3 Amazing things you didn’t know about last year’s tax season

Look, we get it.

Tax can be booooring!

But hear us out.

It’s not just all endless paperwork and deadlines, you know!

In fact, last year a LOT of Sprintax customers were entitled to big tax refunds.

How big?

Well, our average federal refund was well over $1,000.

Doesn’t sound so boring now, does it?

So, with that in mind, we put together this list of 3 amazing things you didn’t know about last year’s tax season.

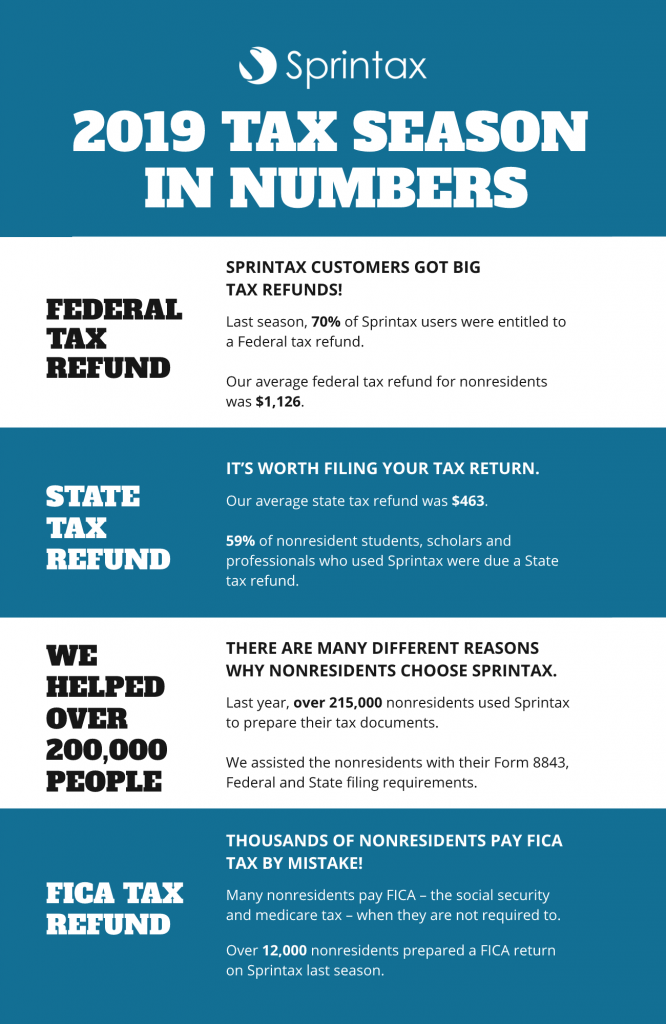

1. Sprintax customers got big tax refunds!

Last season, 70% of Sprintax users were entitled to a Federal tax refund. We also found that 59% of nonresident students, scholars and professionals who used Sprintax were due a State tax refund.

Refunds can really add up!

Last season, our average Federal refund was a massive $1,126 for nonresidents and our average state refund was $463.

Not bad, right?!

These facts really show how it’s worth filing your tax return. You may be one of the lucky people who are due a refund!

The good news is, Sprintax can help you to prepare your tax return documents.

Create your Sprintax account now

2. We helped over 200,000 people

There are many different reasons why nonresidents choose Sprintax. In fact, last year, over 215,000 nonresidents used Sprintax to prepare their tax documents. We assisted the nonresidents with their Form 8843, Federal and State filing requirements.

At Sprintax, we know it’s not easy to master US tax. That’s why our software is built specifically to help you to determine what forms you are required to file.

3. Thousands of nonresidents pay FICA tax by mistake!

Ever see FICA deducted from your paycheck?

You’re not alone!

Many nonresidents pay FICA – the social security and medicare tax – when they are not required to.

If you’d like to apply for a FICA refund, Sprintax can help you.

In fact, over 12,000 nonresidents prepared a FICA return on Sprintax last season.

Why Sprintax?

Sprintax can help you file your nonresident US tax return. If you have a federal or state tax filing requirement, there is a strong possibility that you will be due a refund.

The only way to get that tax refund back is by filing a tax return.

Sprintax online tax preparation can help you with your federal and state returns as well as 8843, FICA and ITIN applications.

As of 31 Mar, 2021 you can now e-file form 1040-NR with Sprintax!

So you can rest assured that we have your nonresident tax requirements covered!

Got US tax questions?

24/7 Live Chat support – Contact our team at any time!