Filing an international student tax return – U.S. tax season survival guide for students on F-1 visa

A handy tax guide for international students and scholars in the US on an F-1 visa

Tax filing might not be the most exciting aspect of international student life in the US.

After all, tax returns for international students probably weren’t high on your list of priorities when moving to the US!

However, the importance of completing these forms correctly cannot be underestimated – the way you handle your international student tax affairs will have a major impact on future Green Card and visa applications.

With this in mind, we’ve created this handy tax guide for international students and scholars in the US on an F-1 visa.

We’ve covered everything you need to know about tax returns, refunds, and how to stay in the taxman’s good books! So, let’s get started!

To easily navigate this guide, we’ve listed the main covered topics in the table of contents below.

Table of Contents

- Tax obligations

- Residency for tax purposes

- Taxable income

- Filing a tax return

- What if I earned no income

- Do I need an ITIN

- What happens if I don’t file

- Correct a wrong tax return

- Do F1 visa students get a tax refund

- Claim a FICA tax refund

- Tax deductions & exemptions

- Other

- Need help with tax return?

What is an F-1 visa?

The F-1 visa is a non-immigrant visa for those wishing to study in the US. It is the most popular visa choice for foreign students in America.

Do international students need to pay tax in the US?

An international student will be taxed in the same manner as a nonresident alien for US federal income tax purposes, which means that they will be taxed only on US-source income.

Every international student is required to file their tax return if they were in the US during the previous calendar year and earned income.

What type of income tax will I have to pay?

International students on F-1 visa, who are considered nonresident aliens for tax purposes, must pay tax in the US on the following types of income:

- Wages and compensation

- Salaries

- Tips

- Interest

- Dividends

- Some scholarships/fellowship grants

- Prizes/awards

There is no specific international student tax – the amount of tax you will have to pay will largely depend on your personal circumstances.

Read more: What income is taxable for nonresident aliens in the US?

Federal tax

Federal income tax is the tax levied by the IRS on the annual earnings of individuals, corporations, trusts, and other legal entities. It applies to all forms of a taxpayer’s income, such as employment earnings. It is also the largest source of revenue for the US government.

State income tax

Most states in the US will collect state income tax in addition to federal income tax. Tax rates and deductions will differ for each individual state in the US, so the amount you will pay will depend on where you are. Because of this, international students may have to file а state tax return and pay state income tax even when no federal return is due.

Nine states don’t have any tax-filing requirements. These are:

- Alaska

- Florida

- Nevada

- New Hampshire (taxes only investment income, not earned income)

- South Dakota

- Tennessee (taxes only investment income, not earned income)

- Texas

- Washington

- Wyoming

You can find out more about state tax here.

Do F-1 students pay taxes on OPT (Optional Practical Training)?

OPT is a program that allows international students to work in the US after their graduation, and gain practical experience. Students with F-1 visas may apply for 12 months of OPT after each level of education completes.

If you earn an income from an OPT, you will be required to pay tax.

International students must also fill in a W-4 tax form with their new employer when they start work.

Learn more about your tax obligations under OPT in this guide.

International students on OPT can prepare their income tax return easily online with Sprintax Returns tax software.

Do CPT (Curricular Practical Training) students need to pay any type of tax on their income?

Yes – students with an F-1 visa that are on CPT will not be exempt from Federal Taxes. Most F-1 students are considered nonresident aliens in the US, and are required to file a US tax return (form 1040-NR) for income from US sources.

Sprintax Forms can help you prepare your pre-employment tax documents!

Residency for tax purposes

There are three main types of residency for tax purposes in the US – residents, nonresidents, and dual-status aliens.

Most F-1 visa holders will be considered nonresident aliens for tax purposes.

The substantial presence test

You’ll be considered a resident for tax purposes if you pass the Substantial Presence Test.

The IRS uses the substantial presence test to determine whether an individual who is not a US citizen or a US permanent resident should be taxed as a resident or a nonresident alien for a specific year. The main difference is that US residents are taxed on their worldwide income while nonresident aliens have to report only their US-sourced income.

With this test, you’ll need to be present in the US on at least:

- 31 days or more throughout the current year, and

- 183 days or more in the period of 3 years that includes both the current year and the 2 years before that, this includes:

- All of the days you were physically in the US within the current year, and

- 1/3 of the days you were physically present in the US within the first year before the current year, and

- 1/6 of the days you were physically present in the US within second year before the current year

What is a nonresident for tax purposes?

If you do not pass the substantial presence test you will be classified as a nonresident alien for tax purposes. This means you will only be taxed on US-sourced income. As well as this, if your country of residence has signed a tax treaty with the US, you may be either partially or completely exempt from tax.

How can I determine my residency status while in the US on an F-1 visa?

In general, international students who are in the US on an F-1 visa are considered nonresident aliens for tax purposes for the first five calendar years of their stay in the US.

Read more: Your US Tax Residency Status Explained

Sprintax Returns software will easily determine your residency status for tax purposes.

Simply create an account to get started.

Can F-1 students become “residents for tax purposes” under certain conditions?

Most F-1 students and scholars who are in the US are nonresident aliens for tax purposes.

However, some can be considered ‘residents’ or ‘resident aliens’. This does not mean that the student is a resident – it is only a tax filing status. You will be considered a resident for tax purposes if you pass the substantial presence test.

Taxable income for international students

What is income for tax purposes?

Income taxes in the US may be imposed by federal, state, and even local governments. As a nonresident for tax purposes, you only pay tax earned on income in the US. The amount of tax you’ll have to pay will depend on how much you earn, the tax rates of each state and your entitlement to tax treaty benefits.

The US has income tax treaties with 65 countries. For nonresident aliens, these treaties can often reduce or eliminate U.S. tax on various types of personal services and other income, such as pensions, interest, dividends, royalties, and capital gains.

Read more: US Tax treaties – what’s the deal?

Social Security and Medicare (FICA) taxes

Most F-1 visa international students who are temporarily present in the US are exempt from FICA taxes on wages paid to them for services performed within the country.

The Internal Revenue Code grants an exemption from social security and Medicare taxes to nonimmigrant students in F-1 status. The exemption period of the F-1 visa is five years from the date of their arrival in the US.

Read more about claiming your FICA tax refund here.

Filing a tax return

Do international students have to file a tax return?

Most F-1 students are considered nonresident aliens by the IRS. As a nonresident alien, you will need to file form 1040-NR (federal tax return) to assess your federal income and taxes.

Even if you don’t earn money during your time in the US, you will still need to file Form 8843 with the IRS by the 15 April 2024 deadline.

You may also be required to file a state tax return, depending on the state. Check out our blog post on everything you need to know about filing a state tax return for international students.

Form 1098-T

Many US nonresidents are unsure if they need to file Form 1098-T (Tuition Statement). This is for U.S. nationals and residents only to figure out any educational credits – these credits are not available to nonresidents. In other words, you won’t need this form when filing.

How do I file a tax return on an F-1 visa?

If you received US-sourced income during the calendar year then you will need to file Form 8843 and most likely Form 1040NR to complete your tax return.

You will be required to enter your name, current address, and social security number (SSN) or IRS individual taxpayer identification number (ITIN) as well as other general personal information.

Prepare your international student tax return easily with Sprintax.

Start your F-1 tax return here

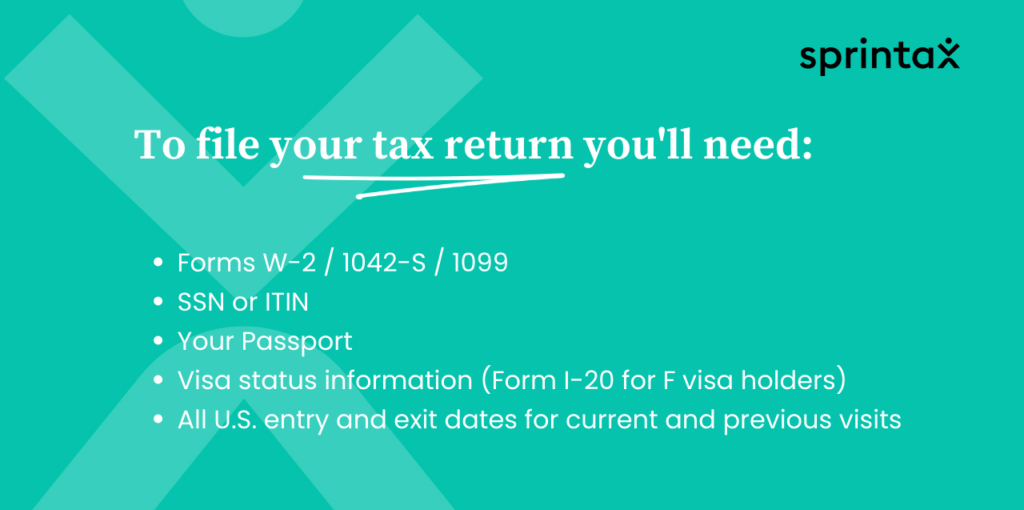

Necessary documents

The first thing you will need is your W-2 form, officially known as a “Wage and Tax Statement”. This is an IRS tax form used to report wages paid to employees and the taxes withheld. You’ll need your W2 to file your tax return and your employer should give it to you at the end of January. It will state the previous year’s earnings and tax withheld.

You will also need your Social Security Number or ITIN.

You will receive a 1042-S form from your school or institution if you received a taxable scholarship (such as for example a stipend or housing allowance).

You may also receive a 1099 form, though this is less common, but you may receive it if you earned rental income, investment income or if you worked as an independent contractor.

Do F-1 students need an ITIN?

Some international students may need an ITIN, based on personal circumstances.

However, you do not need an ITIN if:

- you have a Social Security Number (SSN), or

- you are eligible for an SSN, or

- you are only required to file IRS Form 8843.

Prepare your international student tax return here.

I earned no income in the US, do I still have to file a tax return?

Even if you did not earn any income during your time as an F-1 student in the US, you still have a filing requirement.

You must file a form 8843 with the IRS before the deadline.

Form 8843 is not an income tax return – it’s a statement required by the U.S. government for certain nonresident aliens who are in the US on F-1, J-1, F-2 or J-2 visas for purposes of the substantial presence test (more on this later).

Tax return deadline

The deadline for all F-1 students to file their tax documents is Monday 15 April 2024.

Missing the deadline may lead to some unwanted penalties, and jeopardize your chances of securing a US visa or Green Card in the future.

How to file an extension for taxes

If you are not able to file your federal income tax return by the deadline, you may be able to get an automatic 6-month extension. To apply for the additional time, you must file ‘Form 4868: Application for Automatic Extension of Time to File US Individual Income Tax Return’ by the original deadline.

You should note that Form 4868 is an extended deadline to file your tax return but is not an extension of time to pay any money due.

If you owe any tax, you must estimate your tax liability on Form 4868 as well as pay any amount due at that time.

Can international students file taxes online?

Yes. Sprintax supports e-filing of nonresident federal tax returns. Learn more here.

Where do I send my tax return?

The address you need to send the forms to will depend on where you stayed during your visit.

Generally, you will be sending your tax return to the Department of the Treasury Internal Revenue Service in whichever state you were in.

What happens if international students don’t file a tax return in the US?

It is very important to comply, as missing the deadline may lead to some unwanted fines and penalties, and jeopardize your chances of securing a US visa or Green Card in the future.

I filed the wrong F-1 tax return last year. What should I do?

The IRS acknowledges that tax code is complex, and that people can make mistakes with their documents. Issues can range from small things like forgetting to sign a form to big issues like reporting the wrong income or incorrectly calculating a deduction.

You will need three things to complete your amended tax return: a form 1040X, your original tax return, and any new required documents.

Once you complete the form, you’ll have to mail it to the IRS along with all required supporting documents. Amended returns are only filed on paper.

You can prepare your amended tax return easily with Sprintax.

Do international students get a tax refund?

One of the most frequent questions we receive is: “Can international students get tax refunds?”.

Yes! Many F-1 international students can claim tax refunds from the US.

You can claim your refunds by filing your tax return.

Can an F-1 student claim a tax refund on their scholarship?

An F-1 student could be able to claim a tax refund on their scholarship if it is completely or partially covered by a tax treaty.

How can international students claim a FICA tax refund?

Most F-1 students are not required to pay FICA tax. You will only be obligated to pay this tax if you were in the US for more than 5 years.

If social security or Medicare taxes were withheld in error from pay that is not subject to these taxes, contact the employer who withheld the taxes for a refund. If you are unable to get a full refund of the amount from your employer, file a claim for refund.

You can apply for your FICA refund directly with the IRS. Alternatively, you can apply for your FICA tax refund with Sprintax!

Sprintax is the easy way to find out if you’re due a tax refund. We will help you prepare the required forms before you send them off to the IRS.

To apply for a FICA tax refund with the IRS, you need Form 843 (Claim for Refund and Request for Abatement).

Attach the following items to Form 843:

- A copy of your Form W-2 to prove the amount of social security and Medicare taxes withheld,

- A copy of the page from your passport showing the visa stamp,

- INS Form I-94,

- If applicable INS Form I-538, Certification by Designated School Official, and

- A statement from your employer indicating the amount of the reimbursement your employer-provided and the amount of the credit or refund your employer claimed or that you authorized your employer to claim. If you cannot obtain this statement from your employer, you must provide this information on your own statement and explain why you are not attaching a statement from your employer

- If applicable, Form 8316, Information Regarding Request for Refund of Social Security Tax Erroneously Withheld on Wages Received by a nonresident alien on an F, J, or M Type Visa (PDF)

File Form 843 (with attachments) with the IRS office where your employer’s Forms 941 returns were filed. You can locate the IRS office where your employer files his Form 941 by going to Where to File Tax Returns on the IRS website.

F1 visa tax exemptions and deductions

Can I claim any deductions on my F-1 tax return?

The State and Local Taxes (SALT) deduction decreases taxable income by the amount paid to state and local tax government during the tax year. Most nonresidents (including students and other exchange visitors) can only use SALT as an itemized deduction on their Schedule A, 1040NR form.

There is a cap on SALT deductions at $10,000, which may not affect the deduction most of the students and scholars are eligible for. However, some nonresidents who are paying larger state and local taxes may be unable to use all of them as a deduction.

Can F-1 students claim the personal exemption?

No. The personal exemption was reduced from $4,050 to $0 for F-1 international students in 2018.

What is the Standard Deduction and can F-1 students claim it?

In the US, Standard Deduction is an amount of money that some taxpayers may subtract from their income before tax is applied.

Nonresident aliens cannot claim the standard deduction. However, there is a special rule, described next, for certain nonresident aliens from India, who can claim it under Article 21 of the US-India Income Tax Treaty.

A special rule applies to students and business apprentices who are eligible for the benefits of Article 21(2) of the United States–India Income Tax Treaty. They can claim the standard deduction provided they do not claim itemized deductions.

International students can also benefit from a tax treaty with their home country. The US has income tax treaties with 65 countries.

Under these treaties, residents (not necessarily citizens) of foreign countries may be eligible to be taxed at a reduced rate or exempt from the US. Income taxes on certain items of income they receive from sources within the states. These reduced rates and exemptions vary among countries and specific items of income.

Other frequently asked questions

Do F-1 visa holders pay more or less tax than H-1B?

In general, if the F-1 and H-1B visa holders are considered nonresident aliens, the same tax rate will be applied to their income level.

In certain cases, F-1 students could be able to claim a tax treaty which can reduce or fully exempt their income from taxes. In such cases, the overpaid amount will be refunded to the F-1 student.

You can find a detailed guide on filing taxes on an H1B visa here.

What tax return form should I file from transitioning for F-1 to H-1B visa?

There is no special return that needs to be filed due to the visa change from F-1 to H-1B visa.

If a person changes their visa from F-1 to H-1B they may still qualify as a nonresident alien for tax purposes. In this case, they need to submit a form 1040NR to the tax office.

The H-1B visa is not an exempt visa – if the visa holder stays more than 183 days in the US under this status, they will be considered as residents for tax purposes and would need to file the resident 1040 form.

Do F-1 students have to pay tax on their capital gains in the US?

F-1 students who, at the time of their arrival in the US, intend to reside in the states for longer than one year are subject to the 30% taxation on their capital gains during any tax year in which they are present in the US for 183 days or more, unless a tax treaty provides for a lesser rate of taxation.

This assumes that such capital gains are not effectively connected with the conduct of a US trade or business. These capital gains would be reported on page 4 of Form 1040NR because they are being taxed at a flat rate of 30% or at a reduced flat rate under a tax treaty.

Read more: Do nonresidents pay capital gains tax?

Do paid summer interns on an F-1 visa need to file US tax returns?

Yes, if you earned income as an intern.

Even if you did not earn an income, you are still required to fill out form 8843.

I am an F-1 student and married, can I file a joint tax return?

As a rule of thumb, those who are married on an F-1 visa cannot jointly file.

However, F-1 students can file joint returns if the spouse is a US citizen or resident.

If both F-1 visa holders are nonresidents for tax purposes the filing status on their returns should be ‘Married Filing Separate’.

Who can help me with my international student tax return?

You can file your tax return yourself directly with the IRS. However, every year many F-1 international students feel daunted by the prospect of filing US tax documents and enlist the help of a tax agent or accountant to help them with their return.

But it is important to be careful when choosing who to assist you with your taxes.

Can international students use Turbotax?

Many F-1 international students choose TurboTax to manage their tax returns, but Turbotax is a service for residents..

While TurboTax – the biggest online tax preparation service in the US – offers a fantastic product that helps millions of US residents prepare their taxes and claim refunds, their offering can only be used by US residents.

If you do use TurboTax to file your US taxes, you will be filing as a resident. This means your tax return will be inaccurate and you may be subject to fines and penalties.

Sprintax is the nonresident partner of choice for Turbo Tax.

Why use Sprintax?

Sprintax is the nonresident partner of choice for TurboTax and the only online federal and state self-prep tax software for nonresidents in the US.

By creating a Sprintax account you can easily prepare fully completed and compliant 1040NR (nonresident tax return) and form 8843 tax documents.

Sprintax will also help you to claim your maximum legal tax refund.

With Sprintax you can:

- Save time and stress!

- Determine your residency status

- E-file your Federal tax return

- Prepare a fully compliant US State tax return

- Claim your maximum US tax refund

- Discuss your US tax questions anytime 24/7 with or Live Chat team

Complete your international student tax return with Sprintax

Join the more than 250,000 people who have prepared their US tax return with Sprintax, the nonresident alien tax return software!

Subscribe to the Sprintax Blog!

US tax can be confusing. Especially for nonresidents!

That’s why, if you’re an International Student or J-1 participant in the US, or you work in a University International Student Office, you should subscribe to the Sprintax blog.

You’ll find tons of useful content for nonresidents. We cover tax, student life, acclimatizing to the US and much more.

So what are you waiting for? Sign up today and never miss a thing!