Everything nonresidents need to know about the W-2 and 1099 forms

Have you just received a W-2 form from your employer for the 2023 tax season?

If so, you may be asking yourself what it is and what you need to do with it.

Every year, nonresidents and international students who have earned an income in the US will receive a W-2 form from their employer – outlining wage and salary information. In addition, you may also receive a form 1099 detailing different types of income received during the year e.g., self-employed income, interest on bank accounts, stocks bonds or dividends.

In this guide, we will outline how to use these forms when filing your tax return.

How much tax was withheld from my income?

You may not realize it, but the IRS requires you to make a number of payments throughout the year. You can’t leave it until the filing deadline to pay your total tax bill. But don’t worry, your employer takes care of this for you.

They will withhold a certain amount of tax from your salary each time you are paid. These amounts are then remitted to the IRS throughout the tax year.

You can keep track of what tax is deducted each time by taking a look at your payslip during the year.

W-2 form (Wage and Tax Statement)

So what is a W-2 form?

The main purpose of the W-2 form is to report wage and salary information along with other taxes withheld from your pay check.

At the end of the tax year, when you are calculating your tax and preparing your income tax return, you will need the withholding amount your employer reports on your W-2 form. By subtracting the figure given to you on your W-2 form from your tax bill, you will know whether to expect a tax refund or if you have to make an additional tax payment.

You should have received your W-2 from your employer by 31 January. If you haven’t received it by this date, be sure to contact your employer.

You can find more information about what income is taxable for nonresidents here.

Note: While you read your W-2, always double check that the information is correct. If you find any errors, inform your employer immediately about the mistakes so they can amend them before you start your yearly tax return.

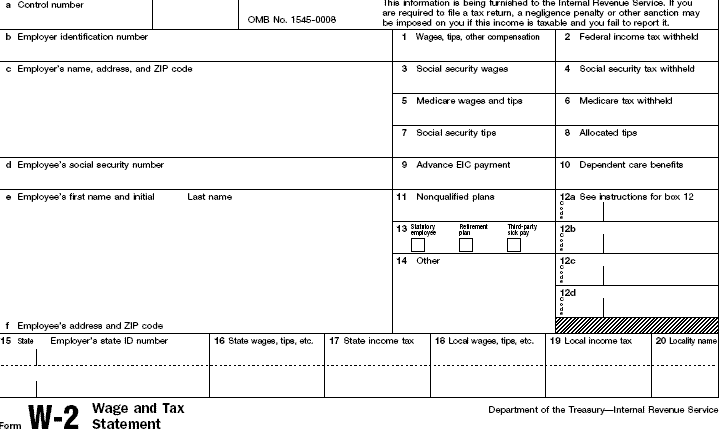

How to read your W-2

The form itself is separated into a number of different boxes. Box one, two and three are the most relevant for the majority of people. You will find your annual wage and salary payments in box one and the amount of federal tax withheld from it in box two of the W-2.

Box three contains your wages that are subject to social security. This figure may be less than your reported wages as only a portion of your income is subject to social security tax.

The other boxes on the form are needed to report your wages subject to Medicare tax, social security taxes that are withheld and any other information on your state income tax withholding.

Other information such as your name, address and SSN are also included on the form.

When is the deadline for W-2?

Your employer must provide you with your W-2 form by 31 January after the end of the tax year to which it relates (for example, you must receive your W-2 form by 31 January 2024 for the year ending on 31 December 2023).

What if I still haven’t received my W-2?

If this deadline has passed and you still have not received your W-2 form from your employer, you should contact them immediately to confirm that it was sent and that it was dispatched to the right address. Your employer may also provide your copy via a secure link online.

Alternatively, you can contact the IRS or use Sprintax offline services provided by our team of tax professionals.

What is a 1099 Form?

If you earned income in the US other than employee salary, it is likely you will receive a Form 1099. This form is used to report rental income or income for services or commission for which you may have been paid. There are a number of different 1099’s that report the different types of income you receive throughout the year.

1099-NEC

The 1099- NEC records income you received as an independent contractor or self-employed person. You will be issued a 1099-NEC form by your clients if they have paid you at least $600 that year.

1099-DIV

You will be issued a 1099-DIV form to report dividends and distributions from any investments you received throughout the year. You must report the form on your tax filing.

1099-INT

You may receive a 1099-INT form if you have other forms of investments such as interest payments. You will more than likely receive the form from your bank where you have interest bearing accounts.

Do I have to pay taxes on a 1099 form?

The short answer is yes. You are required to pay both income tax and self-employment tax (social security and Medicare) on this income.

What is the difference between the W-2 form and 1099’s?

The major difference between the W-2 form and 1099’s has to do with the type of income reported on the form and the tax withholdings.

You’ll receive a W-2 form if you’re an employee.

Depending on your money-making activities, you may receive a few different 1099 forms. In the case of the 1099 form, taxes are not usually withheld by the payer. You, as an independent contractor or self-employed person, are required to estimate your own taxes and pay the self-employment tax.

With a 1099 form, you will be required to make quarterly tax payments based on your annual tax liability rather than withholding taxes with each payment.

As a result, your 1099 form will only show your income from each client and not the taxes you’ve already paid to the government.

How do I file my nonresident tax return using the W-2 and 1099 forms?

Once you have received your W-2 and 1099 forms, you can easily prepare your US nonresident tax return with Sprintax.

Our online self-preparation software provides an all-in-one solution covering both IRS and state tax forms.

The process is quick, easy and stress-free.

To file your tax return today, simply create your Sprintax Returns account here.