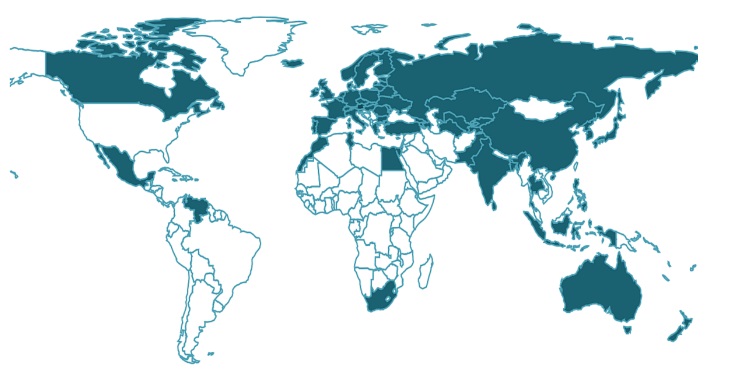

The US has more than 65 open tax treaties with countries around the world.

Whether you’ll be able to claim a tax treaty benefit will depend on a number of factors, including:

- The visa you’re on

- Type of income you received

- What you are being compensated for

- The type of organization that is paying you

You can find out more about tax treaties here.

Is Form W-8BEN required?

Yes, Form W-8BEN must be provided to the withholding agent by nonresident aliens to certify their foreign status and to claim a reduced rate of withholding tax under an income tax treaty (if applicable).

Without this form, the default withholding tax rate on income earned in the US is 30%.

How to fill out W-8BEN

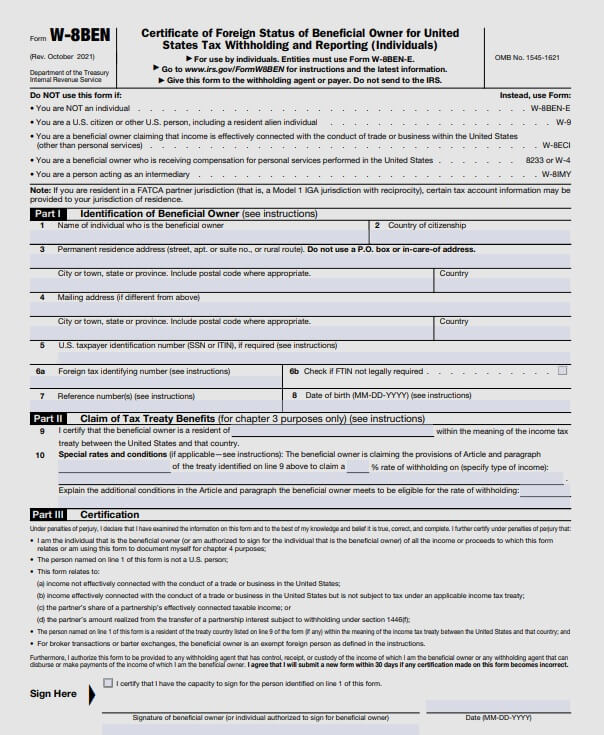

Below, you can see a copy of a W-8BEN.

W-8ben instructions

You can download Form W-8BEN online.

When filling out the form, in section one you will be asked for some straight-forward information such as your name, country of citizenship, mailing address and your SSN/ITIN.

In section two, you will be asked about your tax treaty benefits with your home country.

You should always check to see if you have any applicable benefits rather than assuming that you do.

In section three, you will be required to sign the form to state that all of the information provided is correct.

You can complete form W-8BEN easily online with Sprintax Forms.

How long is a W-8BEN valid?

That depends.

Provided none of your details on the form change, your W-8BEN should be valid for up to three calendar years after the completion date.

For example, if you completed a W-8BEN form on 28 March 2024, it will be valid until 31 December 2027.

When and where to submit W-8BEN

Technically, you do not file W-8 forms with the IRS.

Form W-8BEN will be sent by the organization that is making payments to you.

It should then be returned to the company that sent it to you, not the IRS. You won’t need to file it with a tax return.

When not to use Form W-8BEN

Residents in the US should not file Form W-8BEN.

Instead, residents should file Form W-9.

Also, you shouldn’t complete form W-8BEN to outline personal service income.

Should I file Form 8823 or a W-8BEN?

Which form you need to file depends on your income type.

Form W-8BEN should be completed for any income that isn’t deemed personal services income while an 8233 is completed to outline personal services income.

Another difference between the W-8BEN form and Form 8233 is that the withholding agent should submit form 8233 to the IRS.

Should I file Form W-9 or W-8BEN?

Form W-9 is used by US citizens and resident aliens to provide their Taxpayer Identification Number (TIN) to report their income to the IRS.

Whereas, Form W-8BEN is used by nonresidents who earn income in the US to claim tax treaty benefits.

What is the difference between W-8BEN and W-8BEN-E?

One key difference between W-8BEN and form W-8BEN-E is that the second is for ‘entities’, entities here meaning any type of business or other type of institution that has more than one owner. They may be corporations, partnerships, exempt entities, foundations – public and private, international organizations and even foreign governments.

Money received by foreign businesses is also taxed at a 30% rate in the US. Much like the W-8BEN, this form will allow the business to receive a tax treaty deduction if applicable.

Foreign businesses will have to complete this if they earned the same income as listed above.

In truth, there are a few similarities between the two forms, for example the layout and details requested on both of these forms are similar.

Form W-8BEN vs Form W-8BEN-E

The key difference between the two forms is that W-8BEN applies to income from individuals or single owner entities like independent contractors and sole proprietors and the W-8BEN-E is for income from entities.

Essentially, Form W-8BEN is only for individuals, while entities are required to fill out Form W-8BEN-E.

Form W-8BEN or W-8ECI

Form W-8ECI, is also known as a “Certificate of Foreign Person’s Claim for Exemption That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States.”

If you are a foreign alien with US sourced income that is connected to a trade or business in the US, you may file Form W-8ECI to get an exemption from the 30% withholding tax on this income, which is known as ‘Effectively Connected Income’ (ECI).

The exemption applies to income which is effectively connected with a US business or trade, hence the name W-8ECI, which stands for ‘Effectively Connected Income.’

Whereas, Form W-8BEN is used by nonresident aliens to claim tax treaty benefits.

What happens if the company files incorrectly on my behalf?

This is a relatively common occurrence, so you shouldn’t panic if it happens.

If this happens, you can simply file a tax return in the US (Form 1040-NR) along with Form 8833 to outline that you are in fact applicable for a treaty.

You should receive a tax refund on any overpayments you may have made shortly after this.

You can also choose to file Form 1040-NR with a tax expert such as Sprintax Returns!

When you use our service, you can finally rest assured you’ll be 100% tax compliant.

Sprintax Forms can help you complete Form W-8BEN easily online

Are you unsure how to complete W-8BEN form? Sprintax Forms can help you!

We can offer you:

- Online generation of forms, such as W-8BEN, W4, 8823, and more!

- We’ll easily determine your tax residency status thus ensure you are paying the right amount of tax

- Our software will apply every tax treaty benefit you’re due

Our service was created in order to make tax prep easy and ensure our users are fully compliant with the IRS tax rules.