As the tax season approaches, it’s essential to stay informed about the forms and documents that can significantly impact your tax return.

One such crucial document is Form 1095-A, particularly important for those who have enrolled in a health insurance plan through the Marketplace.

In this blog post, we’ll explore how to obtain a 1095-A tax form, understand its implications on your taxes, and outline how Sprintax can simplify the entire process!

What is Form 1095-A?

Form 1095-A, also known as the Health Insurance Marketplace Statement, is sent by the Marketplace to individuals who have enrolled in a qualified health plan.

It provides essential details about the coverage, including the premium amounts paid and any premium tax credits received.

It will essentially show you:

- The number of advance payments of the premium tax credit that you received

- Your health coverage by month

- Other details about your health insurance

How to get Form 1095-A

Most individuals will receive Form 1095-A in the mail from the Marketplace. You should receive the 1095-A by mid-February.

One of the most common 1095-A questions we receive is: Can I get Form 1095-A online?

Well, the answer here is that it is often available electronically on your online Marketplace account.

Ensure that your contact information is up-to-date to receive the form promptly.

If you face delays or encounter issues with receiving Form 1095-A, don’t hesitate to contact your insurance provider or the Marketplace directly.

They can provide assistance and guidance on obtaining the necessary documentation for tax filing.

How does Form 1095-A affect my taxes?

Form 1095-A is instrumental in determining your eligibility for premium tax credits.

These credits can significantly reduce the overall cost of your health insurance premiums, making healthcare more affordable.

Form 1095-A also plays a critical role in calculating your final tax liability. It helps ensure that you receive the correct tax credits and deductions related to your health insurance coverage, preventing any inconsistencies in your tax return.

What are premium tax credits?

Anyone who pays tax and purchases health insurance through a Health Insurance Marketplace, either for themselves or others in their family, may be eligible to apply for the premium tax credit.

This tax credit is aimed at those with low/moderate income, as it helps make purchasing health insurance coverage more affordable.

If you are eligible for this credit, you should either receive it as an advance credit or claim it as a refundable credit on your tax return.

There are a couple of things to keep in mind if you receive the “advance premium tax credit”.

If you are not due a tax refund, you must simply pay any balance to the IRS. However, if you were due to receive more support through this credit, you can add it to your refund.

How to include 1095-A information with your nonresident tax return

The easiest way to include the information from your 1095-A is to use Sprintax Returns!

So, you have created an account with Sprintax Returns, but how do you include the information from Form 1095-A on our platform?

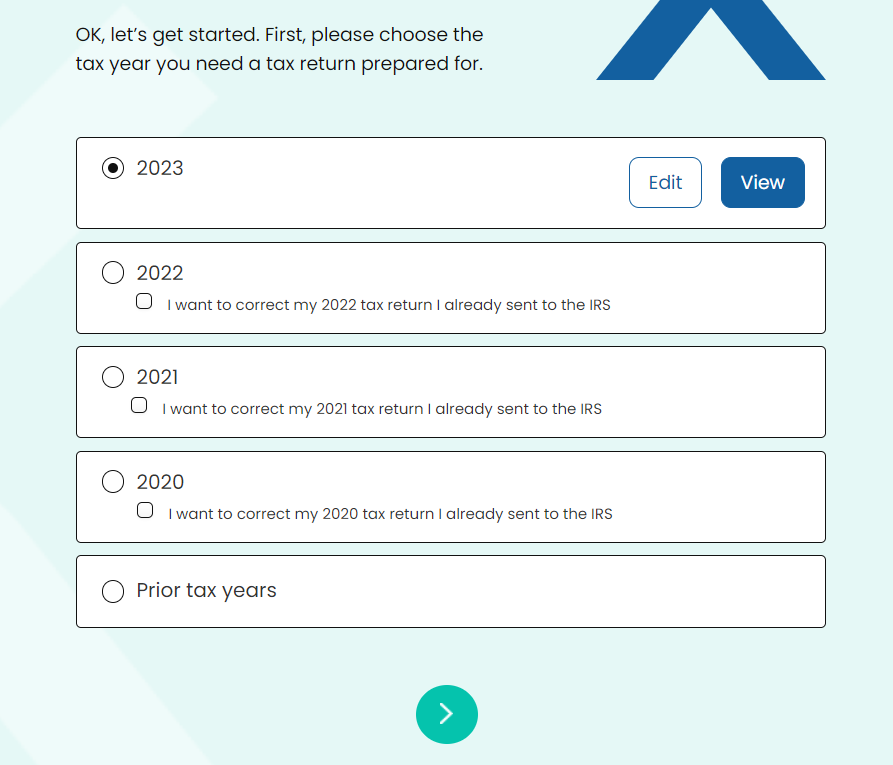

Step one: Firstly, you will need to choose the correct tax year for the form.

If you were present in the US in 2023, you will choose 2023 here.

Remember, you can also amend tax returns from previous years if needed.

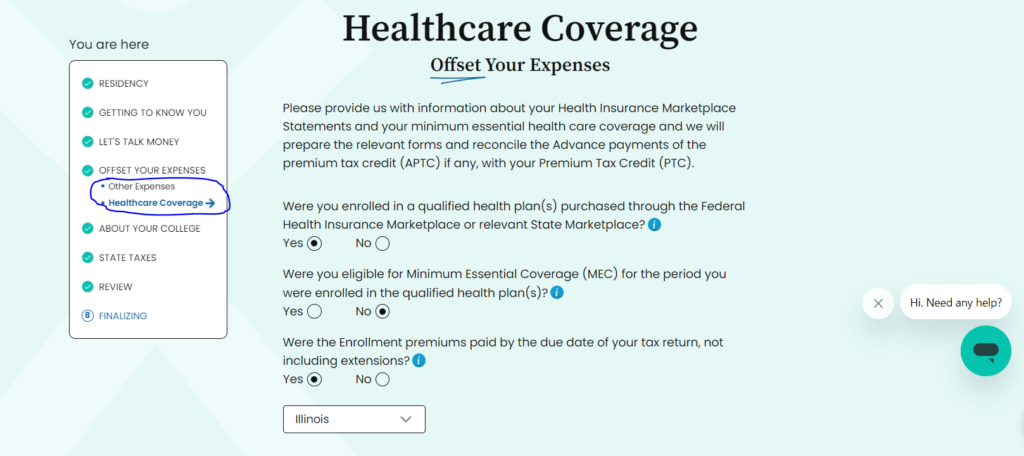

Step two: For the next step of including your 1095-A information, you will need to locate the ‘Offset Your Expenses’ section on the left-hand side of the home screen.

Here, you will see an option that says, ‘Healthcare Coverage’.

Click this Healthcare Coverage link to be re-directed to the 1095-A section.

After answering a couple of straightforward questions, you will be brought to the 1095-A section of Healthcare Coverage.

In this first part, you will need to answer some more questions related to your personal situation.

While some of the questions may be straightforward, some may require you to know some in-depth details on your policy.

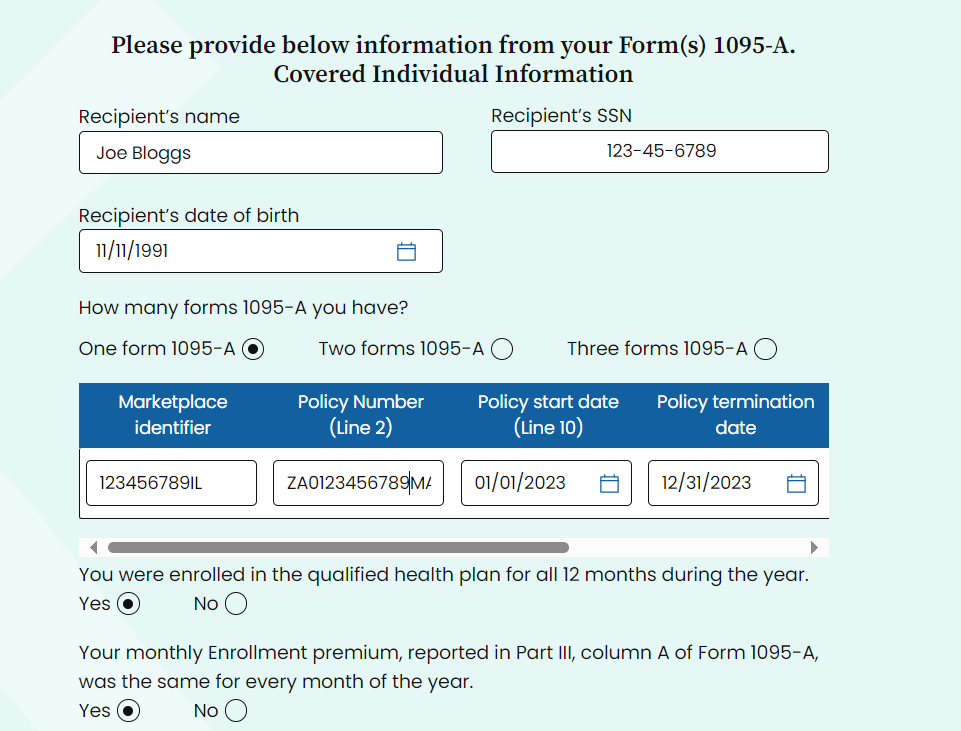

For example, you will need to know the following:

- Marketplace Identifier

- Policy Number

- Policy start date

- Police Termination date

- Coverage start date

- Coverage termination date

Once you have answered these, you will be brought to the final section.

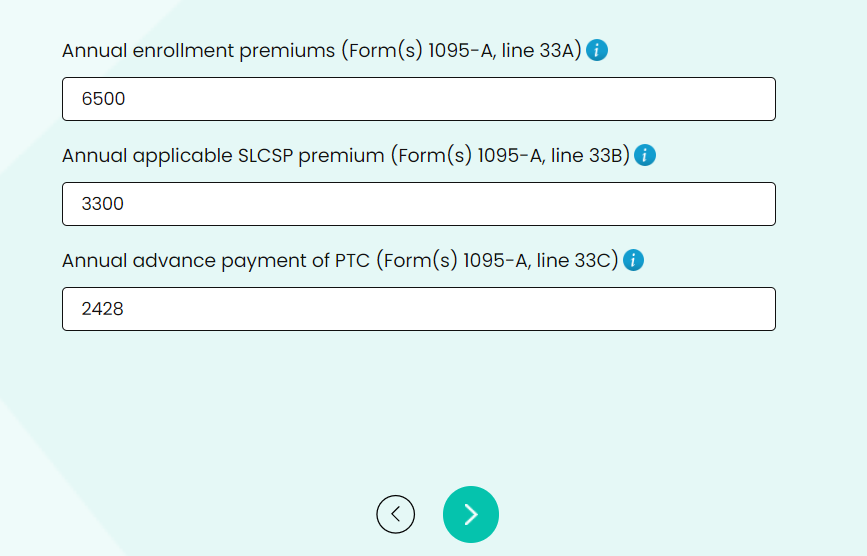

Here, you will be asked to enter three figures in order to finalize the form.

These figures are:

- Annual enrollment premiums

- Annual applicable SLCSP premium

- Annual advance payment of PTC

Once you have fully answered these points, you can submit the form using the green button.

How can I file my taxes?

Sprintax is the easiest way to file your nonresident US taxes!

That’s because Sprintax was designed specifically to with nonresidents in mind – we assist in helping to prepare and file a fully compliant US tax return.

We will also ensure you receive every tax relief you’re entitled to – maximizing any tax refund you’re due.

Here are some key reasons to file with Sprintax:

- Easy online process – you save time and stress

- 100% IRS tax compliance guaranteed

- We can e-file your federal return

- You will receive your maximum US tax refund

- 24/7 Live Chat tax support

Ready to get started? Create your Sprintax account here.